Two sources familiar with the matter allege that the private lending platform that owes Celsius $439 Million is Equitiesfirst.

When Celsius filed for bankruptcy protection, the filing detailed that Celsius was owed a large sum of funds. On July 15, the Financial Times that “Equitiesfirst [has been] revealed as [the] mysterious debtor to troubled crypto firm Celsius.” The report claims two people familiar with the matter disclosed that Equitiesfirst is the ostensible borrower that owes the crypto lender $439 million.

Founded in 2002, Equitiesfirst is an investment firm that “specializes in long-term asset-backed financing,” according to the company’s website. While Equitiesfirst manages stocks, it has also been dealing with select cryptocurrencies since 2016. The managing director and head of Equitiesfirst Singapore, Johnny Heng, spoke about cryptocurrencies in April 2022.

“We used to be pure equities, until some six years ago, we started to offer loans against cryptocurrency as well, and that activity has really taken off [in] the past year or two,” Heng told in an interview. Speaking with FT, an Equitiesfirst spokesperson said: “Equitiesfirst is in [an] ongoing conversation with our client and both parties have agreed to extend our obligations.”

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

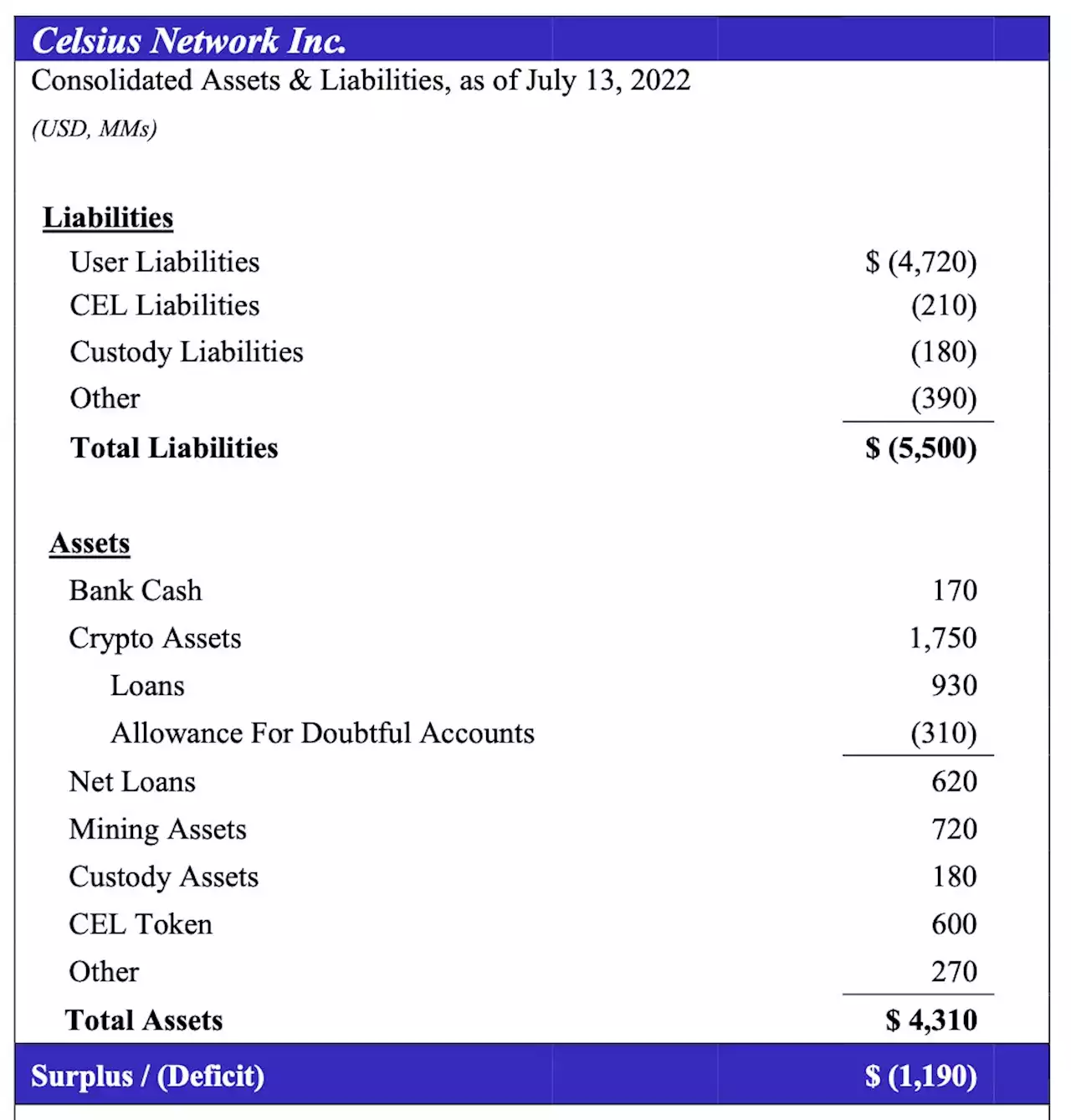

Celsius Acknowledges $1.2B Hole in Balance SheetIn a bankruptcy court filing document, CelsiusNetwork acknowledged this week that its liabilities exceed its assets by $1.2 billion.

Celsius Acknowledges $1.2B Hole in Balance SheetIn a bankruptcy court filing document, CelsiusNetwork acknowledged this week that its liabilities exceed its assets by $1.2 billion.

Read more »

The Fall of Celsius Network: A Timeline of the Crypto Lender’s Descent Into InsolvencyA timeline of Celsius’ battle with insolvency during the crypto crash, from the firm’s decision to limit some user activity before the “pause,” to its decision to file for bankruptcy on the advice of restructuring experts.

The Fall of Celsius Network: A Timeline of the Crypto Lender’s Descent Into InsolvencyA timeline of Celsius’ battle with insolvency during the crypto crash, from the firm’s decision to limit some user activity before the “pause,” to its decision to file for bankruptcy on the advice of restructuring experts.

Read more »

Bitcoin Sustains $20K, Ethereum Merge on Track for September, Celsius Bankruptcy: This Week's Crypto RecapBitcoin managed to sustain its prive above $20,000, Ethereum's merge was confirmed for September under a 'soft schedule,' and Celsius filed for a Chapter 11 Bankruptcy.

Bitcoin Sustains $20K, Ethereum Merge on Track for September, Celsius Bankruptcy: This Week's Crypto RecapBitcoin managed to sustain its prive above $20,000, Ethereum's merge was confirmed for September under a 'soft schedule,' and Celsius filed for a Chapter 11 Bankruptcy.

Read more »

Andorra green lights Bitcoin and Blockchain with Digital Assets ActAn analysis of Andorra’s Digital Assets Act and the potential confusion surrounding Bitcoin, blockchain and crypto according to crypto business owners.

Read more »