U.S. consumer spending barely rose in November, while annual inflation increased at its slowest pace in 13 months, but demand is probably not cooling fast enough to discourage the Federal Reserve from driving interest rates to higher levels next year.

Slowing economic activity amid rising borrowing costs was also flagged by other data from the Commerce Department on Friday showing a modest gain in orders for locally manufactured capital goods last month. Shipments of these goods, which are a proxy for business spending on equipment, fell.

Consumer spending, which accounts for more than two-thirds of U.S. economic activity, edged up 0.1%. Data for October was revised up to show spending surging 0.9% instead of 0.8% as previously reported. Economists polled by Reuters had forecast consumer spending rising 0.2%. Outlays on services increased 0.7%, lifted by housing and utilities as well as financial services and insurance. They offset decreases in air transportation services.

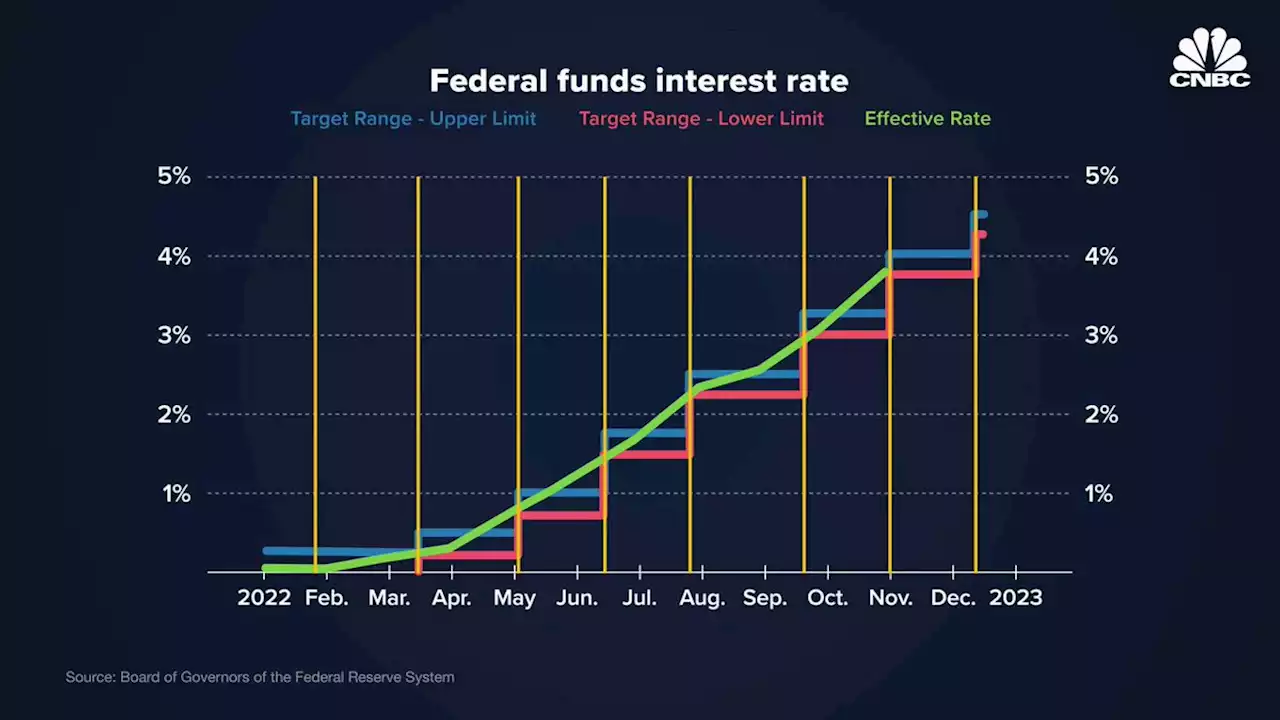

The Fed last week hiked its policy rate by 50 basis points to a 4.25%-4.50% range, the highest since late 2007. Fed officials expect the rate to rise to between 5.00% and 5.25% next year, a level that could be sustained for a while. The personal consumption expenditures price index rose 0.1% last month after climbing 0.4% in October. In the 12 months through November, the PCE price index increased 5.5%. That was the smallest annual gain since October 2021 and followed a 6.1% advance in October.

Consumer prices rose less than expected for a second straight month in November. Consumers' one-year inflation expectations also moderated in December, strengthening views that price pressures peaked several months ago.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

How the Federal Reserve affected 2022's stock marketThe Federal Reserve has emerged as a leading force in the stock market, bolstered by the central bank’s adoption of two unconventional policy tools in the 2000s – large-scale asset purchases and forward guidance. Watch the full video:

How the Federal Reserve affected 2022's stock marketThe Federal Reserve has emerged as a leading force in the stock market, bolstered by the central bank’s adoption of two unconventional policy tools in the 2000s – large-scale asset purchases and forward guidance. Watch the full video:

Read more »

Inflation declined to 5.5% in November, according to key gauge watched by FedInflation fell once again to a 5.5% annual rate in November, as measured by the gauge favored by the Federal Reserve.

Inflation declined to 5.5% in November, according to key gauge watched by FedInflation fell once again to a 5.5% annual rate in November, as measured by the gauge favored by the Federal Reserve.

Read more »

Breakingviews - Missing jobs mystery puts Fed on back footThere’s a conundrum in the United States’ labor market. A study published by the Philadelphia Federal Reserve last week said 10,500 new jobs were added in the second quarter of 2022. Yet the national statistics bureau had previously reported a total over the same period of more than 1 million. Those seemingly missing jobs put the Federal Reserve, which uses the job market as a signal in its fight against inflation, on the back foot.

Breakingviews - Missing jobs mystery puts Fed on back footThere’s a conundrum in the United States’ labor market. A study published by the Philadelphia Federal Reserve last week said 10,500 new jobs were added in the second quarter of 2022. Yet the national statistics bureau had previously reported a total over the same period of more than 1 million. Those seemingly missing jobs put the Federal Reserve, which uses the job market as a signal in its fight against inflation, on the back foot.

Read more »

Existing home sales tumble 7.7% in November, 10th straight month of declinesSales of previously owned houses fell in November for the 10th consecutive month as rising interest rates pushed potential homebuyers out of the market.

Existing home sales tumble 7.7% in November, 10th straight month of declinesSales of previously owned houses fell in November for the 10th consecutive month as rising interest rates pushed potential homebuyers out of the market.

Read more »

US home sales fell in November, the 10th consecutive monthExisting home sales fell 7.7% last month from October to a seasonally adjusted annual rate of 4.09 million, the National Association of Realtors said Wednesday.

US home sales fell in November, the 10th consecutive monthExisting home sales fell 7.7% last month from October to a seasonally adjusted annual rate of 4.09 million, the National Association of Realtors said Wednesday.

Read more »