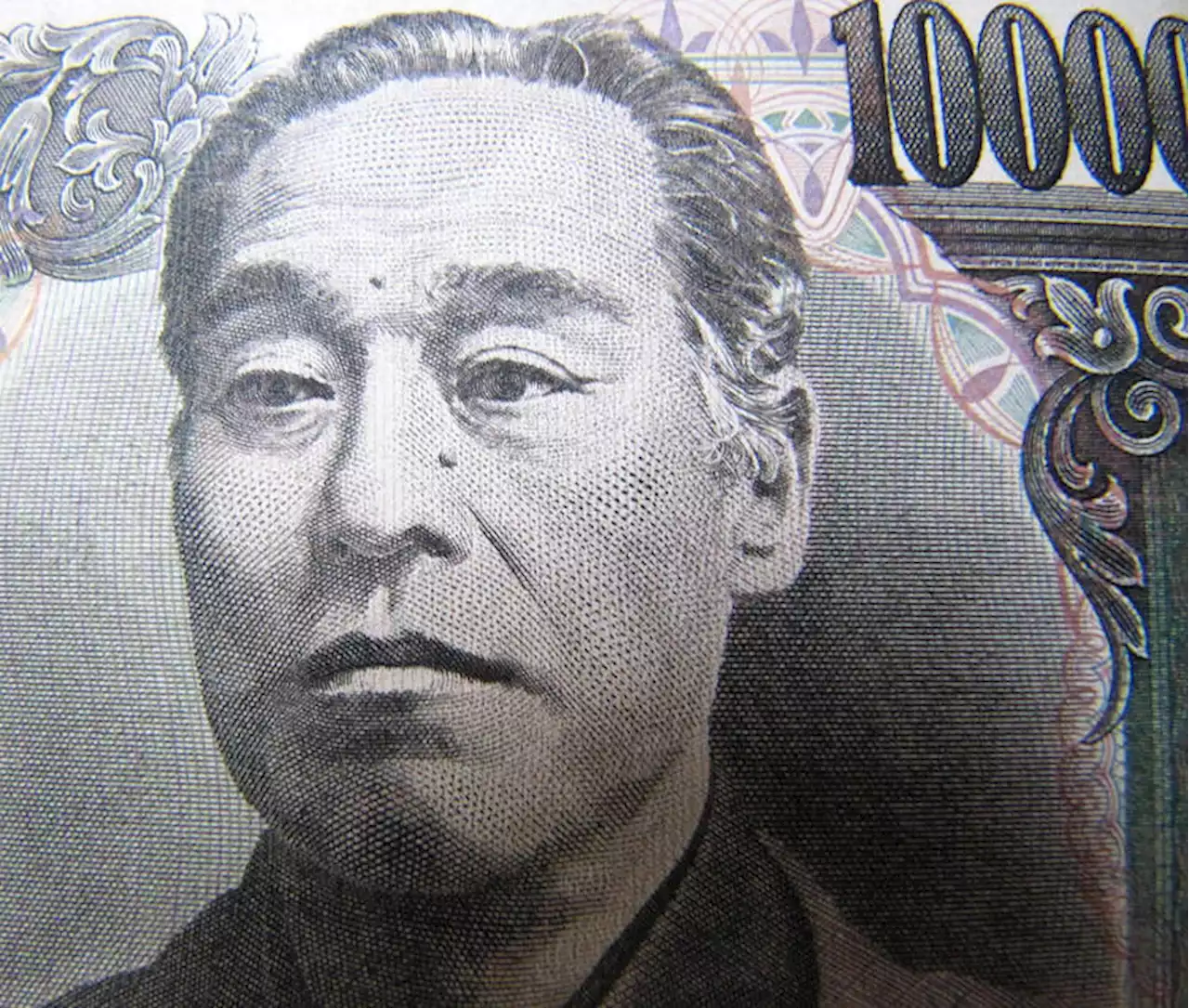

USD/JPY: The door towards April 1990 high at 159.90 is open – DBS Bank USDJPY Banks BOJ

“USD/JPY has traded above 147.26, the peak of August 1998, and opened the door to the 159.90 high in April 1990.”Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

USD/JPY oscillates around 149.20s after Fed’s commentaries, US Housing Starts eyedThe USD/JPY oscillates around the 149.00 figure amidst a risk-on impulse caused by Britain’s new Finance Minister Jeremy Hunt, scrapping the PM Liz Tr

USD/JPY oscillates around 149.20s after Fed’s commentaries, US Housing Starts eyedThe USD/JPY oscillates around the 149.00 figure amidst a risk-on impulse caused by Britain’s new Finance Minister Jeremy Hunt, scrapping the PM Liz Tr

Read more »

USD/JPY awaits Japan intervention around 30-year high above 149.00, yields stay sluggishUSD/JPY awaits Japan intervention around 30-year high above 149.00, yields stay sluggish – by anilpanchal7 USDJPY RiskAppetite YieldCurve BOJ Fed

USD/JPY awaits Japan intervention around 30-year high above 149.00, yields stay sluggishUSD/JPY awaits Japan intervention around 30-year high above 149.00, yields stay sluggish – by anilpanchal7 USDJPY RiskAppetite YieldCurve BOJ Fed

Read more »

USD/JPY sits near 32-year peak, around 149.00 mark as traders await fresh catalystThe USD/JPY pair reverses a knee-jerk intraday fall to the 148.00 neighbourhood and climbs back closer to a 32-year peak touched earlier this Tuesday.

USD/JPY sits near 32-year peak, around 149.00 mark as traders await fresh catalystThe USD/JPY pair reverses a knee-jerk intraday fall to the 148.00 neighbourhood and climbs back closer to a 32-year peak touched earlier this Tuesday.

Read more »

USD/JPY: Strong intervention at 150 would be a technical mistake on MOF's side – CommerzbankUSD/JPY is trading just below the 150 mark. And as a result, everyone is talking about whether the Japanese Ministry of Finance (MOF) will intervene o

USD/JPY: Strong intervention at 150 would be a technical mistake on MOF's side – CommerzbankUSD/JPY is trading just below the 150 mark. And as a result, everyone is talking about whether the Japanese Ministry of Finance (MOF) will intervene o

Read more »

New Zealand Dollar Technical Analysis: NZD/JPY, NZD/USD Rates OutlookThe New Zealand Dollar held critical support, sparked by hotter than expected inflation data. NZD/JPY rates have rebounded from the uptrend from the March 2020 and January 2022 lows, while NZD/USD rates are off their yearly lows.

New Zealand Dollar Technical Analysis: NZD/JPY, NZD/USD Rates OutlookThe New Zealand Dollar held critical support, sparked by hotter than expected inflation data. NZD/JPY rates have rebounded from the uptrend from the March 2020 and January 2022 lows, while NZD/USD rates are off their yearly lows.

Read more »

BoJ verbal intervention in play again as USD/JPY toppled 149.37 in New YorkKuroda said that it is extremely important for fx to move stably reflecting econ fundamentals, noting that the recent yen weakening has been sharp and

BoJ verbal intervention in play again as USD/JPY toppled 149.37 in New YorkKuroda said that it is extremely important for fx to move stably reflecting econ fundamentals, noting that the recent yen weakening has been sharp and

Read more »