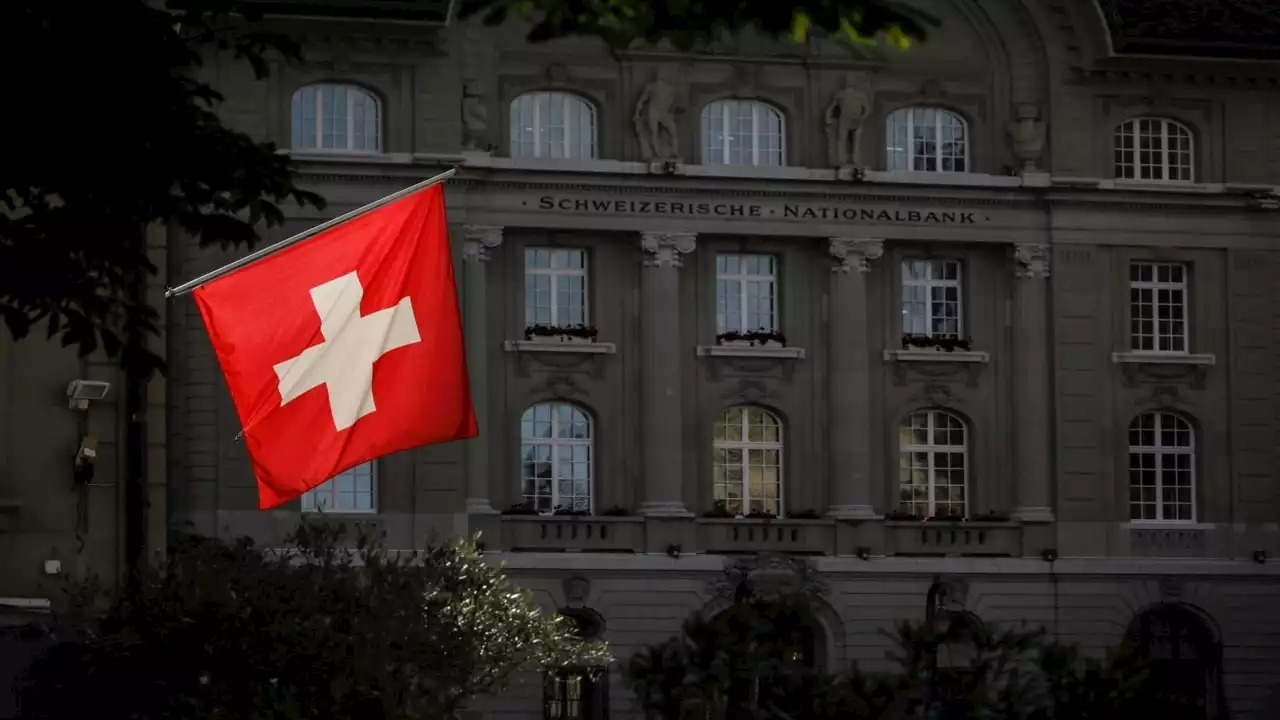

CommSec’s Tom Piotrowski says over the last day six central banks globally raised rates including the Bank of England, Federal Reserve and Swiss National Bank.

“Swiss National Bank hiked rates about half a per cent as they thread the needle on their own banking challenges,” Mr Piotrowski told Sky News Australia.“The markets are pricing in that there will be no change in April, but the reality is we have still got inflation and retail sales numbers to look at next week.

“Depending on how they pan out, that will make a big impression on what we can expect from the RBA next month.”

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Swiss regulators defiant on $26bn Credit Suisse bond wipeoutAmid growing signs of a lawsuit against the UBS-Credit Suisse deal, the Swiss regulator said its AT1 bond write-off was necessary and contractually permitted.

Swiss regulators defiant on $26bn Credit Suisse bond wipeoutAmid growing signs of a lawsuit against the UBS-Credit Suisse deal, the Swiss regulator said its AT1 bond write-off was necessary and contractually permitted.

Read more »

Fed lifts rate by quarter point, says banking system ‘sound’Policymakers said the anticipate that some additional policy firming may be appropriate in order to attain to return inflation to 2 percent over time.

Fed lifts rate by quarter point, says banking system ‘sound’Policymakers said the anticipate that some additional policy firming may be appropriate in order to attain to return inflation to 2 percent over time.

Read more »

Switzerland’s national pride dealt heavy blow by the merger of its banking titans‘A monster is born’, say local press, as Credit Suisse takeover by UBS creates bank twice the size of the Swiss economy

Switzerland’s national pride dealt heavy blow by the merger of its banking titans‘A monster is born’, say local press, as Credit Suisse takeover by UBS creates bank twice the size of the Swiss economy

Read more »

Riskiest bank bonds rise as regulators’ assurances resonateAT1 notes from Europe’s biggest banks including Commerzbank, HSBC and UniCredit climbed in Asia, where bonds including from Westpac were quoted higher.

Riskiest bank bonds rise as regulators’ assurances resonateAT1 notes from Europe’s biggest banks including Commerzbank, HSBC and UniCredit climbed in Asia, where bonds including from Westpac were quoted higher.

Read more »

Fires of 'national significance' spread through Australia's Red CentreThere are five large blazes spreading west of Alice Springs, which have already burnt through an estimated 100,000 hectares.

Fires of 'national significance' spread through Australia's Red CentreThere are five large blazes spreading west of Alice Springs, which have already burnt through an estimated 100,000 hectares.

Read more »

‘The hydropower goldrush’: how Europe’s first wild river national park saw off the damsThe Vjosa River in Albania teems with more than 1,000 species, while rare vultures and Balkan lynx visit its banks. It has seen off the threat of a surge in barriers, but the shadow of development persists

‘The hydropower goldrush’: how Europe’s first wild river national park saw off the damsThe Vjosa River in Albania teems with more than 1,000 species, while rare vultures and Balkan lynx visit its banks. It has seen off the threat of a surge in barriers, but the shadow of development persists

Read more »