Stocks fell sharply Tuesday, led by bank shares, as investors prepared for another possible interest-rate hike by the Federal Reserve.

The Dow Jones Industrial Average fell more than 500 points, or 1.5%, in trading shortly before noon. The tech-heavy Nasdaq and the S&P 500 also cratered.

The Fed will announce Wednesday whether it’s imposing its 10th rate hike since March 2022 to fight inflation. The Consumer Price Index rose 0.1% in March at an annual rate of 5%, well above the central bank’s target rate of 2%. Rising interest rates have created cash shortages at some banks as customers withdraw their money in search of better returns.

Regulators on Monday seized San Francisco-based First Republic Bank and struck a deal with JPMorgan Chase to take over most of its assets.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Federal Reserve's employee stock trading rules not strict enough: Agency watchdogThe federalreserve does not have enough restrictions on how employees trade in the stock market despite the agency having some of the most rigid staff rules, according to a government watchdog.

Federal Reserve's employee stock trading rules not strict enough: Agency watchdogThe federalreserve does not have enough restrictions on how employees trade in the stock market despite the agency having some of the most rigid staff rules, according to a government watchdog.

Read more »

Deregulating Banks Is Dangerous.JohnCassidy writes about First Republic Bank’s sale to JPMorgan Chase, and why Congress should restore the Dodd-Frank regulatory standards for all banks with more than $50 billion in assets.

Deregulating Banks Is Dangerous.JohnCassidy writes about First Republic Bank’s sale to JPMorgan Chase, and why Congress should restore the Dodd-Frank regulatory standards for all banks with more than $50 billion in assets.

Read more »

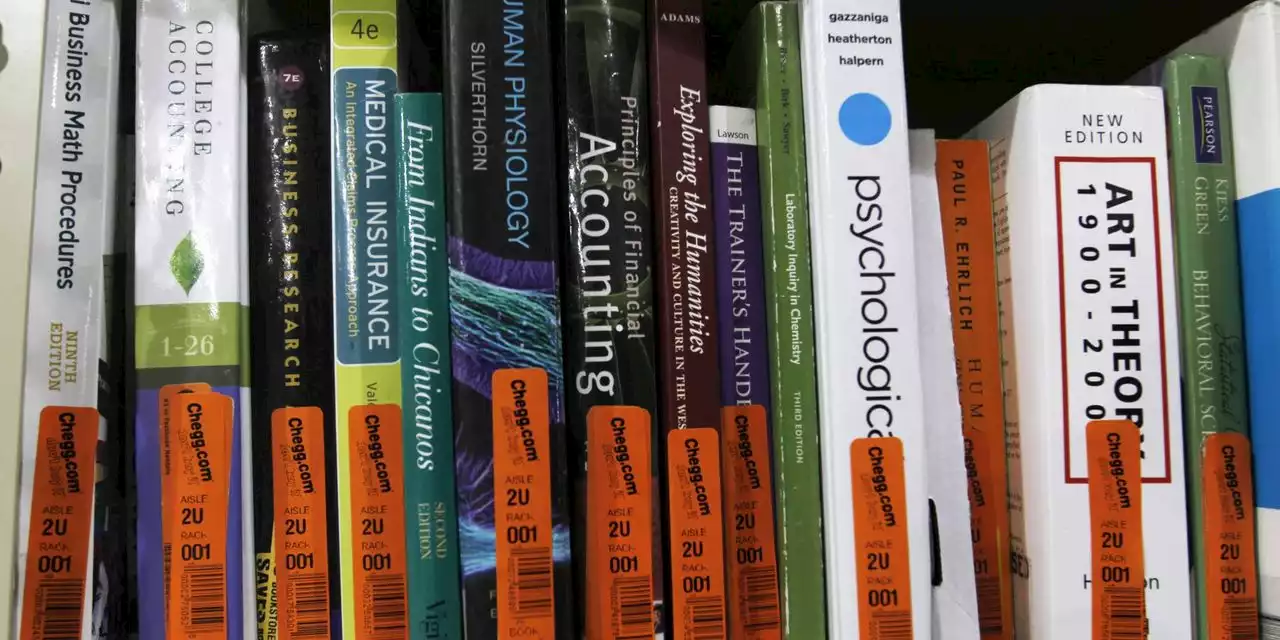

Chegg’s stock tumbles on ChatGPT student usage, Pfizer and Burger King parent shares rise on results and other stocks on the moveThese were the some of the most active stocks during Tuesday premarket trading.

Chegg’s stock tumbles on ChatGPT student usage, Pfizer and Burger King parent shares rise on results and other stocks on the moveThese were the some of the most active stocks during Tuesday premarket trading.

Read more »

Stocks ease; Aussie dollar soars after surprise hikeGlobal shares fell on Tuesday as caution set in ahead of the Federal Reserve's upcoming policy meeting, while bumper profits at Europe's biggest bank gave financial stocks a boost.

Stocks ease; Aussie dollar soars after surprise hikeGlobal shares fell on Tuesday as caution set in ahead of the Federal Reserve's upcoming policy meeting, while bumper profits at Europe's biggest bank gave financial stocks a boost.

Read more »

How Fed's Powell could spoil stock-market's 2023 rally, according to Morgan Stanley's Mike WilsonU.S. stocks could see a sharp selloff later this week if Federal Reserve Chairman Jerome Powell again pushes back against hopes for interest-rate cuts this...

How Fed's Powell could spoil stock-market's 2023 rally, according to Morgan Stanley's Mike WilsonU.S. stocks could see a sharp selloff later this week if Federal Reserve Chairman Jerome Powell again pushes back against hopes for interest-rate cuts this...

Read more »