Hedge funds around the world fled positions in energy stocks, bonds and futures last week just in time to miss this week's whipsaw moves in oil, according to data from two banks.

And on Friday, oil prices hit their lowest since January as recession fears gripped world markets. Brent crude is still up about 12% in the year to date.

Hedge funds that trade with systematically programmed algorithms did not necessarily short the market but rather, vacated their positions because of a lack of any trend in the prices of oil, gas and other energy products, said David Gorton, the founder and chief investment officer of DG Partners, with $2.85 billion under management.

"Our commodities exposure is the lowest it’s been in years. In June, markets reversed hard and commodities have been chopping down and sideways ever since. For a trend follower that’s a nightmare and why the model got out," said Gorton. DG Partners is up 5.2% so far this month and 37% for the year, according to a source familiar with the matter.

The momentum that fueled a stable upward rise in oil prices has changed, said another manager who oversees more than $100 billion and for compliance reasons wished to remain anonymous.Reporting by Nell Mackenzie Editing by Mark Potter and Peter Graff

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Gold and crypto have been called 'inflation-proof' investments—so far in 2022, neither seems to be a great hedgeOne theory suggests that gold and crypto investments should perform well when inflation goes up. So far in 2022, that's not happening.

Gold and crypto have been called 'inflation-proof' investments—so far in 2022, neither seems to be a great hedgeOne theory suggests that gold and crypto investments should perform well when inflation goes up. So far in 2022, that's not happening.

Read more »

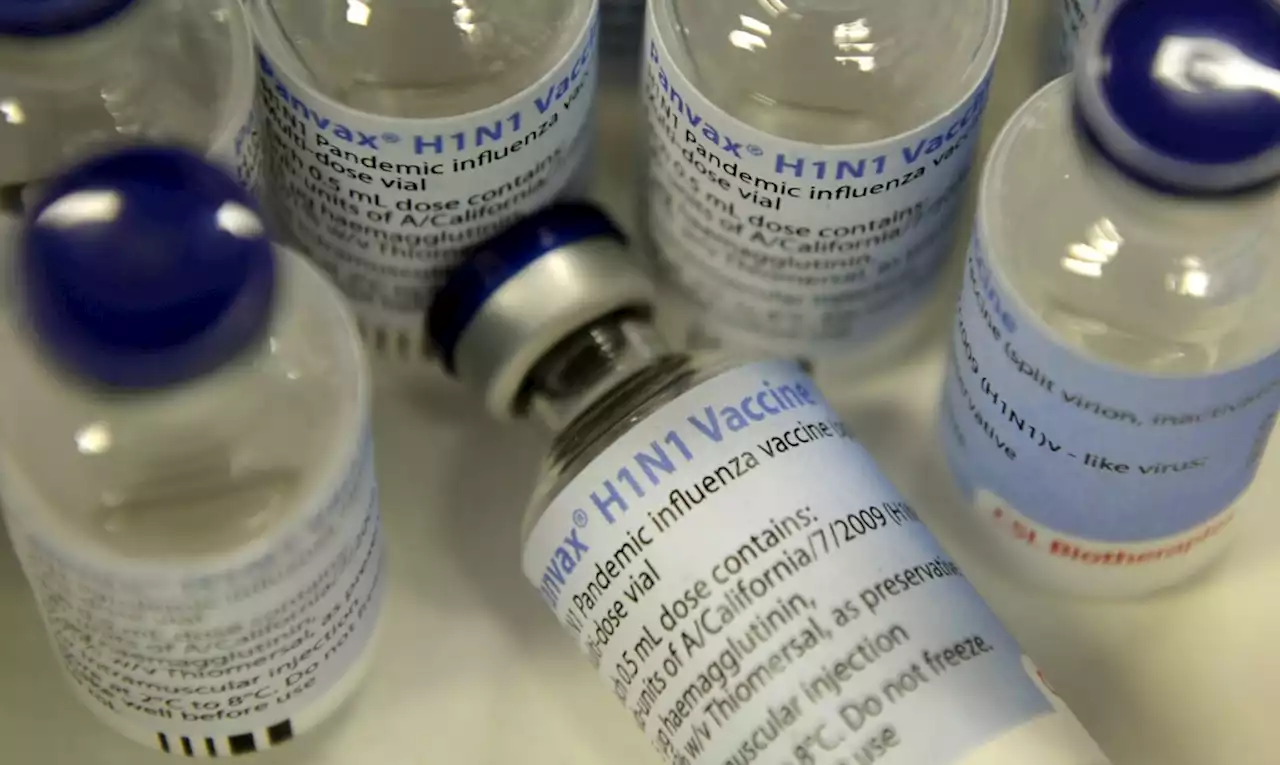

What Australia’s flu season could mean for the US this winter(CNN) — Influenza is always unpredictable. Infectious disease experts like to hedge their forecasts with a caution: When you’ve seen one flu season, you’ve seen one flu season.

What Australia’s flu season could mean for the US this winter(CNN) — Influenza is always unpredictable. Infectious disease experts like to hedge their forecasts with a caution: When you’ve seen one flu season, you’ve seen one flu season.

Read more »

Elliott’s double dip spares Citrix banks’ blushesPaul Singer’s hedge fund has made an unusual bet, picking up $1 bln of bonds backing its own buyout of cloud firm Citrix. The banks get shot of a balance-sheet albatross. And by getting a big discount on debt issued in a frothy market, Elliott benefits from their pain twice over.

Elliott’s double dip spares Citrix banks’ blushesPaul Singer’s hedge fund has made an unusual bet, picking up $1 bln of bonds backing its own buyout of cloud firm Citrix. The banks get shot of a balance-sheet albatross. And by getting a big discount on debt issued in a frothy market, Elliott benefits from their pain twice over.

Read more »

Hedge funds dashed to exit energy positions last week, bank data showHedge funds around the world fled positions in energy stocks, bonds and futures last week just in time to miss this week's whipsaw moves in oil, according to data from two banks.

Hedge funds dashed to exit energy positions last week, bank data showHedge funds around the world fled positions in energy stocks, bonds and futures last week just in time to miss this week's whipsaw moves in oil, according to data from two banks.

Read more »