Financial markets in the U.S. remain hyper-focused on the prospect of a continued climb in interest rates, with traders putting a better-than-50% chance on the Fed’s main policy rate target getting to a 15-year high of between 3.75% and 4% by December.

Financial markets in the U.S. remain hyper-focused on the prospect of a continued climb in interest rates, with traders putting a better-than-50% chance on the Federal Reserve’s main policy rate target getting to a 15-year high of between 3.75% and 4% by December.

As traders began putting a 4% fed funds rate for 2022 on the radar, broader financial markets moved with a lack of conviction on Wednesday, the final day of August trading: U.S. stocks DJIA, -0.88% SPX, -0.78% COMP, -0.56% ultimately finished the day with their fourth straight session of losses, while the policy-sensitive 2-year Treasury yield TMUBMUSD02Y, 3.487% was slightly lower at 3.45% as investors await Friday’s release of fresh nonfarm payrolls data.

In particular, Mandelman and Meyer cited a 1971 speech that Nobel Prize winner Friedman delivered to the American Economic Association, which gave rise to the phrase “long and variable lags” to describe the delayed effect the Fed’s rate moves have on the economy. The main thesis of Friedman’s remarks a half-century ago “still rings true,” they said. “Changes in the stance of monetary policy have the largest impact on output first and then, much later, on inflation.

Financial markets have a tendency to look for quick results and cheered July’s decline in the U.S.’s annual headline consumer price inflation rate to 8.5%, from 9.1% the prior month, only to have Fed Chairman Jerome Powell reaffirm the central bank’s commitment to tackling inflation despite the pain to households and businesses. In his widely followed Jackson Hole speech last Friday, Powell also cited lessons from the 1970’s.

In the days that followed Powell’s Jackson Hole speech on Friday, Steve Hanke, a professor of applied economics at Johns Hopkins University, told CNBC he thinks inflation is going to stay high because of “unprecedented growth” in the money supply and the U.S. is heading for a “whopper” of a recession next year, though not necessarily because of higher interest rates.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Traders see 63% chance that fed funds rate will get to between 3.75% and 4% by DecemberFed funds futures traders are pricing in a better-than-not likelihood that the central bank's main policy rate target will get to between 3.75% and 4% by...

Traders see 63% chance that fed funds rate will get to between 3.75% and 4% by DecemberFed funds futures traders are pricing in a better-than-not likelihood that the central bank's main policy rate target will get to between 3.75% and 4% by...

Read more »

Fed rate hikes won't stop inflation if government spending stays high, paper saysFederal Reserve interest rate hikes will not successfully cool inflation unless the federal government also slows fiscal spending, a new paper suggests.

Fed rate hikes won't stop inflation if government spending stays high, paper saysFederal Reserve interest rate hikes will not successfully cool inflation unless the federal government also slows fiscal spending, a new paper suggests.

Read more »

IMF Expects US Economy to Experience High Inflation for at Least Another Year or Two – Economics Bitcoin NewsThe IMF expects the U.S. economy to experience high inflation for at least another year or two. recession USeconomy globalinflation

IMF Expects US Economy to Experience High Inflation for at Least Another Year or Two – Economics Bitcoin NewsThe IMF expects the U.S. economy to experience high inflation for at least another year or two. recession USeconomy globalinflation

Read more »

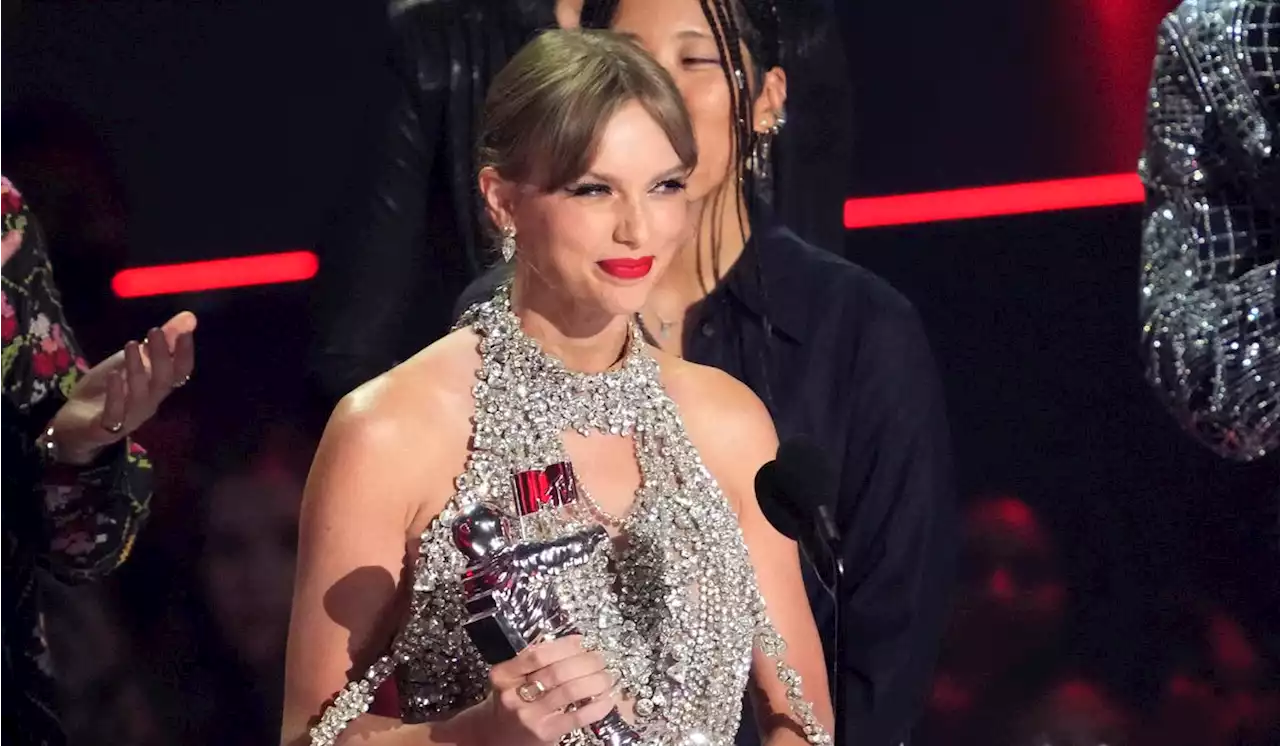

Taylor Swift wins top prize, announces new album at MTV VMAsTaylor Swift took home the top prize at the 2022 MTV Video Music Awards on Sunday before she closed out the show with a surprisingly big announcement: her new album.

Taylor Swift wins top prize, announces new album at MTV VMAsTaylor Swift took home the top prize at the 2022 MTV Video Music Awards on Sunday before she closed out the show with a surprisingly big announcement: her new album.

Read more »

Fed's Williams Pushes Back on Market Expectations of a Rate Cut Next YearNew York Fed President John Williams said he expects rates to continue higher and to remain at those levels until inflation is subdued.

Fed's Williams Pushes Back on Market Expectations of a Rate Cut Next YearNew York Fed President John Williams said he expects rates to continue higher and to remain at those levels until inflation is subdued.

Read more »