The USD/JPY pair consolidates its recent gains in a narrow range below the mid-147.00s during the early Asian trading hours on Friday. The stronger US

. Meanwhile, the US Dollar Index , a measure of the value of USD against six other major currencies, holds above 105.35, near its highest daily close since March. The pair currently trades near 147.45, losing 0.02% on the day.

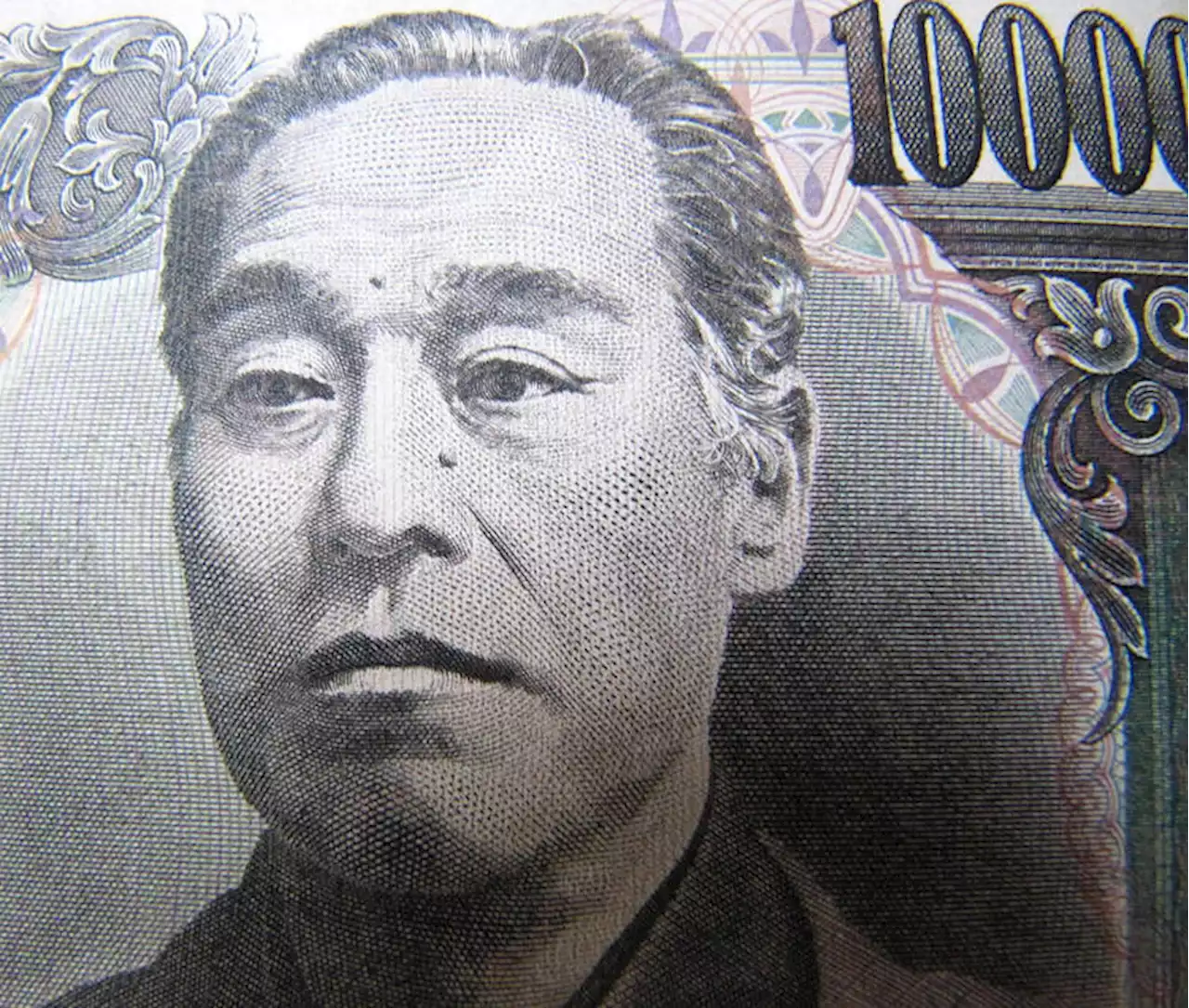

BoJ has stated that a pivot would not be considered as long as wage and inflation figures do not meet its forecast, which keeps the JPY vulnerable against its rivals.Governor Kazuo Ueda stated on Monday in an interview that the central bank could exit its negative interest rate policy when its inflation target of 2% is near and they would have sufficient evidence by the end of the year to evaluate whether interestshould stay negative.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

USD/JPY sits near weekly high, remains below mid-147.00s ahead of US inflation dataThe USD/JPY pair gains some positive traction for the second successive day and climbs to a fresh weekly high during the first half of trading action

USD/JPY sits near weekly high, remains below mid-147.00s ahead of US inflation dataThe USD/JPY pair gains some positive traction for the second successive day and climbs to a fresh weekly high during the first half of trading action

Read more »

USD/JPY hangs near daily low, bears flirt with 200-hour SMA support near 147.00 markThe USD/JPY pair comes under some selling pressure during the Asian session on Thursday and snaps a two-day winning streak to the weekly high, around

USD/JPY hangs near daily low, bears flirt with 200-hour SMA support near 147.00 markThe USD/JPY pair comes under some selling pressure during the Asian session on Thursday and snaps a two-day winning streak to the weekly high, around

Read more »

USD/JPY Price Analysis: Bounces off 147.00 mark, shows resilience below 200-hour SMAThe USD/JPY pair comes under some selling pressure on Thursday and reverses the previous day's positive move to the 147.75 area, or the weekly high. S

USD/JPY Price Analysis: Bounces off 147.00 mark, shows resilience below 200-hour SMAThe USD/JPY pair comes under some selling pressure on Thursday and reverses the previous day's positive move to the 147.75 area, or the weekly high. S

Read more »

USD/JPY Price Analysis: Climbs back closer to mid-147.00s, eyes YTD peak ahead of US CPIThe USD/JPY pair builds on this week's bounce from ascending trend-line support extending from the 138.00 mark, or the late July swing low, and gains

USD/JPY Price Analysis: Climbs back closer to mid-147.00s, eyes YTD peak ahead of US CPIThe USD/JPY pair builds on this week's bounce from ascending trend-line support extending from the 138.00 mark, or the late July swing low, and gains

Read more »

USD/JPY risks a deeper drop near termFurther losses in USD/JPY still appear in store for the time being, comment UOB Group’s Economist Lee Sue Ann and Markets Strategist Quek Ser Leang. K

USD/JPY risks a deeper drop near termFurther losses in USD/JPY still appear in store for the time being, comment UOB Group’s Economist Lee Sue Ann and Markets Strategist Quek Ser Leang. K

Read more »