(Reuters) - Futures for Canada's main stock index slipped on Tuesday, weighed down by weak commodity prices, after soft services sector data from China ...

STORY CONTINUES BELOW THESE SALTWIRE VIDEOS - Futures for Canada's main stock index slipped on Tuesday, weighed down by weak commodity prices, after soft services sector data from China dented global sentiment, while investors braced for the Bank of Canada's interest rate decision slated later this week.

Crude prices declined on the sour sentiment after China data came out, although expectations of an extension in supply cuts by leading OPEC+ producers limited losses. [O/R]Canada's economy unexpectedly contracted in the second quarter at an annualized rate of 0.2%, and growth was most likely flat in July, data on Friday showed, which will probably allow the Bank of Canada to hold rates ahead of a possible recession.

Most economists in a Reuters poll expect the BoC to hold its key interest rate steady at 5.00% on Sept. 6 and keep it at that level through at least the end of March 2024. Australia's central bank on Tuesday kept interest rates steady for a third month, encouraging speculation that the tightening cycle was over as policymakers indicated they have a firmer grip on prices.

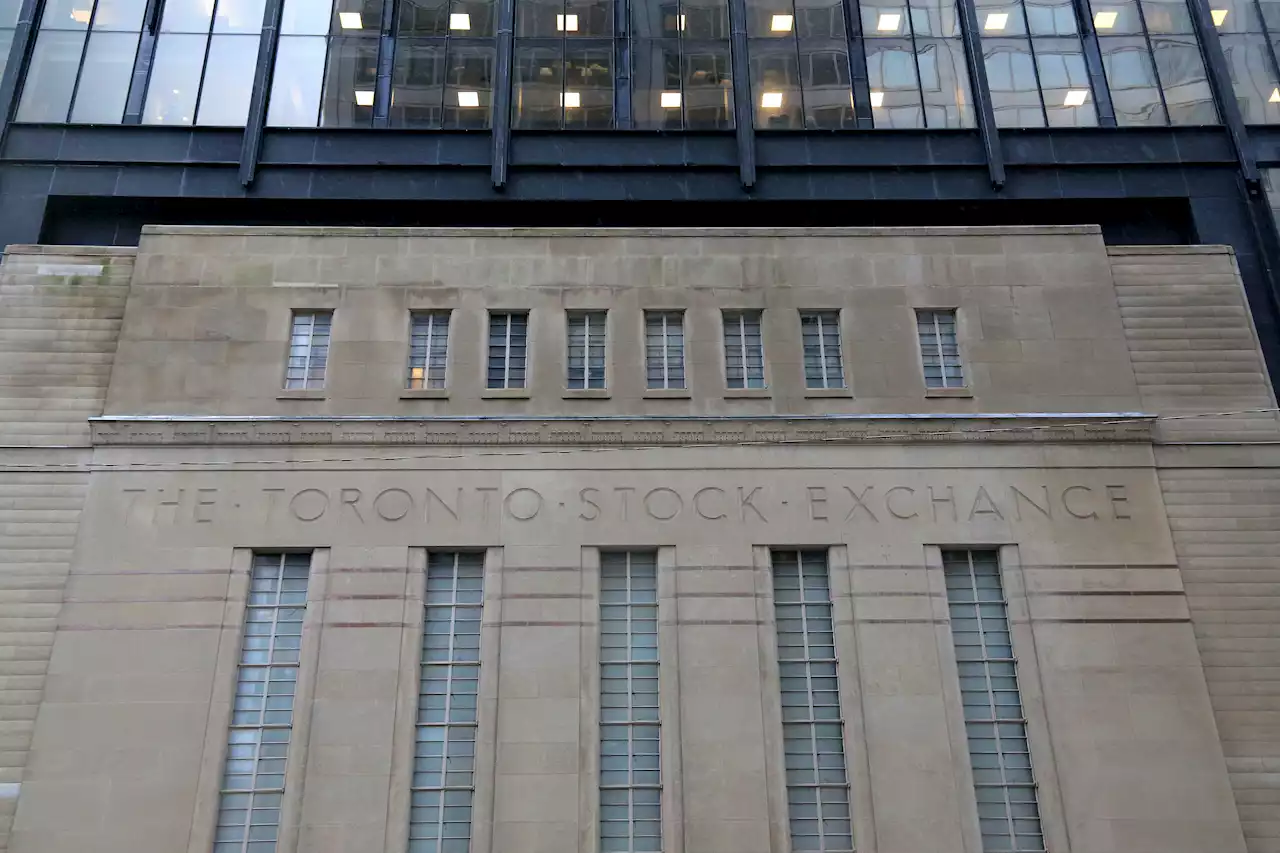

Toronto Stock Exchange's S&P/TSX composite index ended over 1% higher on Friday. The benchmark index was closed on Monday due to the Labor Day holiday.Brent crude: $88.33; -0.8% [O/R]

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Futures fall as rising yield, China service data weighAdding to the downbeat mood, a private survey showed China's services activity expanded at the slowest pace in eight months in August, as weak demand persisted and stimulus efforts failed to meaningfully revive consumption. The S&P 500 ended higher on Friday after a jump in unemployment cemented expectations of a pause in the Fed's interest rate hikes this month. Traders' bets that the Fed will leave rates unchanged in the next policy meeting stood at 93%, while pricing in a 62% chance of a pause in November, up from 52% a week ago, according to the CME FedWatch tool.

Futures fall as rising yield, China service data weighAdding to the downbeat mood, a private survey showed China's services activity expanded at the slowest pace in eight months in August, as weak demand persisted and stimulus efforts failed to meaningfully revive consumption. The S&P 500 ended higher on Friday after a jump in unemployment cemented expectations of a pause in the Fed's interest rate hikes this month. Traders' bets that the Fed will leave rates unchanged in the next policy meeting stood at 93%, while pricing in a 62% chance of a pause in November, up from 52% a week ago, according to the CME FedWatch tool.

Read more »

Futures fall as rising yield, China service data weigh(Reuters) - U.S. stock index futures fell on Tuesday as higher Treasury yields weighed on growth stocks, while a slow pace of expansion in services ...

Futures fall as rising yield, China service data weigh(Reuters) - U.S. stock index futures fell on Tuesday as higher Treasury yields weighed on growth stocks, while a slow pace of expansion in services ...

Read more »

China Seeks $40 Billion Fund to Drive Chipmaking, Reuters SaysChina is seeking to raise a $40 billion fund to bankroll investments in domestic chipmaking and research, Reuters reported, citing unidentified people familiar with the matter.

China Seeks $40 Billion Fund to Drive Chipmaking, Reuters SaysChina is seeking to raise a $40 billion fund to bankroll investments in domestic chipmaking and research, Reuters reported, citing unidentified people familiar with the matter.

Read more »

China's exports, imports likely contracted more slowly in August: Reuters pollBEIJING (Reuters) - China's exports likely contracted at a slower pace in August, a Reuters poll showed on Tuesday, highlighting that manufacturers ...

China's exports, imports likely contracted more slowly in August: Reuters pollBEIJING (Reuters) - China's exports likely contracted at a slower pace in August, a Reuters poll showed on Tuesday, highlighting that manufacturers ...

Read more »

The latest numbers on the microchip shortage: Most cuts in AsiaMicrochip shortages continued to trip up automakers in China and Asian markets outside of China.

The latest numbers on the microchip shortage: Most cuts in AsiaMicrochip shortages continued to trip up automakers in China and Asian markets outside of China.

Read more »

Ethereum bears grow more confident as futures market sees increased sell-offEthereum's taker buy-sell ratio (30-day SMA) has plummeted to a yearly low, suggesting that the coin's futures market is plagued by an increase in sell orders.

Ethereum bears grow more confident as futures market sees increased sell-offEthereum's taker buy-sell ratio (30-day SMA) has plummeted to a yearly low, suggesting that the coin's futures market is plagued by an increase in sell orders.

Read more »