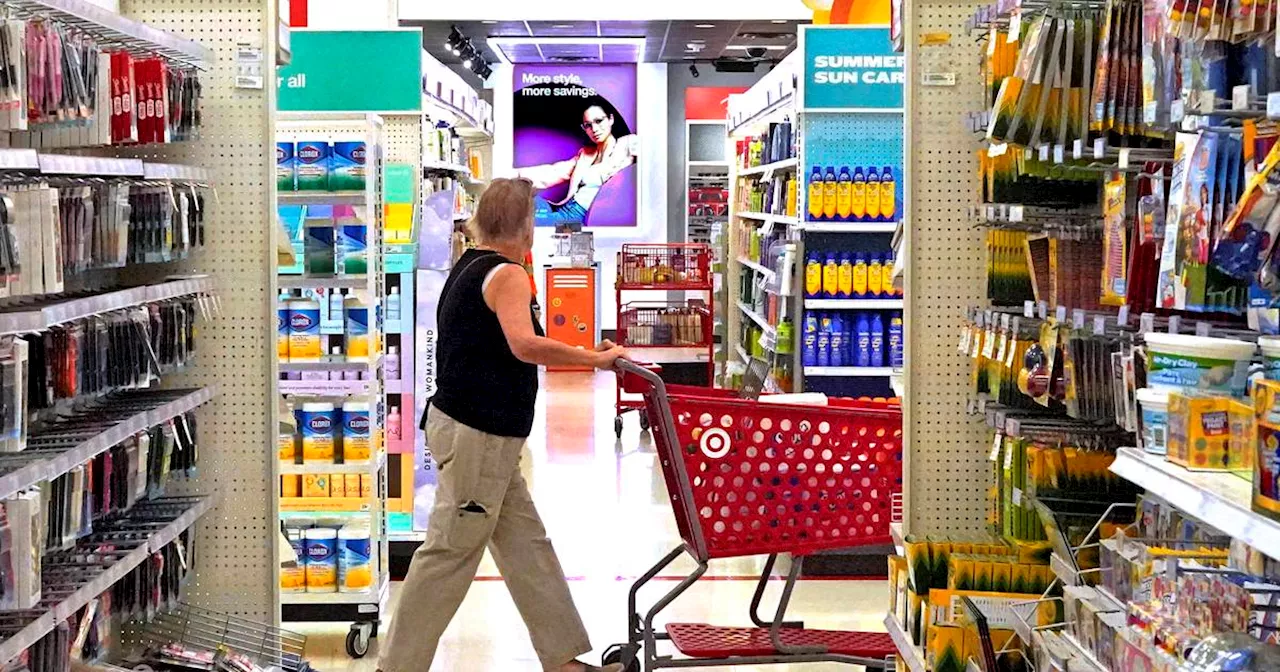

An inflation gauge that is closely monitored by the Federal Reserve showed price increases remained elevated in September amid brisk consumer spending and strong economic growth.

WASHINGTON — Friday’s report from the Commerce Department showed that prices rose 0.4% from August to September, the same as the previous month. And compared with 12 months earlier, inflation was unchanged at 3.4%. Taken as a whole, the figures the government issued Friday show a still-surprisingly resilient consumer, willing to spend briskly enough to power the economy even in the face of persistent inflation and high interest rates.

In Friday’s report on inflation, the government also said that consumer spending last month jumped a robust 0.7%. Spending on services jumped, Friday’s report said, led by greater outlays for international travel, housing and utilities. Excluding volatile food and energy costs, “core” prices rose 0.3% from August to September, above the 0.1% uptick the previous month. Compared with a year earlier, though, core inflation eased to 3.7%, the slowest rise since May 2021 and down from 3.8% in August.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Fed, Bank of England, BOJ, US payrolls, BP, Shell, HSBC and Apple resultsFederal Reserve rate decision – 01/11 – Having overseen a pause in September the US Federal Reserve looks set to undertake a similar decision this wee

Fed, Bank of England, BOJ, US payrolls, BP, Shell, HSBC and Apple resultsFederal Reserve rate decision – 01/11 – Having overseen a pause in September the US Federal Reserve looks set to undertake a similar decision this wee

Read more »

Federal Reserve preferred inflation gauge shows persistent underlying price pressuresAn inflation gauge that is closely monitored by the Federal Reserve showed price increases remained elevated in September amid brisk consumer spending and strong economic growth

Federal Reserve preferred inflation gauge shows persistent underlying price pressuresAn inflation gauge that is closely monitored by the Federal Reserve showed price increases remained elevated in September amid brisk consumer spending and strong economic growth

Read more »

Federal Reserve's preferred inflation gauge shows still-persistent underlying price pressuresAn inflation gauge that's closely monitored by the Federal Reserve showed price increases remained elevated in September amid brisk consumer spending and strong economic growth. Prices rose 0.4% from August to September, the same as the previous month. And compared with 12 months earlier, inflation was unchanged at 3.4%.

Federal Reserve's preferred inflation gauge shows still-persistent underlying price pressuresAn inflation gauge that's closely monitored by the Federal Reserve showed price increases remained elevated in September amid brisk consumer spending and strong economic growth. Prices rose 0.4% from August to September, the same as the previous month. And compared with 12 months earlier, inflation was unchanged at 3.4%.

Read more »

Federal Reserve's preferred inflation gauge shows still-persistent underlying price pressuresAn inflation gauge that's closely monitored by the Federal Reserve showed price increases remained elevated in September amid brisk consumer spending and strong economic growth.

Federal Reserve's preferred inflation gauge shows still-persistent underlying price pressuresAn inflation gauge that's closely monitored by the Federal Reserve showed price increases remained elevated in September amid brisk consumer spending and strong economic growth.

Read more »

Federal Reserve's preferred inflation gauge shows still-persistent underlying price pressuresAn inflation gauge that's closely monitored by the Federal Reserve showed price increases remained elevated in September amid brisk consumer spending and strong economic growth.

Federal Reserve's preferred inflation gauge shows still-persistent underlying price pressuresAn inflation gauge that's closely monitored by the Federal Reserve showed price increases remained elevated in September amid brisk consumer spending and strong economic growth.

Read more »

Americans face still-persistent inflation yet keep spending despite Federal Reserve's rate hikesAn inflation gauge showed price increases remained elevated in September amid brisk consumer spending and strong economic growth.

Americans face still-persistent inflation yet keep spending despite Federal Reserve's rate hikesAn inflation gauge showed price increases remained elevated in September amid brisk consumer spending and strong economic growth.

Read more »