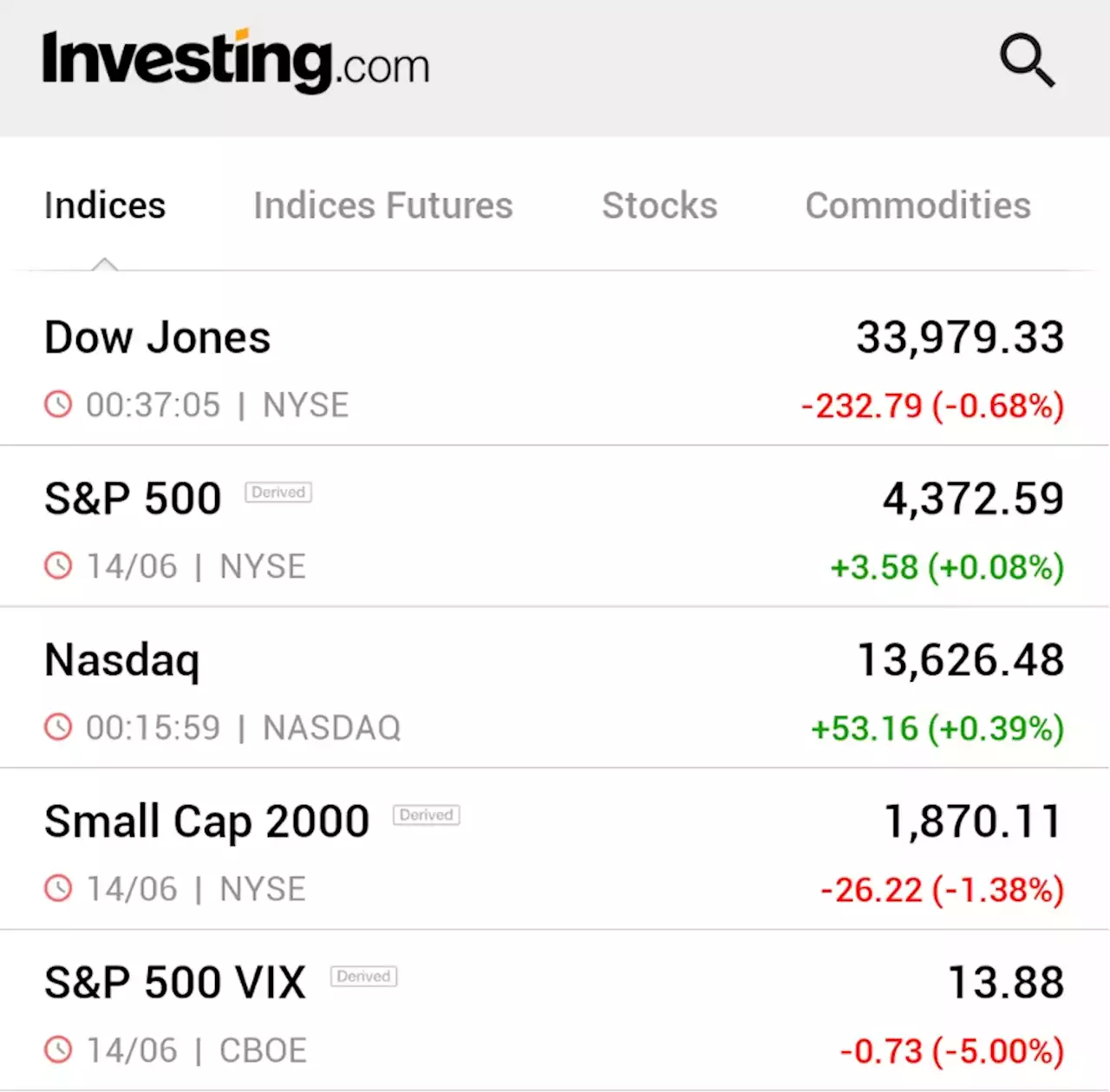

*U.S. STOCKS END MIXED IN WILD SESSION AFTER FED SIGNALS MORE RATE HIKES TO COME $DIA $SPY $QQQ $IWM $VIX 🇺🇸🇺🇸

- U.S. stocks ended mixed on Wednesday after the Federal Reserve kept U.S. interest rates unchanged but signaled in new economic projections that borrowing costs will likely rise by another half of a percentage point by the end of this year.

The new projections added a hawkish tilt to the Fed's interest rate decision, showing policymakers at the median see the benchmark overnight interest rate rising from the current 5.00%-5.25% range to a 5.50%-5.75% range by the end of the year.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

US stocks end mixed after Fed signals more rate hikes to comeU.S. stocks ended mixed on Wednesday after the Federal Reserve kept U.S. interest rates unchanged but signaled in new economic projections that borrowing costs will likely rise by another half of a percentage point by the end of this year.

US stocks end mixed after Fed signals more rate hikes to comeU.S. stocks ended mixed on Wednesday after the Federal Reserve kept U.S. interest rates unchanged but signaled in new economic projections that borrowing costs will likely rise by another half of a percentage point by the end of this year.

Read more »

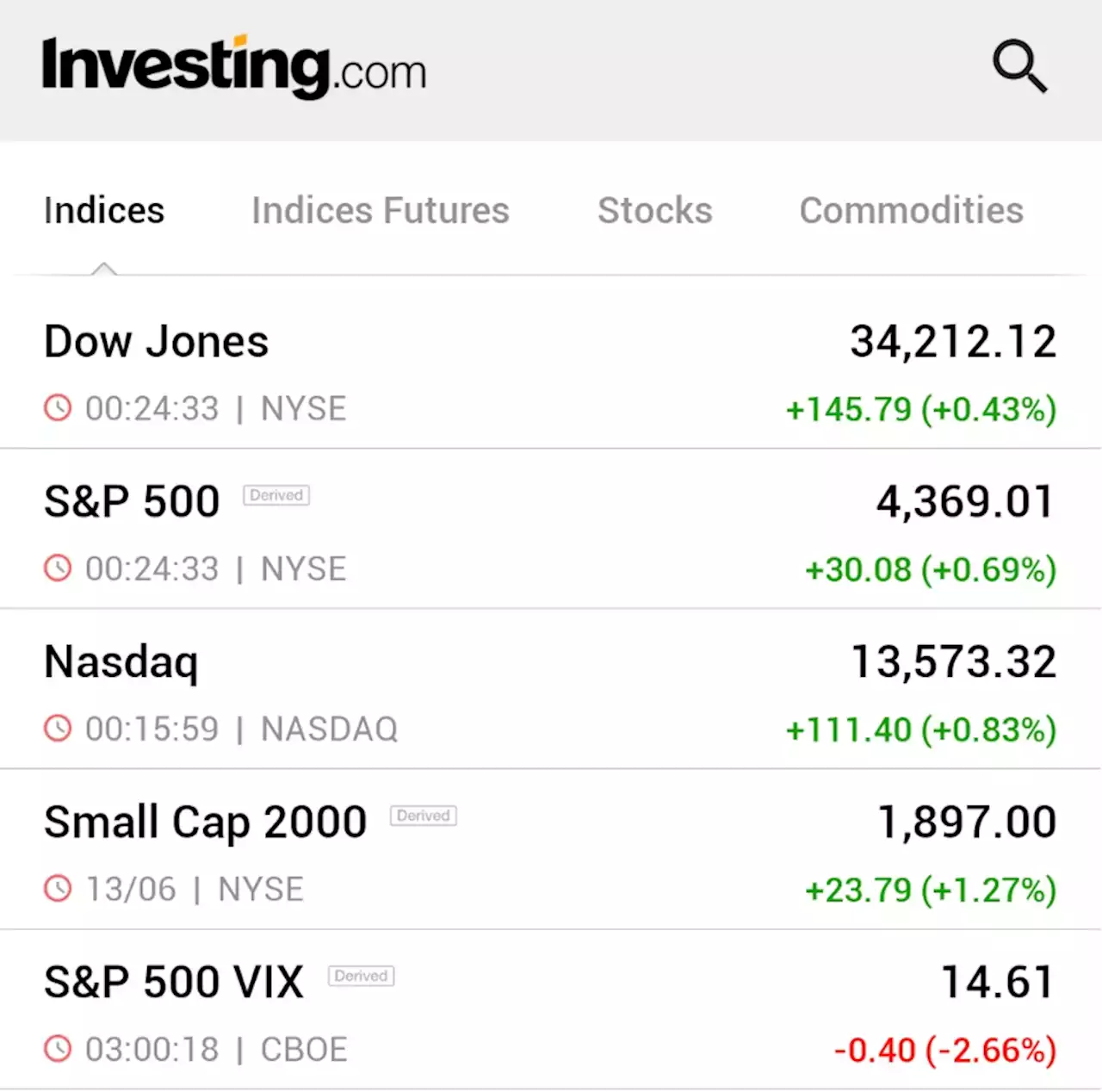

US stocks end higher as inflation data cements bets on rate hike pause By Reuters*S&P 500, NASDAQ END AT 13-MONTH HIGHS AS U.S. STOCKS RALLY AHEAD OF FED DECISION $DIA $SPY $QQQ $IWM $VIX 🇺🇸🇺🇸

US stocks end higher as inflation data cements bets on rate hike pause By Reuters*S&P 500, NASDAQ END AT 13-MONTH HIGHS AS U.S. STOCKS RALLY AHEAD OF FED DECISION $DIA $SPY $QQQ $IWM $VIX 🇺🇸🇺🇸

Read more »

Stocks end mostly higher after Fed skips June rate hike but pencils in more this yearU.S. stocks finished mostly higher on Wednesday in a choppy session that saw the Fed leave rates steady in June, while penciling in another 50 basis points...

Stocks end mostly higher after Fed skips June rate hike but pencils in more this yearU.S. stocks finished mostly higher on Wednesday in a choppy session that saw the Fed leave rates steady in June, while penciling in another 50 basis points...

Read more »

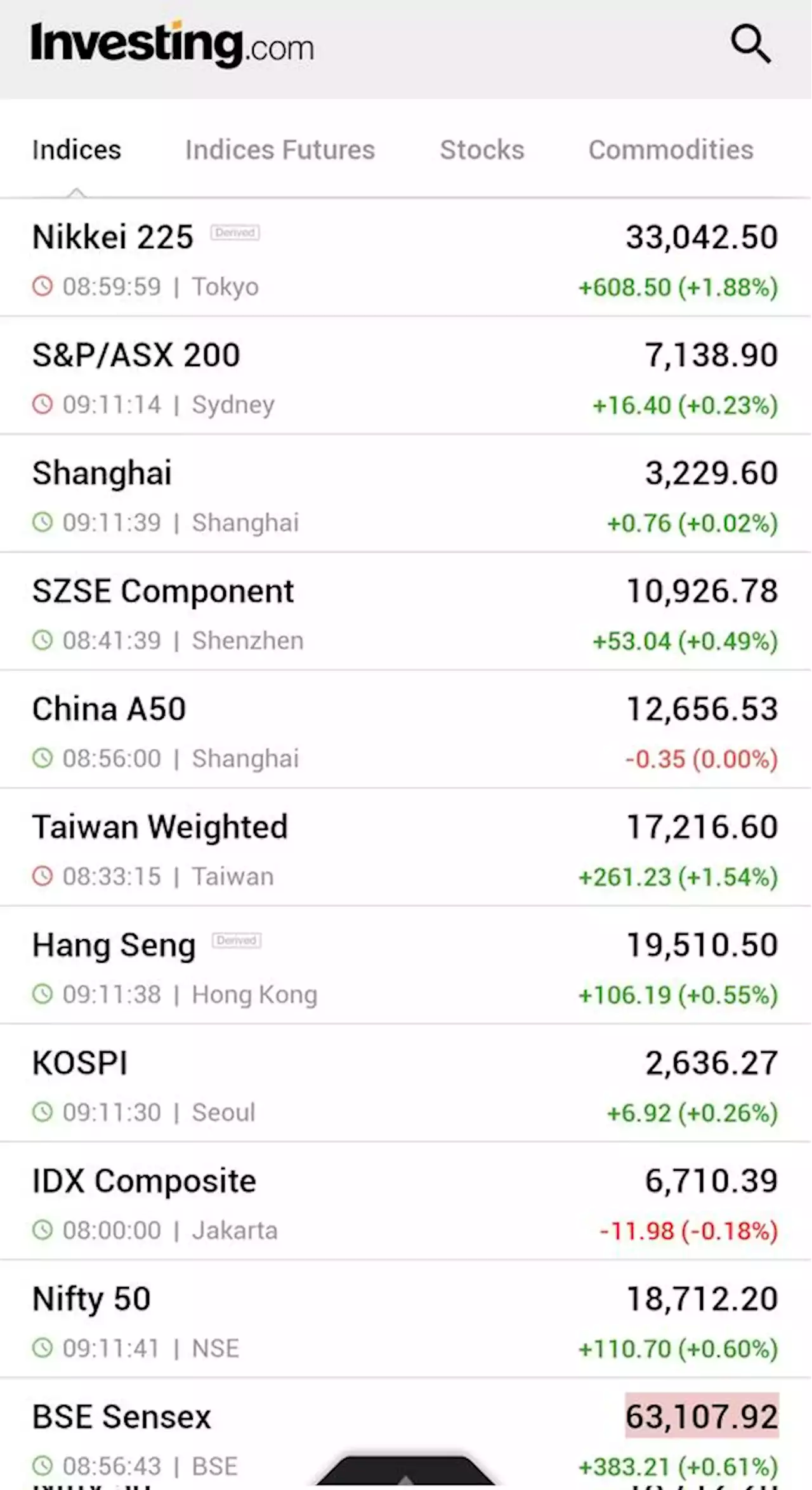

Asia shares track Wall Street rally with US inflation data, Fed in focus By Reuters⚠️BREAKING: *ASIAN STOCKS RISE ACROSS THE REGION AMID GLOBAL RALLY, NIKKEI JUMPS TO 33-YEAR HIGH 🇯🇵🇦🇺🇨🇳🇭🇰🇰🇷🇮🇩🇮🇳

Asia shares track Wall Street rally with US inflation data, Fed in focus By Reuters⚠️BREAKING: *ASIAN STOCKS RISE ACROSS THE REGION AMID GLOBAL RALLY, NIKKEI JUMPS TO 33-YEAR HIGH 🇯🇵🇦🇺🇨🇳🇭🇰🇰🇷🇮🇩🇮🇳

Read more »

Asian stocks buoyed by chipmakers as Fed, CPI data loom By Investing.com⚠️BREAKING: *ASIA STOCKS END HIGHER AS JAPAN'S NIKKEI CLOSES AT NEW 33-YEAR PEAK 🇯🇵🇦🇺🇨🇳🇭🇰🇰🇷🇮🇩🇮🇳

Asian stocks buoyed by chipmakers as Fed, CPI data loom By Investing.com⚠️BREAKING: *ASIA STOCKS END HIGHER AS JAPAN'S NIKKEI CLOSES AT NEW 33-YEAR PEAK 🇯🇵🇦🇺🇨🇳🇭🇰🇰🇷🇮🇩🇮🇳

Read more »

Expect stock rally to end, recession to hit, Fed to stop hikes: SiegelThe stock rally will end soon, recession will hit, and the Fed won't hike interest rates again, markets guru Jeremy Siegel predicts

Read more »