Investors eyed the forthcoming non-farm payroll report from the Labor Department on Friday.

"The Fed is signaling a willingness to keep tightening, but markets aren't convinced it will happen as much as the Fed projects," Kathy Jones, chief fixed income strategist for the Schwab Center for Financial Research, wrote in a bond market update. "The gap between the peak rate implied by the dot plot and market expectations has narrowed but hasn't closed."

The three major averages are on their way to a losing week. The S&P 500 is off by about 0.9%, while the Nasdaq is on pace for a 0.8% decline. The Dow is the underperformer of the three, tracking for a 1.4% loss.Stock futures were lower Thursday ahead of non-farm payroll data due out on Friday morning.

Futures tied to the Dow Jones Industrial Average were flat. S&P 500 and Nasdaq 100 futures were both 1% lower. Investors will turn their attention from private jobs data from ADP on Thursday to the Labor Departments non-farm payrolls on Friday. Economists polled by Dow Jones are forecasting an increase of 240,000 positions.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Stock futures fall as investors await Fed meeting minutes: Live updatesInvestors are coming off a positive session Monday, which kicked off the start of a new trading month, quarter and half-year for traders.

Stock futures fall as investors await Fed meeting minutes: Live updatesInvestors are coming off a positive session Monday, which kicked off the start of a new trading month, quarter and half-year for traders.

Read more »

Stock market news today: Investors await Fed meeting minutesUS stocks slip as investors await Fed minutes and parse China growth data

Read more »

5 reasons investors should start preparing for stock market lossesWhat You Need To Know About Markets And The Economy

Read more »

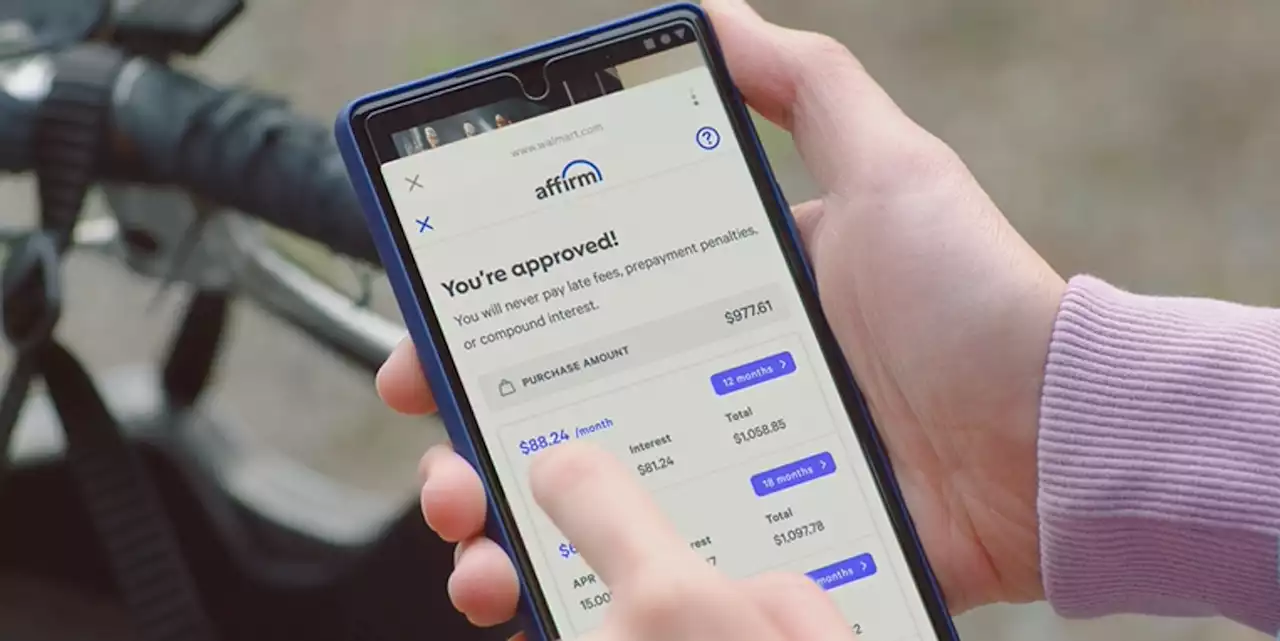

Affirm's stock dives after analyst gives reasons investors should sellAffirm's stock fell Thursday after Piper recommended investors sell, as higher rates and competition hurt revenue and lead to margin contraction.

Affirm's stock dives after analyst gives reasons investors should sellAffirm's stock fell Thursday after Piper recommended investors sell, as higher rates and competition hurt revenue and lead to margin contraction.

Read more »

Retail investors keep chasing the stock market rally, rotating to EVs from AI: analystsIndividual investors keep chasing a 2023 stock-market rally, but show signs of pivoting toward electric-vehicle makers and away from AI plays, research firm...

Retail investors keep chasing the stock market rally, rotating to EVs from AI: analystsIndividual investors keep chasing a 2023 stock-market rally, but show signs of pivoting toward electric-vehicle makers and away from AI plays, research firm...

Read more »

'Complacent' stock market investors start to 'respect' higher-for-longer U.S. interest ratesFinancial markets finally come around to idea that U.S. interest rates are likely to stay higher for longer, driven by a blowout private-sector jobs report.

'Complacent' stock market investors start to 'respect' higher-for-longer U.S. interest ratesFinancial markets finally come around to idea that U.S. interest rates are likely to stay higher for longer, driven by a blowout private-sector jobs report.

Read more »