U.S. Treasury yields fell on Tuesday as investors awaited comments from Federal Reserve officials and looked to key inflation data due later in the week.

Yields and prices move in opposite directions and one basis point equals 0.01%.Investors braced themselves for fresh inflation figures due this week, including the consumer price index print and core inflation figures on Wednesday and the producer price index report on Thursday.

The data is likely to inform the Federal Reserve's next policy moves, including regarding interest rates. At the conclusion of its last meeting in March, the central bank hinted thatBefore then, investors will hear from a series of central bank officials, with Chicago Fed President Austan Goolsbee, Philadelphia Fed President Patrick Harker and Minneapolis Fed President Neel Kashkari due to make remarks on Tuesday.

Meanwhile, various major U.S. banks are slated to publish earnings reports later in the week. Investors will be watching the releases closely to assess the state of the banking sector after last month's turmoil and concerns about the stability of the financial system.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Treasury yields fall after data shows U.S. job growth slowed in MarchThe yield on the benchmark 10-year Treasury note slipped to 3.3626%, while the yield on the 30-year Treasury bond dipped to 3.5811%.

Treasury yields fall after data shows U.S. job growth slowed in MarchThe yield on the benchmark 10-year Treasury note slipped to 3.3626%, while the yield on the 30-year Treasury bond dipped to 3.5811%.

Read more »

Community wants Arbitrum Foundation to return 700M ARB to DAO TreasuryThe new proposal is open for voting until April 14. At the time of writing, 55% of voters supported the proposal, 42% opposed it, and 2% abstained.

Community wants Arbitrum Foundation to return 700M ARB to DAO TreasuryThe new proposal is open for voting until April 14. At the time of writing, 55% of voters supported the proposal, 42% opposed it, and 2% abstained.

Read more »

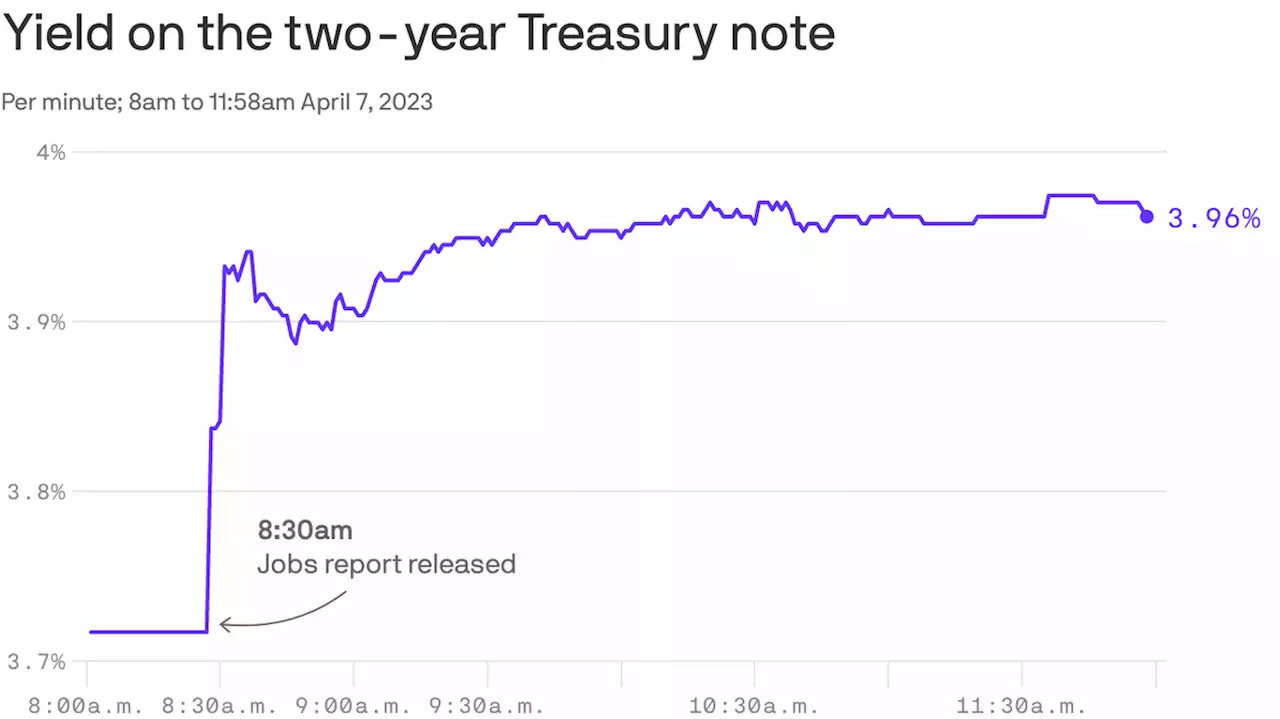

Treasury yields rise on nearly perfect jobs reportYields on short-term Treasury notes, heavily influenced by expectations for what the central bank will do with monetary policy, shot higher after the jobs data was released Friday.

Treasury yields rise on nearly perfect jobs reportYields on short-term Treasury notes, heavily influenced by expectations for what the central bank will do with monetary policy, shot higher after the jobs data was released Friday.

Read more »

Treasury yields decline as U.S.-China tensions boost demand for bondsTreasury yields declined on Monday as renewed geopolitical tensions helped boost demand for bond-market safety plays. Bond yields move inversely to prices,...

Treasury yields decline as U.S.-China tensions boost demand for bondsTreasury yields declined on Monday as renewed geopolitical tensions helped boost demand for bond-market safety plays. Bond yields move inversely to prices,...

Read more »

Ethereum's 'Shapella' Upgrade Nears; U.S. Treasury Outlines Illicit Finance Risks Associated with DeFiEthereum developers have started to refer to the blockchain’s upcoming hard fork – in this case, a key upgrade – as “Shapella.” Ether Capital CEO Brian Mosoff joins the conversation ahead of the two major Ethereum network upgrades expected to occur simultaneously on April 12. Plus, TRM Labs Head of Legal and Government Affairs Ari Redbord discusses the Treasury Department's first analysis of illicit finance risks associated with DeFi.

Ethereum's 'Shapella' Upgrade Nears; U.S. Treasury Outlines Illicit Finance Risks Associated with DeFiEthereum developers have started to refer to the blockchain’s upcoming hard fork – in this case, a key upgrade – as “Shapella.” Ether Capital CEO Brian Mosoff joins the conversation ahead of the two major Ethereum network upgrades expected to occur simultaneously on April 12. Plus, TRM Labs Head of Legal and Government Affairs Ari Redbord discusses the Treasury Department's first analysis of illicit finance risks associated with DeFi.

Read more »

TRM Labs Exec on Future of Crypto Regulation, Treasury’s Warning on DeFiThe U.S. Treasury Department is out with a new report warning that decentralized finance (DeFi) services that aren’t compliant with anti-money laundering and terrorist financing rules pose “the most significant current illicit finance risk” in that corner of the crypto sector. TRM Labs Head of Legal and Government Affairs Ari Redbord breaks down the Treasury Department's first analysis of hazards in the DeFi space. Plus, his outlook on the crypto regulatory framework in the U.S.

TRM Labs Exec on Future of Crypto Regulation, Treasury’s Warning on DeFiThe U.S. Treasury Department is out with a new report warning that decentralized finance (DeFi) services that aren’t compliant with anti-money laundering and terrorist financing rules pose “the most significant current illicit finance risk” in that corner of the crypto sector. TRM Labs Head of Legal and Government Affairs Ari Redbord breaks down the Treasury Department's first analysis of hazards in the DeFi space. Plus, his outlook on the crypto regulatory framework in the U.S.

Read more »