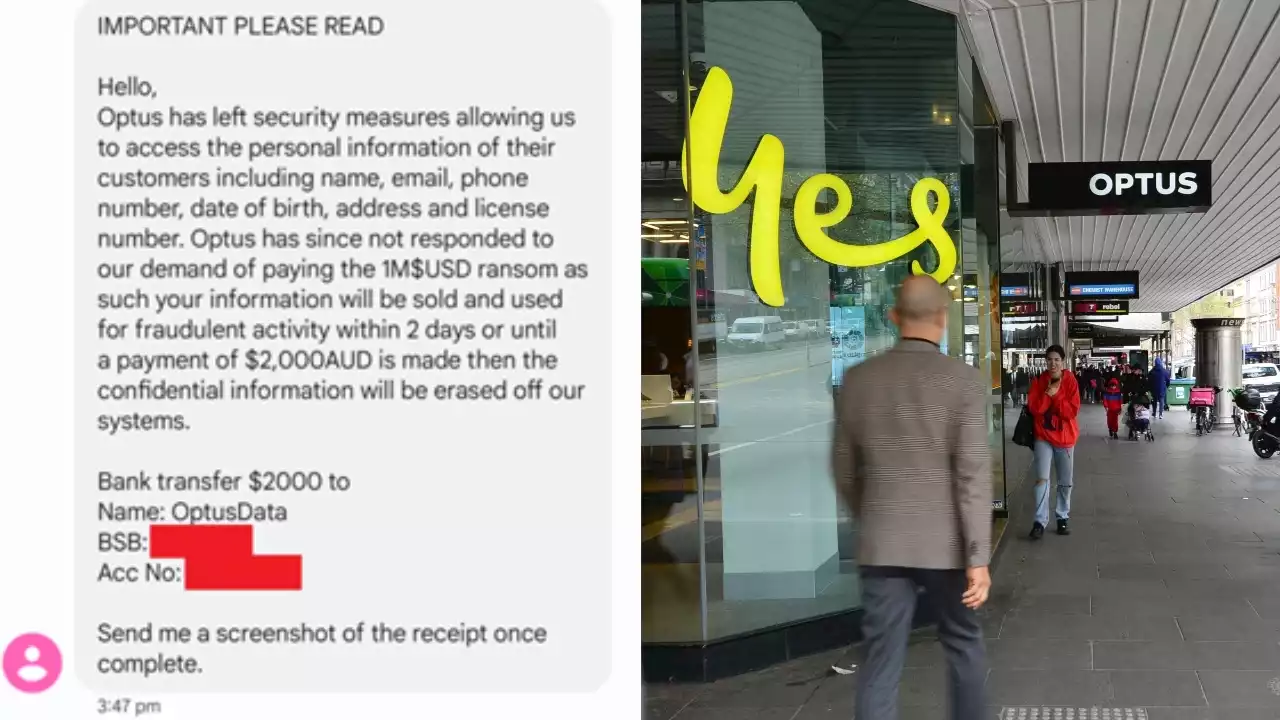

Scamwatch has revealed four new hoaxes targeting Optus customers, warning scammers will use the data breach and target victims in 'any way that they can'.

Scamwatch revealed four new hoaxes targeting Optus customers warning scammers would use the data breach and target people in"any way that they can".

Stream more local news with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 "Optus is not contacting people about issuing new sim cards. Delete these messages," Scamwatch said. Scammers are also posing as the telco to send out fake emails alerting customers about an"issue" with a bill.The agency warned any messages appearing to offer compensation to customers following the data breach are a scam.

And lastly, the agency warned any messages appearing to offer compensation to customers following the data breach are a scam.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Government ‘working around the clock’ to protect impacted Optus customers: ChalmersTreasurer Jim Chalmers says the government has been 'working around the clock' to ensure 'unwilling victims' of the Optus data breach can be protected. 'We do expect Optus to do whatever they can to protect their customers and to provide the necessary support. I think we've made that clear in recent days,' Mr Chalmers said in his press conference today. 'Since Saturday, when I spoke to the Governor of the Reserve Bank, the Chair of APRA and CEO of one of the Big Four banks, we've made sure that we have been working closely with the financial system and with the regulators. Mr Chalmers said the Treasury convened a meeting of several of the banks and Australian Banking Association, the Customer-owned Banking Association, APRA, ACCC and the Australian Financial Crimes Exchange to 'better understand' any options and considerations. 'One of the big focuses of these discussions … is the safe and secure sharing of data between Optus and regulated financial institutions, with the appropriate safeguards, to allow those institutions to undertake enhanced monitoring for the purposes of best protecting their consumers from any bad behaviour following this data breach.'

Government ‘working around the clock’ to protect impacted Optus customers: ChalmersTreasurer Jim Chalmers says the government has been 'working around the clock' to ensure 'unwilling victims' of the Optus data breach can be protected. 'We do expect Optus to do whatever they can to protect their customers and to provide the necessary support. I think we've made that clear in recent days,' Mr Chalmers said in his press conference today. 'Since Saturday, when I spoke to the Governor of the Reserve Bank, the Chair of APRA and CEO of one of the Big Four banks, we've made sure that we have been working closely with the financial system and with the regulators. Mr Chalmers said the Treasury convened a meeting of several of the banks and Australian Banking Association, the Customer-owned Banking Association, APRA, ACCC and the Australian Financial Crimes Exchange to 'better understand' any options and considerations. 'One of the big focuses of these discussions … is the safe and secure sharing of data between Optus and regulated financial institutions, with the appropriate safeguards, to allow those institutions to undertake enhanced monitoring for the purposes of best protecting their consumers from any bad behaviour following this data breach.'

Read more »

The four scams Optus customers need to watch out forScammers will contact the almost 10 million affected customers "anyway they can", as fall-out from last week&x27;s data breach continues.

Read more »

Flat-footed response aggravates anxiety of Optus attackIn a fluid digital world, governments and firms cannot prevent data theft completely. But they should be doing much more to stop cyberattacks in the first place and smooth the process when people have their information stolen. | The Age's View mbachelard

Flat-footed response aggravates anxiety of Optus attackIn a fluid digital world, governments and firms cannot prevent data theft completely. But they should be doing much more to stop cyberattacks in the first place and smooth the process when people have their information stolen. | The Age's View mbachelard

Read more »

Optus hack victims warned about new scam as fraudsters try to 'cash in'If you receive an email looking like this, be skeptical. It could be a fraudster.

Read more »

Optus ‘hasn’t done enough’ to protect customers’ sensitive dataAssistant Treasurer Stephen Jones says clearly Optus “hasn’t done enough” to protect its customers' sensitive data, after the hacker behind the cyberattack on the telecommunications company released 10,000 customer records on Tuesday. “As every day goes by more information is revealed on the extent of this breach,” Mr Jones told Sky News Australia. “We now understand that Medicare data has been released.”

Optus ‘hasn’t done enough’ to protect customers’ sensitive dataAssistant Treasurer Stephen Jones says clearly Optus “hasn’t done enough” to protect its customers' sensitive data, after the hacker behind the cyberattack on the telecommunications company released 10,000 customer records on Tuesday. “As every day goes by more information is revealed on the extent of this breach,” Mr Jones told Sky News Australia. “We now understand that Medicare data has been released.”

Read more »

Government ‘working around the clock’ to protect impacted Optus customers: ChalmersTreasurer Jim Chalmers says the government has been 'working around the clock' to ensure 'unwilling victims' of the Optus data breach can be protected. 'We do expect Optus to do whatever they can to protect their customers and to provide the necessary support. I think we've made that clear in recent days,' Mr Chalmers said in his press conference today. 'Since Saturday, when I spoke to the Governor of the Reserve Bank, the Chair of APRA and CEO of one of the Big Four banks, we've made sure that we have been working closely with the financial system and with the regulators. Mr Chalmers said the Treasury convened a meeting of several of the banks and Australian Banking Association, the Customer-owned Banking Association, APRA, ACCC and the Australian Financial Crimes Exchange to 'better understand' any options and considerations. 'One of the big focuses of these discussions … is the safe and secure sharing of data between Optus and regulated financial institutions, with the appropriate safeguards, to allow those institutions to undertake enhanced monitoring for the purposes of best protecting their consumers from any bad behaviour following this data breach.'

Government ‘working around the clock’ to protect impacted Optus customers: ChalmersTreasurer Jim Chalmers says the government has been 'working around the clock' to ensure 'unwilling victims' of the Optus data breach can be protected. 'We do expect Optus to do whatever they can to protect their customers and to provide the necessary support. I think we've made that clear in recent days,' Mr Chalmers said in his press conference today. 'Since Saturday, when I spoke to the Governor of the Reserve Bank, the Chair of APRA and CEO of one of the Big Four banks, we've made sure that we have been working closely with the financial system and with the regulators. Mr Chalmers said the Treasury convened a meeting of several of the banks and Australian Banking Association, the Customer-owned Banking Association, APRA, ACCC and the Australian Financial Crimes Exchange to 'better understand' any options and considerations. 'One of the big focuses of these discussions … is the safe and secure sharing of data between Optus and regulated financial institutions, with the appropriate safeguards, to allow those institutions to undertake enhanced monitoring for the purposes of best protecting their consumers from any bad behaviour following this data breach.'

Read more »