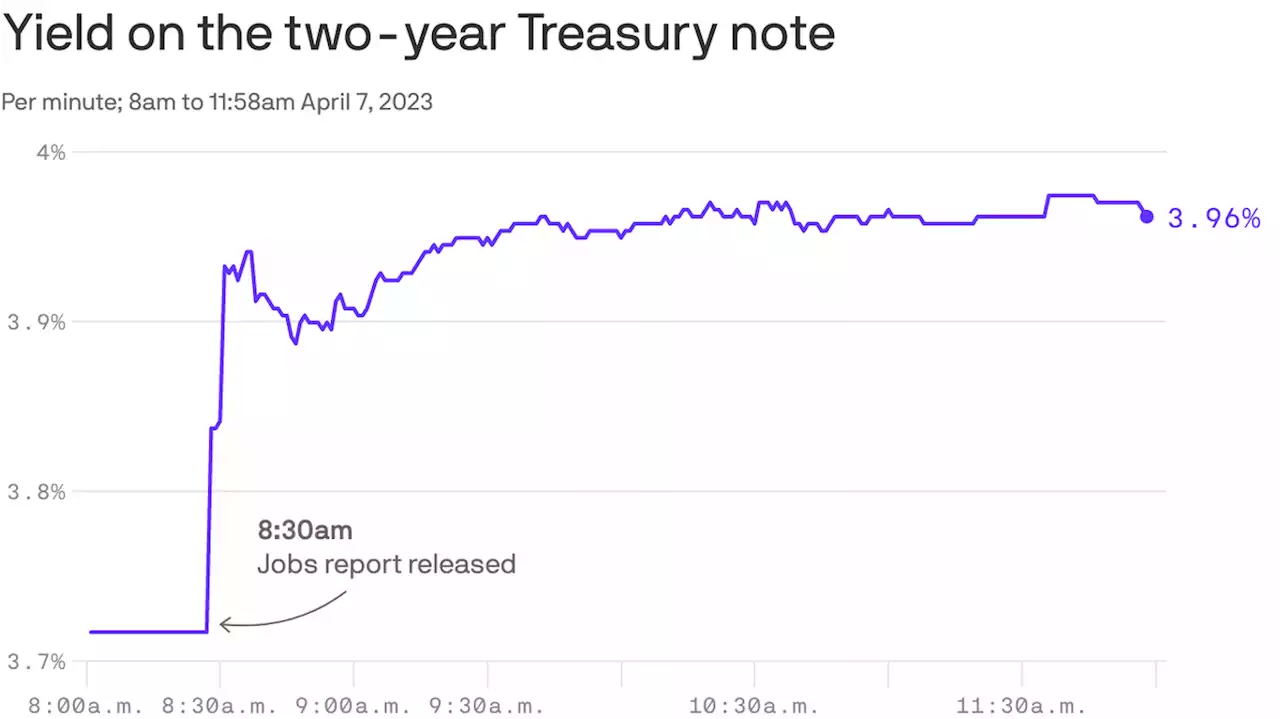

Yields on short-term Treasury notes, heavily influenced by expectations for what the central bank will do with monetary policy, shot higher after the jobs data was released Friday.

Investors are betting that the Fed will keep raising interest rates after jobs data in March showed the economy could very well beYields on short-term Treasury notes, heavily influenced by expectations for what the central bank will do with

monetary policy, shot higher after the data was released Friday.in what's typically a muted market.With the stock market closed for Good Friday, the bond market was perhaps the main venue for investors to express views on what the report meant.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Treasury yields fall after data shows U.S. job growth slowed in MarchThe yield on the benchmark 10-year Treasury note slipped to 3.3626%, while the yield on the 30-year Treasury bond dipped to 3.5811%.

Treasury yields fall after data shows U.S. job growth slowed in MarchThe yield on the benchmark 10-year Treasury note slipped to 3.3626%, while the yield on the 30-year Treasury bond dipped to 3.5811%.

Read more »

S&P 500 Futures, US Treasury bond yields drop on China news, US inflation, Fed Minutes in focusS&P 500 Futures, US Treasury bond yields drop on China news, US inflation, Fed Minutes in focus – by anilpanchal7 SP500 Futures YieldCurve Fed China

S&P 500 Futures, US Treasury bond yields drop on China news, US inflation, Fed Minutes in focusS&P 500 Futures, US Treasury bond yields drop on China news, US inflation, Fed Minutes in focus – by anilpanchal7 SP500 Futures YieldCurve Fed China

Read more »

Community wants Arbitrum Foundation to return 700M ARB to DAO TreasuryThe new proposal is open for voting until April 14. At the time of writing, 55% of voters supported the proposal, 42% opposed it, and 2% abstained.

Community wants Arbitrum Foundation to return 700M ARB to DAO TreasuryThe new proposal is open for voting until April 14. At the time of writing, 55% of voters supported the proposal, 42% opposed it, and 2% abstained.

Read more »

OPEC's surprise production cut complicates the Fed's fight against inflation | CNN BusinessA surprise production cut announcement this week from Saudi Arabia and several other OPEC+ oil producers complicates the Federal Reserve's mission to cool the economy and could worsen inflation in the United States, economists say.

OPEC's surprise production cut complicates the Fed's fight against inflation | CNN BusinessA surprise production cut announcement this week from Saudi Arabia and several other OPEC+ oil producers complicates the Federal Reserve's mission to cool the economy and could worsen inflation in the United States, economists say.

Read more »

The US economy is still creating problems for the FedIndicators like a rise in initial jobless claims, a drop in open job listings, and layoff increases all suggest a slowing in the labor market — and the economy — that is consistent with the Fed being able to back off its rate hikes.

The US economy is still creating problems for the FedIndicators like a rise in initial jobless claims, a drop in open job listings, and layoff increases all suggest a slowing in the labor market — and the economy — that is consistent with the Fed being able to back off its rate hikes.

Read more »

EUR/USD stays defensive around 1.0900 despite hawkish ECB, US inflation, Fed Minutes eyedEUR/USD stays defensive around 1.0900 despite hawkish ECB, US inflation, Fed Minutes eyed – by anilpanchal7 EURUSD ECB Fed Inflation RiskAppetite

EUR/USD stays defensive around 1.0900 despite hawkish ECB, US inflation, Fed Minutes eyedEUR/USD stays defensive around 1.0900 despite hawkish ECB, US inflation, Fed Minutes eyed – by anilpanchal7 EURUSD ECB Fed Inflation RiskAppetite

Read more »