USD/CAD attempts a recovery to near 1.3550 as Fed policy hogs limelight – by Sagar_Dua24 USDCAD Fed BOC Inflation PMI

USD/CAD has rebounded to near 1.3550 as pre-Fed policy anxiety is supporting US Dollar’s appeal.

After better-than-anticipated US ISM Manufacturing PMI, an upbeat performance is expected from the US service sector.The USD/CAD pair has attempted a recovery move after defending the crucial support of 1.3530 in the early Asian session. Theasset has rebounded to near 1.3550 and is expected to add gains further as the appeal for the US Dollar is improving ahead of the interest rate decision by the Federal Reserve .

S&P500 futures are showing some losses in early Asia as investors are expected to go light toward the Fed’s policy decision. The risk profile is showing some caution as investors are worried that hawkish interest rate guidance from the Fed would dentMeanwhile, rising odds of one more interest rate hike from the Fed are impacting the demand for US government bonds, which has sent US yields on fire. The 10-year US Treasury yields have jumped to 3.57%.

As per the consensus, ISM Services PMI is seen higher at 53.1 from the former release of 51.2. Also, New Orders Index is expected to jump to 57.0 vs. the prior release of 52.2. On the Canadian Dollar front, S&P Manufacturing PMI missed estimates after landing at 50.2 vs. the consensus of 50.5. This week, investors will keep the focus on the speech from Bank of Canada Governor Tiff Macklem, which is scheduled for Thursday. BoC Macklem is expected to guide the likely

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

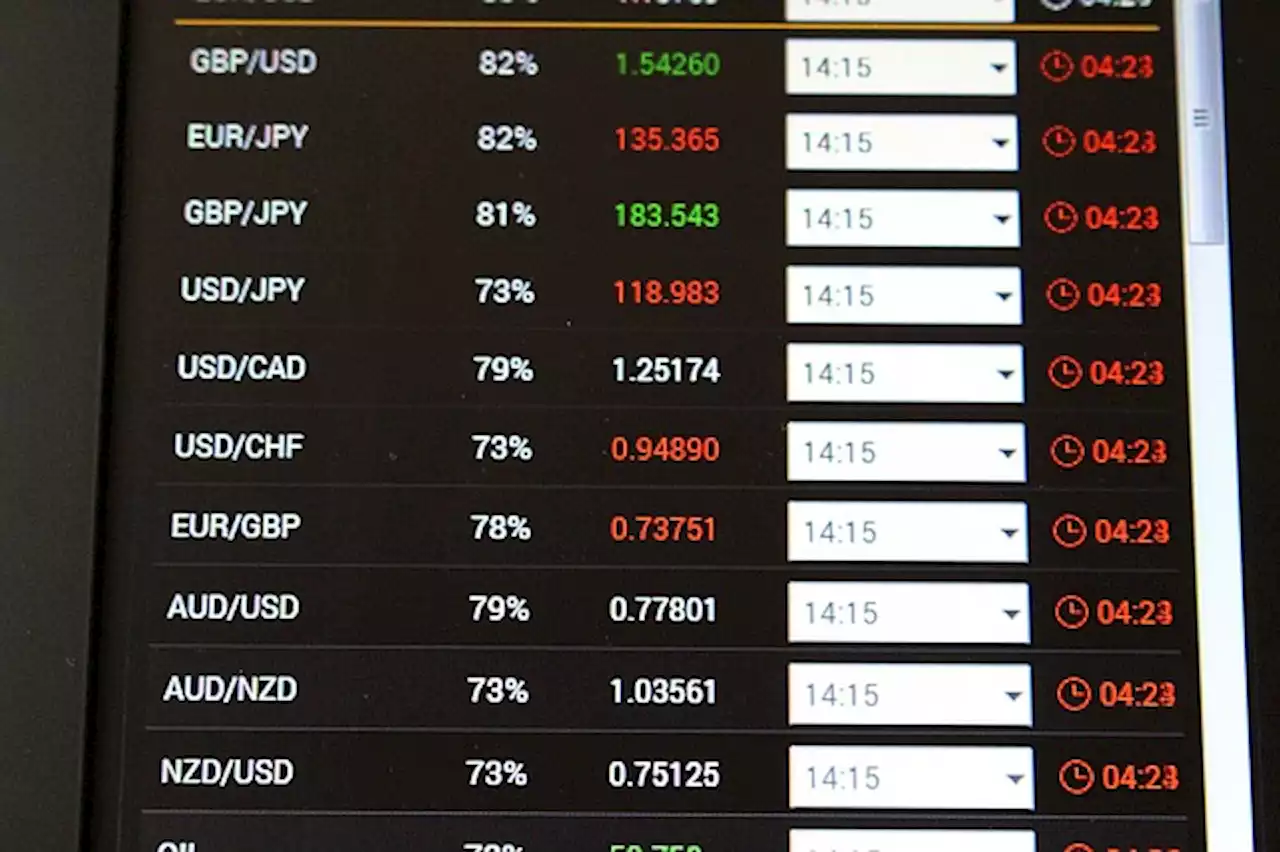

Pairs in Focus This Week \u2013 GBP/USD, EUR/USD, Gold, USD/CADGet the Forex Forecast using fundamentals, sentiment, and technical position analyses for major pairs for the week of April 30th, 2022 here.

Pairs in Focus This Week \u2013 GBP/USD, EUR/USD, Gold, USD/CADGet the Forex Forecast using fundamentals, sentiment, and technical position analyses for major pairs for the week of April 30th, 2022 here.

Read more »

USD/CAD recovery fades near 1.3550 despite softer Oil price, First Republic, US/Canada data eyedUSD/CAD recovery fades near 1.3550 despite softer Oil price, First Republic, US/Canada data eyed – by anilpanchal7 USDCAD Oil RiskAppetite NFP Fed

USD/CAD recovery fades near 1.3550 despite softer Oil price, First Republic, US/Canada data eyedUSD/CAD recovery fades near 1.3550 despite softer Oil price, First Republic, US/Canada data eyed – by anilpanchal7 USDCAD Oil RiskAppetite NFP Fed

Read more »

USD/CAD Price Analysis: Finds an intermediate cushion below 1.3550, US/Canada PMI in focusThe USD/CAD pair has gauged an intermediate cushion below 1.3550 after a vertical sell-off from the weekly high of 1.3668. The Loonie asset is buildin

USD/CAD Price Analysis: Finds an intermediate cushion below 1.3550, US/Canada PMI in focusThe USD/CAD pair has gauged an intermediate cushion below 1.3550 after a vertical sell-off from the weekly high of 1.3668. The Loonie asset is buildin

Read more »

USD/CAD Price Analysis: Key EMA confluence prods Loonie pair sellers near 1.3530USD/CAD Price Analysis: Key EMA confluence prods Loonie pair sellers near 1.3530 USDCAD Technical Analysis SwingTrading ChartPatterns SupportResistance

USD/CAD Price Analysis: Key EMA confluence prods Loonie pair sellers near 1.3530USD/CAD Price Analysis: Key EMA confluence prods Loonie pair sellers near 1.3530 USDCAD Technical Analysis SwingTrading ChartPatterns SupportResistance

Read more »

USD/CAD clings to gains near 1.3575 area amid sliding Oil prices, modest USD strengthThe USD/CAD pair attracts some buyers near the 100-day Simple Moving Average (SMA) on Monday and stalls Friday's sharp retracement slide from the 1.36

USD/CAD clings to gains near 1.3575 area amid sliding Oil prices, modest USD strengthThe USD/CAD pair attracts some buyers near the 100-day Simple Moving Average (SMA) on Monday and stalls Friday's sharp retracement slide from the 1.36

Read more »

Stock Market Calm Rekindles Debate Over Fed TighteningEconomic growth has slowed, but inflation remains persistent in key areas, raising concerns that the Fed’s balance-sheet size could force the Fed to take rates even higher.

Stock Market Calm Rekindles Debate Over Fed TighteningEconomic growth has slowed, but inflation remains persistent in key areas, raising concerns that the Fed’s balance-sheet size could force the Fed to take rates even higher.

Read more »