Prime lending rate of commercial banks remains at 11.75%.

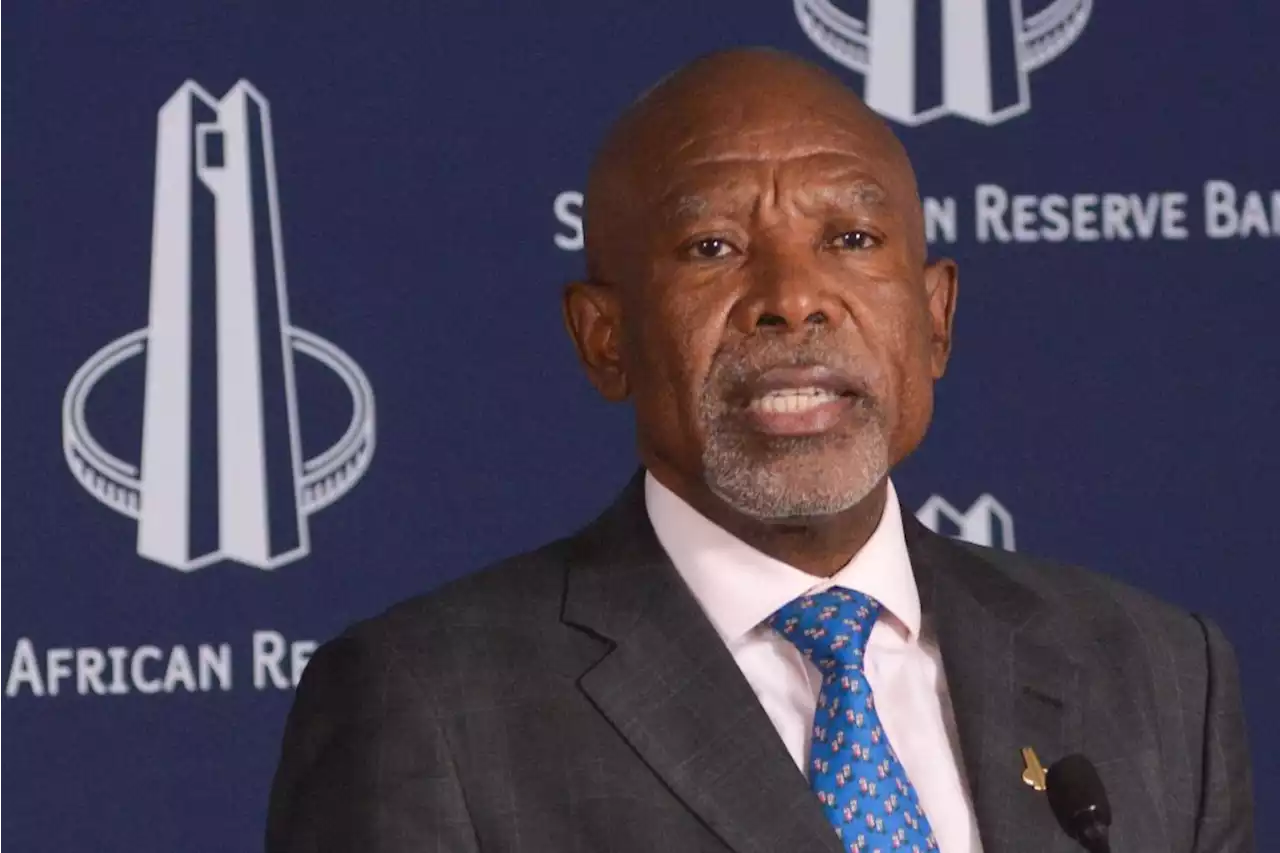

The repo rate of the South African Reserve Bank remains unchanged at 8.25%, bank governor Lesetja Kganyago confirmed in a widely expected move on Thursday.

Inflation is now within the Sarb’s target range, despite a slight uptick in the latest CPI reading for August, which came in at 4.8% year on year on Wednesday. However, headline inflation in July fell more than expected to a two-year low of 4.7% from 5.4% in June. “While goods price inflation has eased in much of the world, core inflation remains elevated and oil prices have increased significantly, keeping consumer price inflation from falling further,” Kganyago said on Thursday. ADVERTISEMENT CONTINUE READING BELOW “Globally, monetary policy is likely to remain focused on ensuring inflation continues to retreat,” he added.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Remgro sees worst conditions in 75 years, but dividend still surgesRemgro, the diversified investment holding company whose stakes include energy, food producers and industrial companies, says businesses are operating in the most difficult trading environment since its inception 75 years ago.

Remgro sees worst conditions in 75 years, but dividend still surgesRemgro, the diversified investment holding company whose stakes include energy, food producers and industrial companies, says businesses are operating in the most difficult trading environment since its inception 75 years ago.

Read more »

Sarb likely to hold rates steady, but fuel and food prices remain a concernWith inflation braking, the South African Reserve Bank looks set to keep its key repo rate on hold at 8.25%, and the prime lending rate at 11.75%, when its Monetary Policy Committee wraps its next three-day meeting on Thursday, 21 September.

Sarb likely to hold rates steady, but fuel and food prices remain a concernWith inflation braking, the South African Reserve Bank looks set to keep its key repo rate on hold at 8.25%, and the prime lending rate at 11.75%, when its Monetary Policy Committee wraps its next three-day meeting on Thursday, 21 September.

Read more »

BREAKING: SARB votes to keep interest rates on holdThe South African Reserve Bank’s (SARB) Monetary Policy Committee (MPC) voted to keep interest rates on hold on Thursday, 21 September.

BREAKING: SARB votes to keep interest rates on holdThe South African Reserve Bank’s (SARB) Monetary Policy Committee (MPC) voted to keep interest rates on hold on Thursday, 21 September.

Read more »

International buyers snatch prime Cape Town propertiesWeaker rand, economic and geopolitical challenges drive Euro buyers to Cape property.

International buyers snatch prime Cape Town propertiesWeaker rand, economic and geopolitical challenges drive Euro buyers to Cape property.

Read more »