The stock market's bubble bust will only be halfway over when the Fed starts cutting rates - and there will be much more pain ahead, legendary investor Jeremy Grantham says

Though some investors are looking for signs of the, that's the wrong way to think about stocks in the current environment, Grantham said."Great Bubbles" in the stock market are different from typical bull and bear markets, meaning it's likely there's another round of pain ahead.

"Most of the decline in these great bear markets only happens after the first interest rate cut. So you tell me when the first interest rate cut is, and I will tell you when the second half of the pain is going to start," Grantham said in an interview withInvestors have already seen hefty losses over the last year amid rising inflation and higher interest rates, which have taken away the liquidity that previously caused asset prices to soar.

Fed Chair Jerome Powell has said rates will stay elevated through the rest of this year, which is expected to hinder stock performance. But markets are pricing in a 33% chance of a 25 basis-point rate cut as soon as July, according to the

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

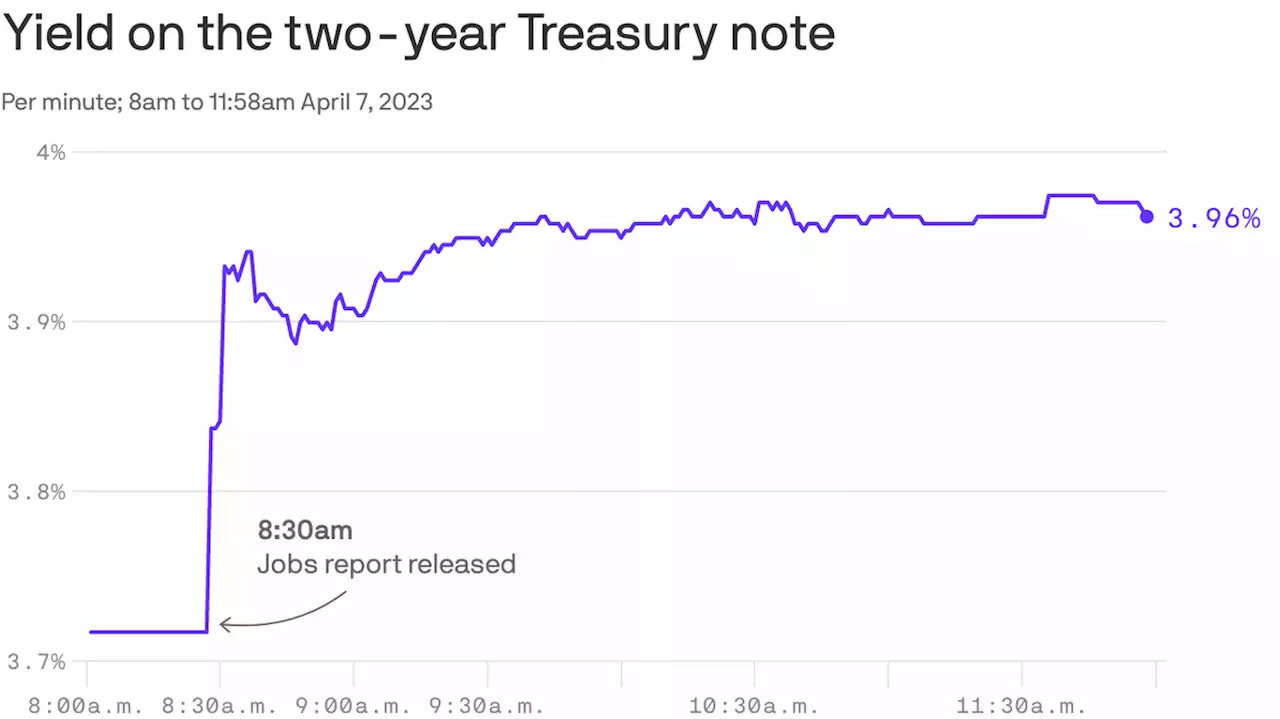

Treasury yields rise on nearly perfect jobs reportYields on short-term Treasury notes, heavily influenced by expectations for what the central bank will do with monetary policy, shot higher after the jobs data was released Friday.

Treasury yields rise on nearly perfect jobs reportYields on short-term Treasury notes, heavily influenced by expectations for what the central bank will do with monetary policy, shot higher after the jobs data was released Friday.

Read more »

OPEC's surprise production cut complicates the Fed's fight against inflation | CNN BusinessA surprise production cut announcement this week from Saudi Arabia and several other OPEC+ oil producers complicates the Federal Reserve's mission to cool the economy and could worsen inflation in the United States, economists say.

OPEC's surprise production cut complicates the Fed's fight against inflation | CNN BusinessA surprise production cut announcement this week from Saudi Arabia and several other OPEC+ oil producers complicates the Federal Reserve's mission to cool the economy and could worsen inflation in the United States, economists say.

Read more »

Top 4 stock trading tips: Retiree who returned 155%A retired healthcare executive returned 155% in 2020 after learning to trade stocks. Here are her top 4 tips for beating the market and the 2 books that helped her get ahead

Read more »

The US economy is still creating problems for the FedIndicators like a rise in initial jobless claims, a drop in open job listings, and layoff increases all suggest a slowing in the labor market — and the economy — that is consistent with the Fed being able to back off its rate hikes.

The US economy is still creating problems for the FedIndicators like a rise in initial jobless claims, a drop in open job listings, and layoff increases all suggest a slowing in the labor market — and the economy — that is consistent with the Fed being able to back off its rate hikes.

Read more »

30 best global stock picks to buy now: How to beat the market, RBCRBC: Buy these 30 high-conviction stocks as they continue delivering market-beating returns in an up-and-down year

Read more »

EUR/USD stays defensive around 1.0900 despite hawkish ECB, US inflation, Fed Minutes eyedEUR/USD stays defensive around 1.0900 despite hawkish ECB, US inflation, Fed Minutes eyed – by anilpanchal7 EURUSD ECB Fed Inflation RiskAppetite

EUR/USD stays defensive around 1.0900 despite hawkish ECB, US inflation, Fed Minutes eyedEUR/USD stays defensive around 1.0900 despite hawkish ECB, US inflation, Fed Minutes eyed – by anilpanchal7 EURUSD ECB Fed Inflation RiskAppetite

Read more »