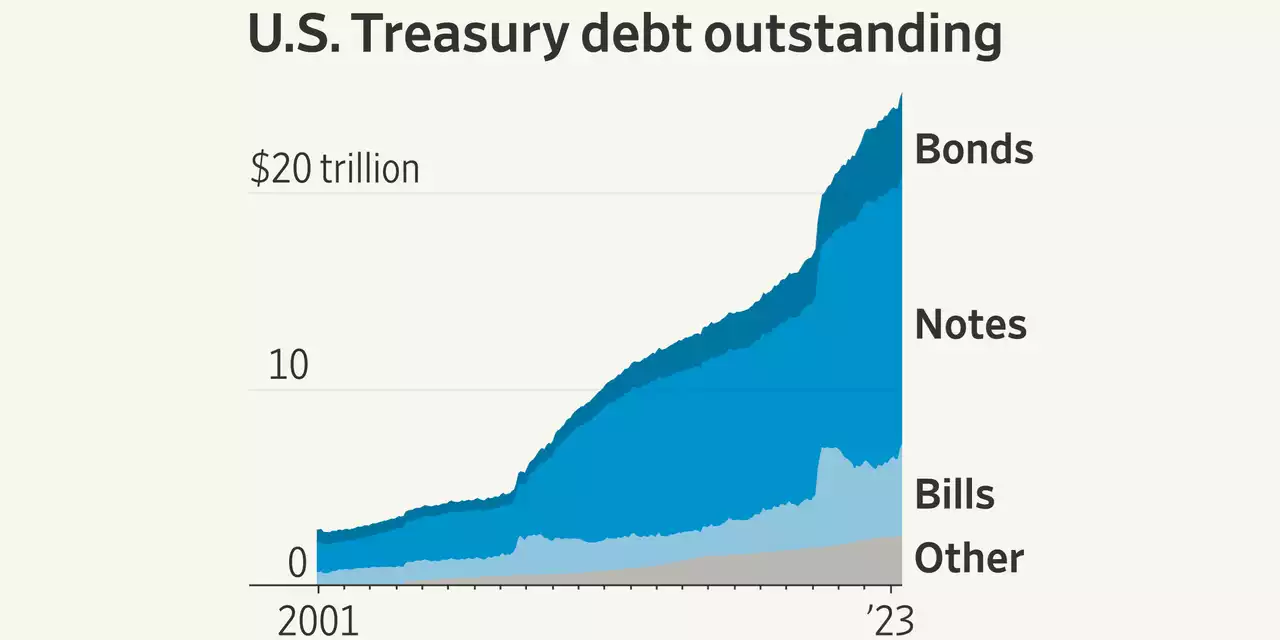

The August selloff in Treasurys began with worries about the fiscal outlook. It's now being driven by growing expectations rates won't return to recent lows.

An aggressive August selloff in long-dated Treasurys, which began with worries about the fiscal outlook, is now being driven by expectations U.S. interest rates likely won’t return to the past decade’s lows.

At the heart of Monday’s moves were questions about whether the so-called neutral rate of Federal Reserve policy, or level which is likely to prevail when the economy is operating at full strength and inflation is stable, has gone up and by how much. Economists refer to the real neutral rate of interest, after subtracting inflation, as r* or “r-star.” And it’s a topic that Fed Chairman Jerome Powell is seen as likely to delve into during his speech at the annual Jackson Hole symposium on Friday.

Rising U.S. deficits are among the factors which may be contributing to a higher neutral rate of interest. Another is better-than-expected U.S. economic growth, with the Atlanta Fed’s GDPNow forecasting model predicting a 5.8% growth rate for real gross domestic product in the third quarter — even after more than a year of Fed rate hikes. With the fed funds rate target now between 5.25%-5.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Today’s lowest mortgage rates? 15-year terms at 6.25%Check out the mortgage purchase rates for August 18, 2023, which are unchanged from yesterday.

Today’s lowest mortgage rates? 15-year terms at 6.25%Check out the mortgage purchase rates for August 18, 2023, which are unchanged from yesterday.

Read more »

Big Treasury Rout Lures Fresh BuyersBond investors say the summer selloff in U.S. Treasury debt is providing the best buying opportunity in years.

Big Treasury Rout Lures Fresh BuyersBond investors say the summer selloff in U.S. Treasury debt is providing the best buying opportunity in years.

Read more »

US Treasury Secretary Says She Didn't Know the Mushrooms She Ate Were PsychedelicUS Treasury Secretary Janet Yellen ate psychedelic mushrooms on a recent trip to China, but did not know they had hallucinogenic properties.

US Treasury Secretary Says She Didn't Know the Mushrooms She Ate Were PsychedelicUS Treasury Secretary Janet Yellen ate psychedelic mushrooms on a recent trip to China, but did not know they had hallucinogenic properties.

Read more »

Markets Week Ahead: Gold, US Dollar, Nasdaq 100, Treasury Yields, Jackson Hole, ChinaSurging Treasury yields pushed down gold prices as the US Dollar outperformed and equity markets wobbled. Ahead, all eyes are on the Fed’s Jackson Hole Symposium as markets continue watching economic developments out of China.

Markets Week Ahead: Gold, US Dollar, Nasdaq 100, Treasury Yields, Jackson Hole, ChinaSurging Treasury yields pushed down gold prices as the US Dollar outperformed and equity markets wobbled. Ahead, all eyes are on the Fed’s Jackson Hole Symposium as markets continue watching economic developments out of China.

Read more »

Treasury yields up near multi-year highs as Powell speech eyed later in weekBond yields rose on Monday, leaving benchmark rates hovering near 15-year highs as traders eyed a speech by Fed Chair Jay Powell at the end of the week.

Treasury yields up near multi-year highs as Powell speech eyed later in weekBond yields rose on Monday, leaving benchmark rates hovering near 15-year highs as traders eyed a speech by Fed Chair Jay Powell at the end of the week.

Read more »