pstrongIt has S$47m in assets under management at launch./strong/p pSGX Securities has officially welcomed the Lion-OCBC Securities APAC Financial Dividend Plus ETF, an ETF with S$47m in assets under management (AUM) that tracks the region’s financial sector. This is reportedly the world’s first ETF tracking the APAC financial sector.

SGX Securities has officially welcomed the Lion-OCBC Securities APAC Financial Dividend Plus ETF, an ETF with S$47m in assets under management that tracks the region’s financial sector. This is reportedly the world’s first ETF tracking the APAC financial sector.

This will allow investors to ride on the strength of the financial sector and have access to “stable and high” dividend returns, said Janice Kan, co-head of equities, SGX Group. “With its listing on SGX, local investors will be able to tap into the strengths of Asia Pacific’s financial sector through a convenient and familiar platform,” He said.The ETF is available in both Singapore dollar and United States dollar denominations under the SGX tickers YLD and YLU respectively. Investors can trade the ETF via their brokers and trading platforms.Since you're here...

We can also organize a real life or digital event for you and find thought leader speakers as well as industry leaders, who could be your potential partners, to join the event. We also run some awards programmes which give you an opportunity to be recognized for your achievements during the year and you can join this as a participant or a sponsor.3.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

OCBC Securities marks fourth ETF launch in SingaporepstrongThe ETF guarantees a minimum 5% annual dividend for the first 2 years./strong/p pOCBC Securities and Lion Global Investors (LGI) will list Lion-OCBC Securities APAC Financials Dividend Plus Exchange Traded Fund (ETF) on the Singapore Exchange (SGX).

OCBC Securities marks fourth ETF launch in SingaporepstrongThe ETF guarantees a minimum 5% annual dividend for the first 2 years./strong/p pOCBC Securities and Lion Global Investors (LGI) will list Lion-OCBC Securities APAC Financials Dividend Plus Exchange Traded Fund (ETF) on the Singapore Exchange (SGX).

Read more »

APAC Realty partners with Upper Room Realty for Philippine expansionpstrongThe Philippines is APAC Realty’s 13th country in its Asia Pacific portfolio, and the 40th globally./strong/p pAPAC Realty Limited announced its expansion in the Philippines through an ERA Franchise Agreement with Upper Room Realty (Phils.) Inc.

APAC Realty partners with Upper Room Realty for Philippine expansionpstrongThe Philippines is APAC Realty’s 13th country in its Asia Pacific portfolio, and the 40th globally./strong/p pAPAC Realty Limited announced its expansion in the Philippines through an ERA Franchise Agreement with Upper Room Realty (Phils.) Inc.

Read more »

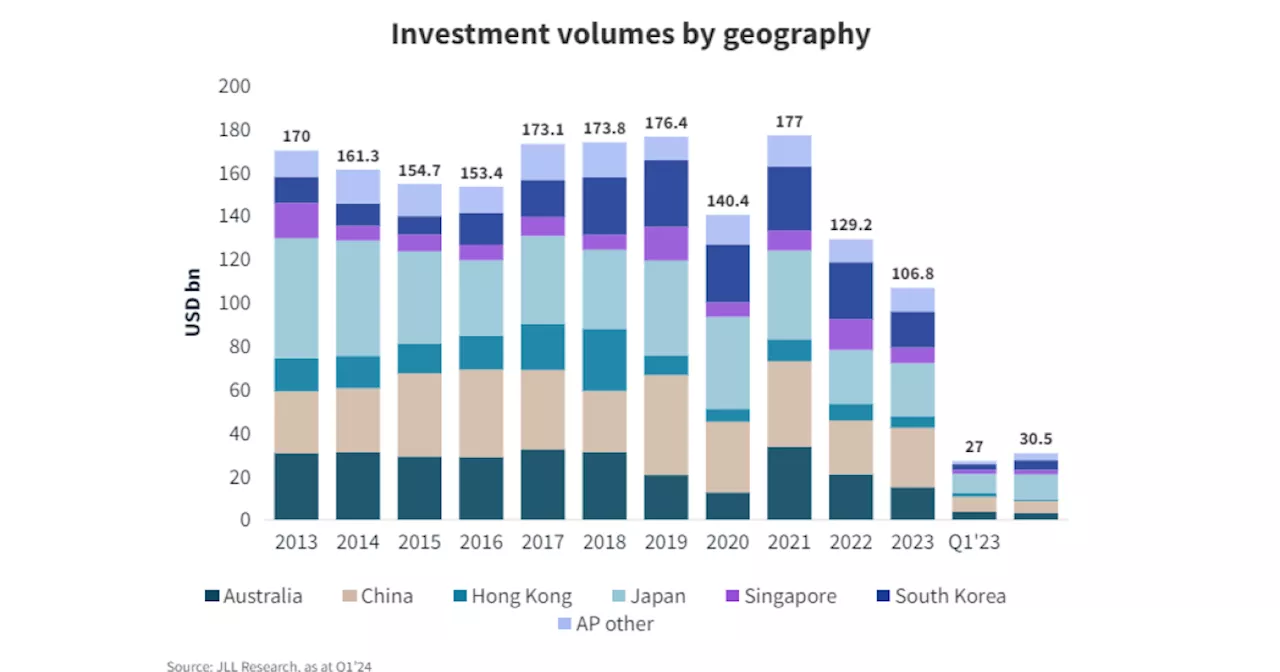

Singapore, APAC commercial real estate investments up in Q1pemSingapore property investments hit US$2.2b last quarter./em/p pCommercial real estate transactions in Asia Pacific rose 13% YoY to US$30.5b in the first quarter, snapping seven straight quarters of decline as investments in key markets like Singapore picked up, according to JLL. /p pNearly half of the total or US$11.

Singapore, APAC commercial real estate investments up in Q1pemSingapore property investments hit US$2.2b last quarter./em/p pCommercial real estate transactions in Asia Pacific rose 13% YoY to US$30.5b in the first quarter, snapping seven straight quarters of decline as investments in key markets like Singapore picked up, according to JLL. /p pNearly half of the total or US$11.

Read more »

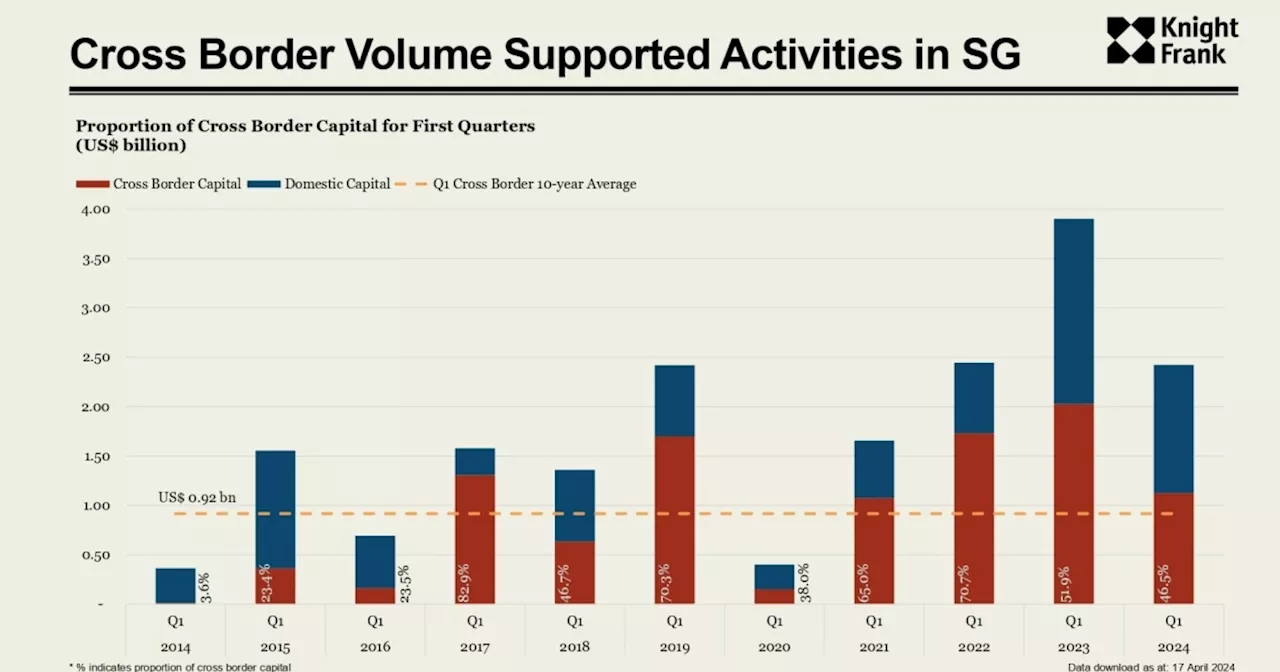

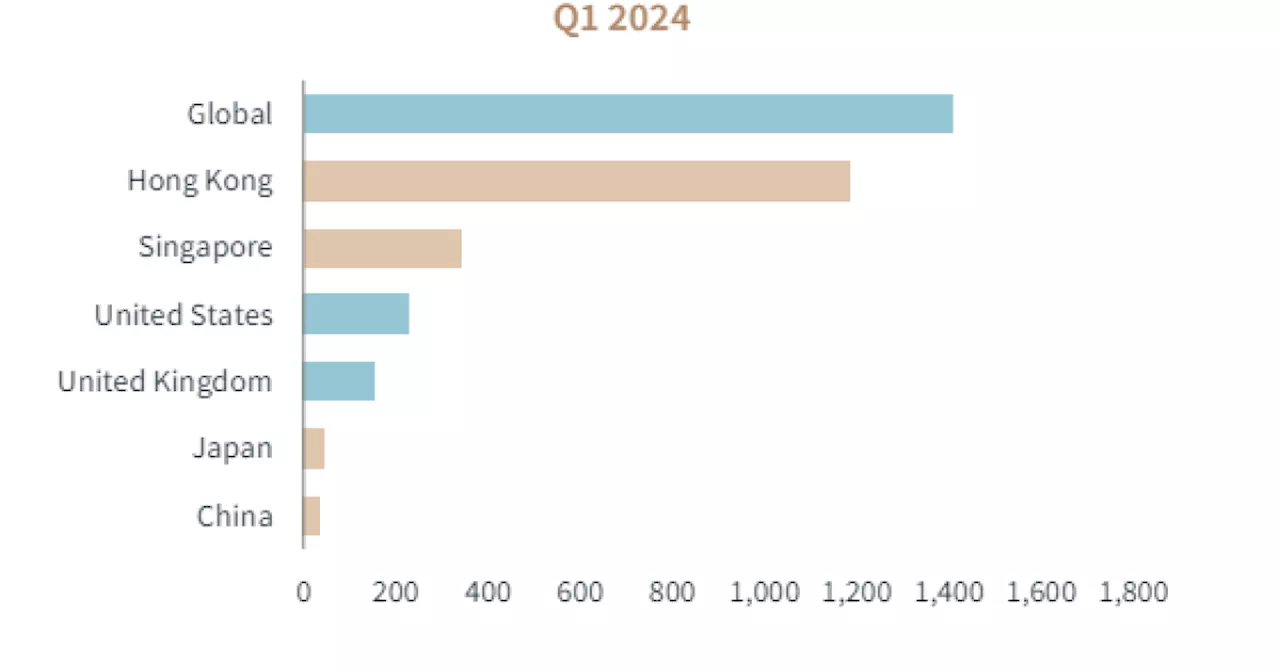

Singapore leads APAC in attracting cross-border capitalpstrongOverseas investments made up 45.6% of Singapore's capital in 1Q24./strong/p pSingapore received the highest portion of cross-border capital in Asia-Pacific, receiving US$906m from institutional investors./p pKnight Frank data revealed that overseas investments constituted 45.6% of Singapore's total capital in 1Q24.

Singapore leads APAC in attracting cross-border capitalpstrongOverseas investments made up 45.6% of Singapore's capital in 1Q24./strong/p pSingapore received the highest portion of cross-border capital in Asia-Pacific, receiving US$906m from institutional investors./p pKnight Frank data revealed that overseas investments constituted 45.6% of Singapore's total capital in 1Q24.

Read more »

Singapore’s outbound real estate investments in APAC dip in Q1: JLLpemCautious sentiment and pricing uncertainties dampen cross-border activity./em/p pSingapore’s cross-border investments in Asia Pacific commercial real estate dropped to under US$400m in the first quarter, tracking a regional downtrend, according to JLL.

Singapore’s outbound real estate investments in APAC dip in Q1: JLLpemCautious sentiment and pricing uncertainties dampen cross-border activity./em/p pSingapore’s cross-border investments in Asia Pacific commercial real estate dropped to under US$400m in the first quarter, tracking a regional downtrend, according to JLL.

Read more »

AIMS APAC REIT 1Q24 DPU falls despite income risepstrongDPU for the period declined by 5.9%./strong/p pAIMS APAC REIT's distribution per unit fell 5.9% to $0.09360 in FY24 despite higher income./p pIn a bourse filing, the REIT explained that the lower DPU was due to an "enlarged unit base" following an Equity Fund Raising (EFR) in July 2023.

AIMS APAC REIT 1Q24 DPU falls despite income risepstrongDPU for the period declined by 5.9%./strong/p pAIMS APAC REIT's distribution per unit fell 5.9% to $0.09360 in FY24 despite higher income./p pIn a bourse filing, the REIT explained that the lower DPU was due to an "enlarged unit base" following an Equity Fund Raising (EFR) in July 2023.

Read more »