Lloyds Banking Group should have issued a warning to Carl Borg-Neal, 58, instead of dismissing him for using the infamous racial slur, judges ruled.

Lloyds Bank, a retail lender based in the United Kingdom, has been ordered to pay compensation to a manager who was fired for saying the N-word.The judges sitting on the London Central Employment Tribunal ruled that Borg-Neal uttered the slur as part of a question about “the use of the N-word by black people in rap lyrics or to each other when playing basketball.”

The judges accepted Borg-Neal’s contention that his dyslexia can lead him to blurt out thoughts without being mindful of others’ reactions.Carl Borg-Neal, 58, was fired by Lloyds in July 2021 after he uttered the N-word during a race education training session put on by the company.Borg-Neal’s dyslexia also entitles him to protections under UK laws governing the rights of disabled employees, the judges ruled.

Borg-Neal — a former mayor of the town Andover, about 200 miles west of London — is expected to receive a significant sum in damages from the bank. Judges are expected to rule on the size of the payout in October.Test Valley Borough Council His attorney, Emma Hamnett, said that the firing had a “devastating effect” on her client’s mental health.

“He explained over and again to Lloyds that his use of the N-word in full was not intentional, not intended to cause upset and he offered many apologies,” Hamnett said.“We have a zero-tolerance policy on any racial discrimination or use of racist language,” the bank told The Post in a statement.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

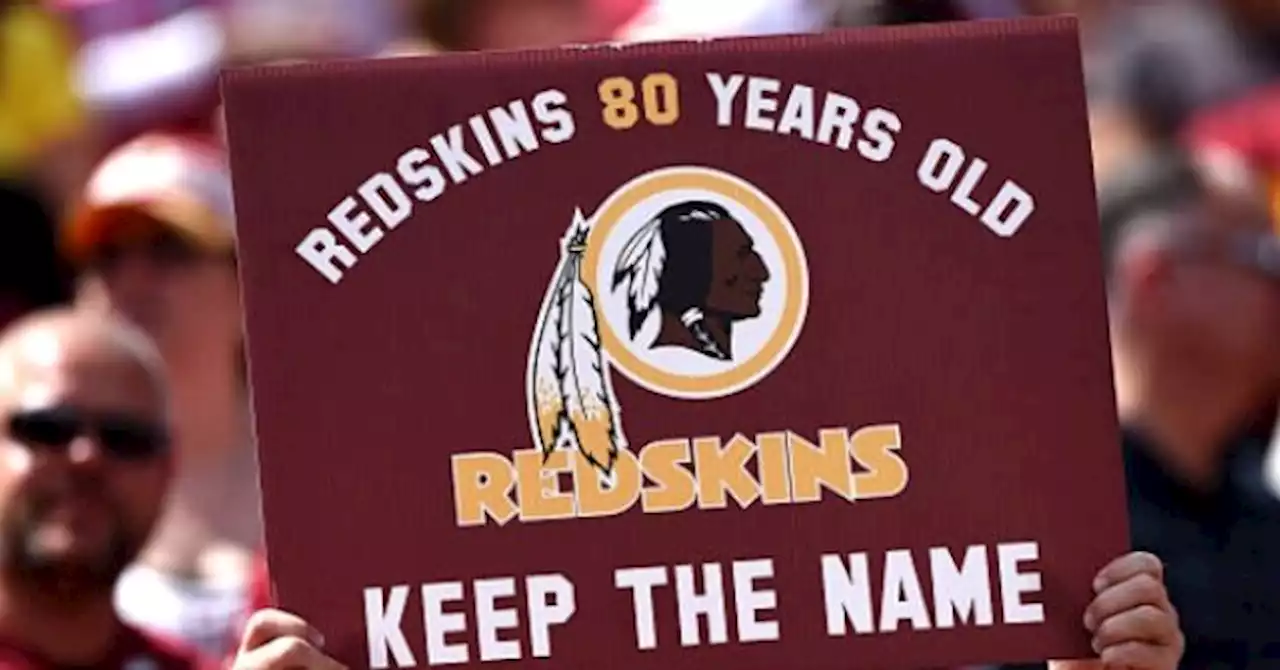

Native American Group Organizing Redskins Name Change Petition Blasts Commanders for Calling them a 'Fake Group'The Native American group leading the petition to reinstate the name Redskins has blasted the Washington Commanders for calling them 'fake.'

Native American Group Organizing Redskins Name Change Petition Blasts Commanders for Calling them a 'Fake Group'The Native American group leading the petition to reinstate the name Redskins has blasted the Washington Commanders for calling them 'fake.'

Read more »

Council Post: Finance Transformation With AI And Open BankingLet's discuss how we can progressively transform the finance, risk and regulatory compliance ecosystem of open banking by leveraging AI.

Council Post: Finance Transformation With AI And Open BankingLet's discuss how we can progressively transform the finance, risk and regulatory compliance ecosystem of open banking by leveraging AI.

Read more »

Safe Banking Act offers hope for diverse ownership in Illinois' booming cannabis industryThere are currently 30,000 employees in the state of Illinois who work in the multi-billion-dollar cannabis industry. Yet for people of color, positions at the very top of the booming business are all too often out of reach.

Safe Banking Act offers hope for diverse ownership in Illinois' booming cannabis industryThere are currently 30,000 employees in the state of Illinois who work in the multi-billion-dollar cannabis industry. Yet for people of color, positions at the very top of the booming business are all too often out of reach.

Read more »

Despite crackdown on junk fees, this banking surcharge just hit a record highSome banking fees have come down significantly, but ATM fees are back on the rise, a new report finds.

Despite crackdown on junk fees, this banking surcharge just hit a record highSome banking fees have come down significantly, but ATM fees are back on the rise, a new report finds.

Read more »

Australia: Encouraging monthly CPI and construction activity dataAnalysts at Australia and New Zealand Banking Group (ANZ) express their view on a batch of Australian economic data released earlier this Wednesday. K

Australia: Encouraging monthly CPI and construction activity dataAnalysts at Australia and New Zealand Banking Group (ANZ) express their view on a batch of Australian economic data released earlier this Wednesday. K

Read more »

Oakland community group Homies Empowerment set to open Freedom SchoolOakland community group Homies Empowerment is set to open its Freedom School in the fall. Interview with founder and principal Dr. Cesar Cruz.

Oakland community group Homies Empowerment set to open Freedom SchoolOakland community group Homies Empowerment is set to open its Freedom School in the fall. Interview with founder and principal Dr. Cesar Cruz.

Read more »