Yes, you could owe the IRS even more.

on Feb. 23, warning taxpayers about a price hike coming in the next few months. The tax agency said that interest rates will increase for the calendar quarter starting April 1, 2022. You can accrue interest on two types of payments: overpayment or underpayment. So starting in April, overpayments will have an interest rate of 4 percent, except for corporations which will earn a 3 percent rate and a 1.5 percent rate for the portion of a corporate overpayment that exceeds $10,000.

On the other hand, the date by which you have to pay penalties and additions to your taxes in order to avoid building up interest might vary based on your penalty. According to the IRS, both the Failure to File penalty and accuracy-related penalties are due on the return due date or extended return due date. Failure to Pay, estimated tax, and Dishonored Check penalties are due on the date the tax agency sends you a notice or assesses the penalty.

"If you received a notice, you will not be charged interest on the amount shown if you pay the amount you owe in full on or before the 'pay by' date," the IRS says.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Bank of Canada hiking path full of risksWatch: Financial Post Editor\u002Din\u002DChief Kevin Carmichael on rising inflation and interest rates

Read more »

Mortgage rates fall amid geopolitical uncertainty. How the Russia-Ukraine crisis could impact home buyers --- and interest ratesInterest rates have slid in the face of Russia's invasion of neighboring Ukraine, but surging gas prices could compel the Federal Reserve to hike rates faster.

Mortgage rates fall amid geopolitical uncertainty. How the Russia-Ukraine crisis could impact home buyers --- and interest ratesInterest rates have slid in the face of Russia's invasion of neighboring Ukraine, but surging gas prices could compel the Federal Reserve to hike rates faster.

Read more »

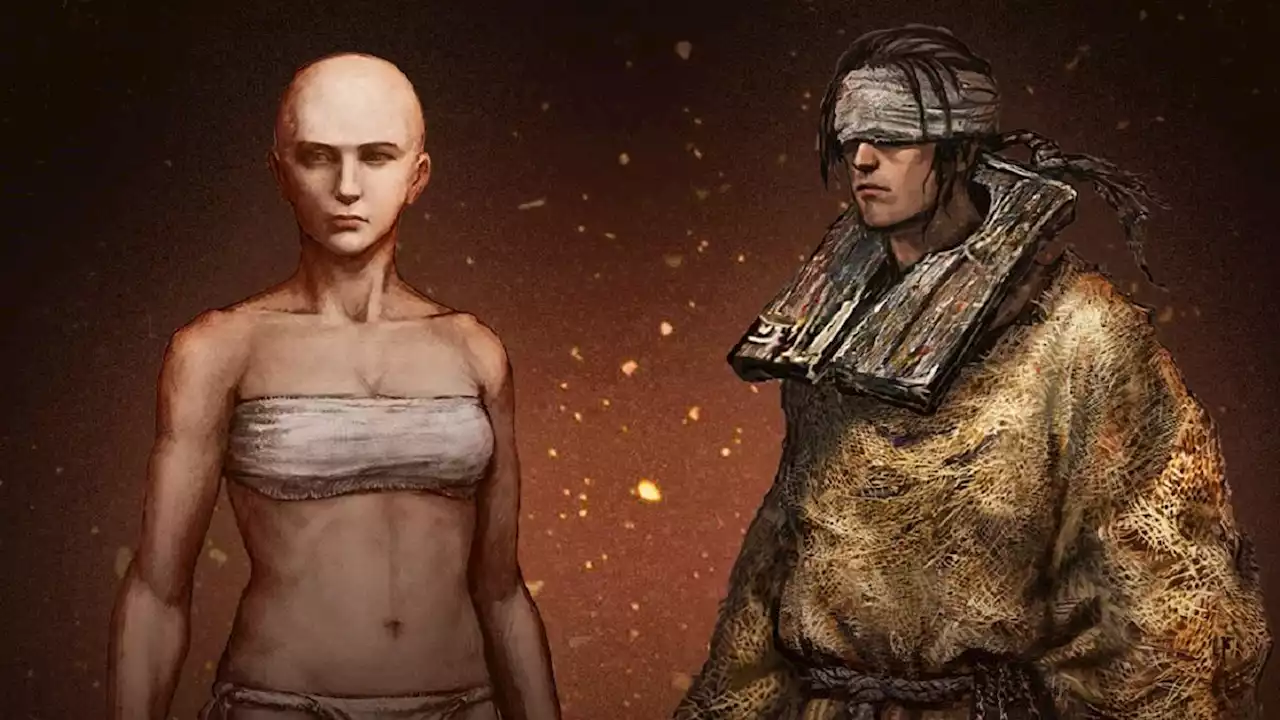

Elden Ring: Best Starting ClassesElden Ring's got no shortage of classes to choose from, and whether this is your first [...]

Elden Ring: Best Starting ClassesElden Ring's got no shortage of classes to choose from, and whether this is your first [...]

Read more »

If You Have Roku, Prepare to Lose Channels Immediately — Best LifeRoku has announced that it was removing all non-certified channels from its streaming service a week ahead of schedule.

Read more »