Stock trading is a bipartisan activity in Washington, disclosures show. Republicans traded a larger dollar amount overall — an estimated $201 million vs. Democrats’ $154 million.

Congress resembled a Wall Street trading desk last year, with lawmakers making an estimated total of $355 million worth of stock trades, buying and selling shares of companies based in the U.S. and around the world.

At the top of the list of the biggest traders on Capitol Hill by dollar volume is Rep. Michael McCaul, a Texas Republican, who disclosed an estimated $31 million in stock buys and $35 million in stock sales. He’s followed by Democratic Rep. Ro Khanna of California with $34 million in estimated purchases and $19 million in sales, GOP Rep. Mark Green of Tennessee with $26 million in estimated buys and $26 million in sells, and Democratic Rep.

Independent analysis firms have ended up offering such databases, with 2iQ Research, for example, launching Capitol Trades last year. For the table above, Capitol Trades estimated the value of buys and sells using the midpoint of the declared range for the transaction. Lawmakers aren’t required to disclose a transaction’s exact value, but rather give ranges such as $1,001 to $15,000, or $15,001 to $50,000.

While Khanna’s 2021 disclosures put him at No. 2 behind McCaul for biggest trader in Congress by dollar volume, Capitol Trades ranks him at No. 1 when going by his disclosed number of trades, which was 3,555. A $50 million question for a Florida congressman, plus other notable traders Republican Rep. Scott Franklin of Florida would rank as the second-biggest trader in Congress by dollar amount last year due to a May 2021 disclosure showing a sale of shares in insurance company BRP Group worth an estimated $50 million. The Florida congressman previously had been CEO of an insurance company, Lanier Upshaw, and BRP acquired that company.

“The trustee made the decision to liquidate the equities, and then invest in exchange-traded funds to have a similar kind of exposure and risk-return profile, while eliminating the concerns around the holding of individual equities,” he told MarketWatch, saying those concerns included the challenges around “periodic transaction reporting requirements for members of Congress.”

Efforts to ban congressional stock trading “When the public sees a large volume of trades by members of Congress, it just raises the question of why that is occurring, and if it is without conflicts of interest,” said Kedric Payne, senior director of ethics and general counsel at the Campaign Legal Center, a government watchdog group. “It chips away at that public confidence in their government.”

““When the public sees a large volume of trades by members of Congress, it just raises the question of why that is occurring, and if it is without conflicts of interest.””

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Starbucks CEO Kevin Johnson's total compensation rose 39% in 2021 to $20.4 millionStarbucks Corp. undefined disclosed that Chief Executive Kevin Johnson's total compensation for 2021 totaled $20.43 million in 2021, up 39% from $14.67...

Starbucks CEO Kevin Johnson's total compensation rose 39% in 2021 to $20.4 millionStarbucks Corp. undefined disclosed that Chief Executive Kevin Johnson's total compensation for 2021 totaled $20.43 million in 2021, up 39% from $14.67...

Read more »

Starbucks' top lawyer's pay surpassed $5 million last yearStarbucks Corp general counsel Rachel Gonzalez received more than $5.3 million in total compensation last year, a regulatory filing shows.

Starbucks' top lawyer's pay surpassed $5 million last yearStarbucks Corp general counsel Rachel Gonzalez received more than $5.3 million in total compensation last year, a regulatory filing shows.

Read more »

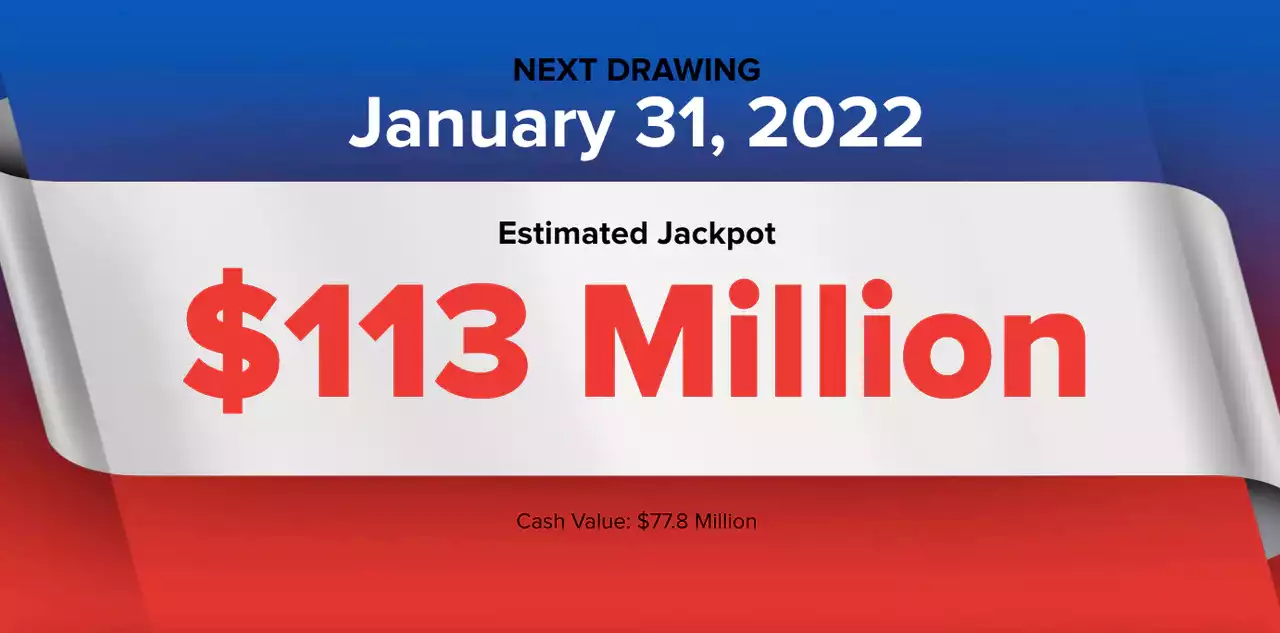

Powerball winning numbers for Monday, Jan. 31, 2022; jackpot $113 millionThe Powerball jackpot is an estimated $113 million for the drawing on Monday, Jan. 31, 2022.

Powerball winning numbers for Monday, Jan. 31, 2022; jackpot $113 millionThe Powerball jackpot is an estimated $113 million for the drawing on Monday, Jan. 31, 2022.

Read more »

No action yet on Mississippi ballot initiative fix, but that's about to changeMississippi lawmakers will soon consider a bill to reinstate the ballot initiative process after it was struck down last year.

No action yet on Mississippi ballot initiative fix, but that's about to changeMississippi lawmakers will soon consider a bill to reinstate the ballot initiative process after it was struck down last year.

Read more »

Major guilds announce film nominees, clarifying Oscar fieldNEW YORK (AP) — Hopes that a few of last year’s biggest box-office hits, “Spider-Man: No Way Home” and “No Time to Die,” might join the best-picture Oscar race w…

Major guilds announce film nominees, clarifying Oscar fieldNEW YORK (AP) — Hopes that a few of last year’s biggest box-office hits, “Spider-Man: No Way Home” and “No Time to Die,” might join the best-picture Oscar race w…

Read more »

Covid-19 Fuels Best-Ever Commercial Real-Estate SalesInvestors bet big on apartment buildings, warehouses and on U.S. growth shifting to the Sunbelt as the pandemic reordered peoples’ lives, explains ahirtens WSJWhatsNow

Covid-19 Fuels Best-Ever Commercial Real-Estate SalesInvestors bet big on apartment buildings, warehouses and on U.S. growth shifting to the Sunbelt as the pandemic reordered peoples’ lives, explains ahirtens WSJWhatsNow

Read more »