US Dollar retreats ahead of important US economic data point UnitedStates DollarIndex Inflation SEO Macroeconomics

Daily digest: US Dollar facing its first big data point with US CPI

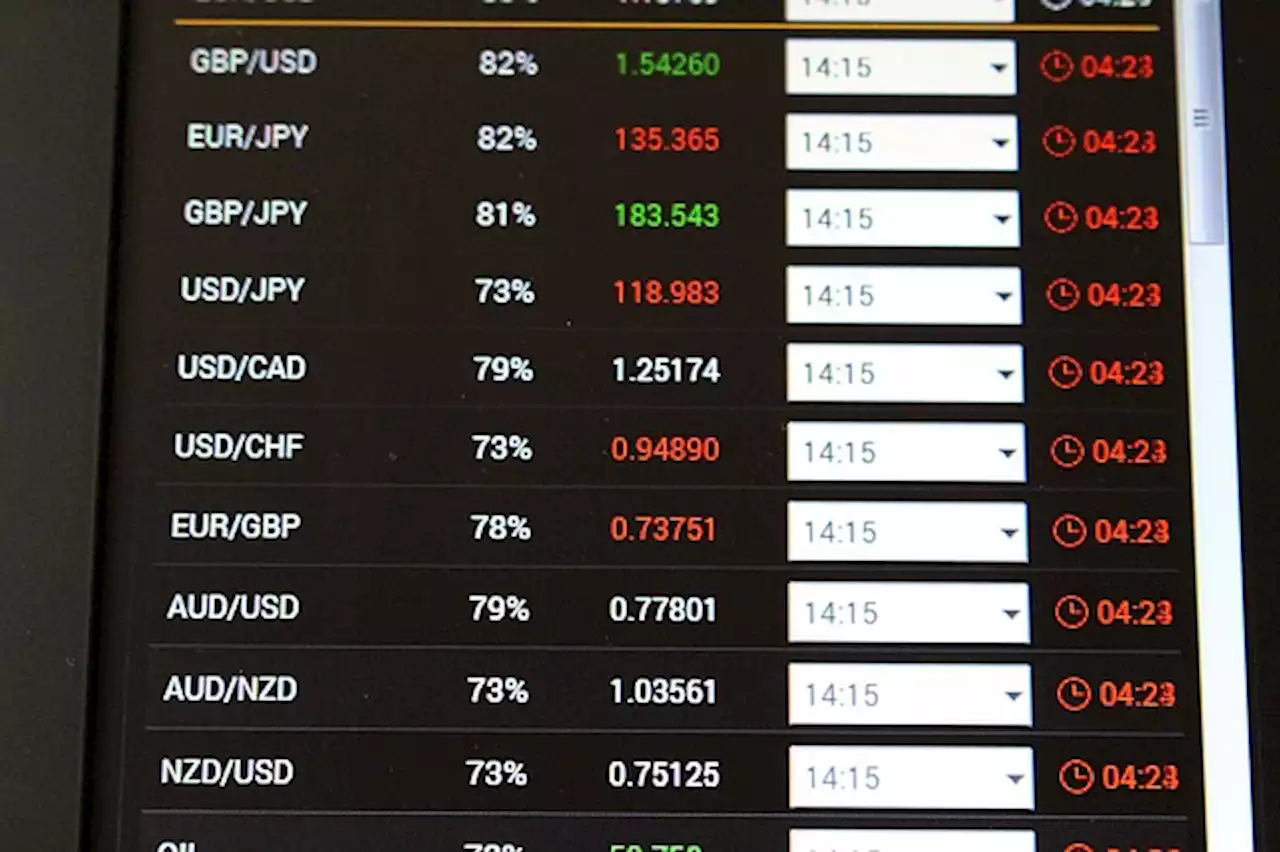

US equity futures rallied substantially on Monday and the party does not look to be over. All major indices in Asia and Europe are in the green while US equity futures are firmly in the green again. Japan’s Nikkei prints even a 33-year high. The benchmark 10-year US Treasury bond yield trades at 3.73%. Steady for now after the whipsaw move on Monday with the 10-year Treasury yield moving from 3.72% to 3.8% before closing at 3.74%. The US Dollar is showing further signs of weakening as almost every currency in the Dollar Index is gaining traction against the Greenback. That floor at 103 really comes close now and could see a firm break on the back of the US CPI numbers later this Tuesday.

Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.Information on these pages contains forward-looking statements that involve risks and uncertainties.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Pairs in Focus This Week \u2013 EUR/USD, GBP/USD, Gold, OilGet the Forex Forecast using fundamentals, sentiment, and technical position analyses for major pairs for the week of June 11th, 2022 here.

Pairs in Focus This Week \u2013 EUR/USD, GBP/USD, Gold, OilGet the Forex Forecast using fundamentals, sentiment, and technical position analyses for major pairs for the week of June 11th, 2022 here.

Read more »

Weekly Forex Forecast \u2013 NASDAQ 100 Index, USD/JPY, GBP/USDThe difference between success and failure in Forex / CFD trading is highly likely to depend mostly upon which assets you choose to trade each week and in which

Weekly Forex Forecast \u2013 NASDAQ 100 Index, USD/JPY, GBP/USDThe difference between success and failure in Forex / CFD trading is highly likely to depend mostly upon which assets you choose to trade each week and in which

Read more »

USD/CAD ticks higher on sliding Oil prices, subdued USD demand acts as a headwindThe USD/CAD pair kicks off the new week on a slight positive note and for now, seems to have snapped a four-day losing streak to a one-month low, arou

USD/CAD ticks higher on sliding Oil prices, subdued USD demand acts as a headwindThe USD/CAD pair kicks off the new week on a slight positive note and for now, seems to have snapped a four-day losing streak to a one-month low, arou

Read more »

USD/JPY strengthens beyond mid-139.00s on modest USD uptick, lacks bullish convictionThe USD/JPY pair gains some positive traction for the second successive day and climbs back above mid-139.00s during the Asian session on Monday. The

USD/JPY strengthens beyond mid-139.00s on modest USD uptick, lacks bullish convictionThe USD/JPY pair gains some positive traction for the second successive day and climbs back above mid-139.00s during the Asian session on Monday. The

Read more »

USD/CAD hangs near one-month low on weaker USD, bearish Oil prices could limit lossesUSD/CAD hangs near one-month low on weaker USD, bearish Oil prices could limit losses – by hareshmenghani USDCAD Fed Inflation Recession Currencies

USD/CAD hangs near one-month low on weaker USD, bearish Oil prices could limit lossesUSD/CAD hangs near one-month low on weaker USD, bearish Oil prices could limit losses – by hareshmenghani USDCAD Fed Inflation Recession Currencies

Read more »

GBP/USD corrects from 1.2600 as USD Index recovers strongly ahead of Fed’s policyThe GBP/USD pair has shown a corrective move to near 1.2560 in the European session. The Cable faced some barriers around 1.2600 as the US Dollar Inde

GBP/USD corrects from 1.2600 as USD Index recovers strongly ahead of Fed’s policyThe GBP/USD pair has shown a corrective move to near 1.2560 in the European session. The Cable faced some barriers around 1.2600 as the US Dollar Inde

Read more »