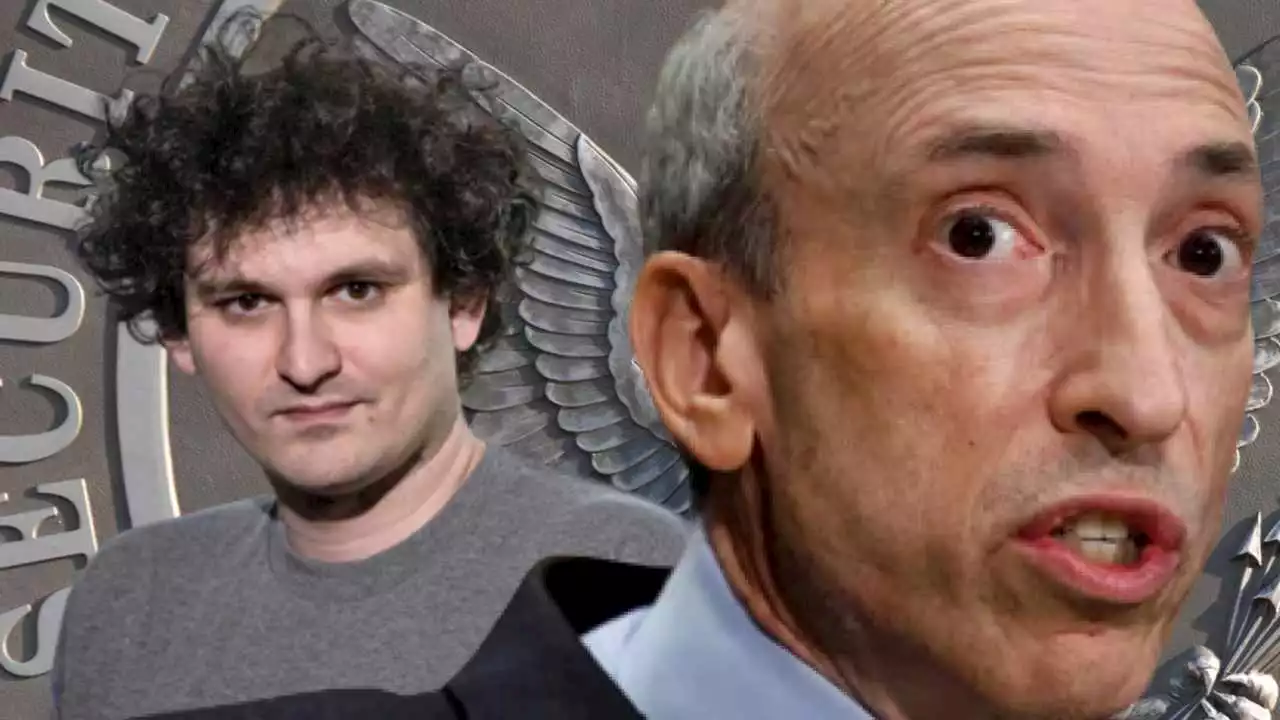

SEC Commissioner Gary Gensler met with Sam Bankman-Fried, the head of FTX eight months before its collapse and the company was forced into bankruptcy.

D.A. Davidson director of research Gil Lauria and Duke Financial Economics Center policy director Lee Reiners debate the case for cryptocurrency as the FTX crisis continues to unfold on 'The Claman Countdown.'

While exchanges such as Coinbase, Binance, and Bankman-Fried’s FTX process crypto trades for customers, they operate in a regulatory gray area without explicit SEC approval, thus opening management to possible sanctions. Katsuyama and his team, along with Bankman-Fried with his top people, provided Gensler and senior SEC officials with the broad outlines of their idea and questioned whether existing SEC rules — formulated through so-called no-action letters that set industry standards — would apply to their new venture, according to people with direct knowledge of the matter.

Officials from FTX and IEX together held one more meeting with the SEC on the concept as it began to take shape in the months to follow. Executives from IEX met with SEC officials separately nearly up until the time of the FTX bankruptcy last week, these people say. Bankman-Fried, 30, was once worth north of $20 billion, but his fortune has largely evaporated amid the FTX collapse as he faces mounting legal woes. The ties between FTX and Alameda are the focus of numerous criminal and regulatory investigations following FTX's bankruptcy and reports that Bankman-Fried may have used FTX customer accounts to privately fund risky investments made by Alameda.

Gensler was appointed SEC chair two years ago and has ruffled feathers by pushing the SEC's authority into nontraditional areas such as corporate climate change disclosure. The FTX debacle also coincides with Gensler's aggressive crackdown on alleged crypto abuse despite questions as to whether the SEC has the authority to regulate digital coins.

"Reports to my office alleged he was helping SBF and FTX work on legal loopholes to obtain a regulatory monopoly. We're looking into this," Emmer wrote. Fox Business has learned that if the GOP wins control of the House, they plan hearings into the Gensler-FTX deliberations.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

FTX Founder Secretly Moved Funds Through Backdoor: FTX InsiderFTX insider has reportedly stated that recent FTX 'hack' was illegal withdrawal of funds from FTX to Alameda Research

FTX Founder Secretly Moved Funds Through Backdoor: FTX InsiderFTX insider has reportedly stated that recent FTX 'hack' was illegal withdrawal of funds from FTX to Alameda Research

Read more »

Conflicting Reports Emerge About SEC Helping Bankrupt Crypto Exchange FTX With Legal Loopholes – Regulation Bitcoin NewsConflicting reports have surfaced about whether the SEC and Chair Gary Gensler helped FTX with legal loopholes. crypto cryptocurrency

Conflicting Reports Emerge About SEC Helping Bankrupt Crypto Exchange FTX With Legal Loopholes – Regulation Bitcoin NewsConflicting reports have surfaced about whether the SEC and Chair Gary Gensler helped FTX with legal loopholes. crypto cryptocurrency

Read more »

FTX asked about, but did not receive special exemption from SECSam Bankman-Fried and other FTX executives met with the SEC to discuss no-action treatment around digital asset broker-dealing, but the SEC did not grant a request.

FTX asked about, but did not receive special exemption from SECSam Bankman-Fried and other FTX executives met with the SEC to discuss no-action treatment around digital asset broker-dealing, but the SEC did not grant a request.

Read more »

SoftBank Vision Fund faces $100 million loss on FTX investment - San Francisco Business TimesOn the same day that FTX filed for bankruptcy, SoftBank revealed how much money it invested in the failing cryptocurrency exchange operator.

SoftBank Vision Fund faces $100 million loss on FTX investment - San Francisco Business TimesOn the same day that FTX filed for bankruptcy, SoftBank revealed how much money it invested in the failing cryptocurrency exchange operator.

Read more »

SoftBank Vision Fund faces $100 million loss on FTX investment - Silicon Valley Business JournalOn the same day that FTX filed for bankruptcy, SoftBank revealed how much money it invested in the failing cryptocurrency exchange operator.

SoftBank Vision Fund faces $100 million loss on FTX investment - Silicon Valley Business JournalOn the same day that FTX filed for bankruptcy, SoftBank revealed how much money it invested in the failing cryptocurrency exchange operator.

Read more »