Banks have failed to allow online sellers to choose a cheaper payments network, the RBA said.

National Australia Bank and the Commonwealth Bank are laggards in enabling retailers to decide on sending card payments to the cheapest network, the Reserve Bank says.

Mr Connolly, head of payments policy at the RBA, said competition between payments networks is critical in stripping out costs for merchants. “We understand that it takes time for investment of this size to take place,” he said. “But it is possible that these fees could be lower if there was more competition in payments, particularly for mobile and online transactions.

ANZ, Westpac and NAB missed a deadline for enabling the service but are committed to switching it on next month. Mr Connolly suggested the government, through its overarching payments system plan, would make it easier for the banks to prioritise new investment.“Rather than the RBA having to use its powers of compulsion, the government and the RBA can work together to regulate the industry and implement the timeline,” he said.

He also confirmed major technology companies Apple, Google and Samsung have assured the RBA that retailers accepting payments from smartphones will be able to choose to route transactions to the cheaper eftpos debit network.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

RBA review poised to shake up board structureThe three reviewers are due to hand their report by this Friday to Treasurer Jim Chalmers.

RBA review poised to shake up board structureThe three reviewers are due to hand their report by this Friday to Treasurer Jim Chalmers.

Read more »

Consumer spending slows, heaping pressure on RBA to hold ratesTen successive interest rate rises are forcing the nation’s shoppers to slash their spending on non-essential items as evidence grows the Reserve Bank will need to pause its aggressive tightening of monetary policy at its next meeting.

Consumer spending slows, heaping pressure on RBA to hold ratesTen successive interest rate rises are forcing the nation’s shoppers to slash their spending on non-essential items as evidence grows the Reserve Bank will need to pause its aggressive tightening of monetary policy at its next meeting.

Read more »

Consumer spending slows, heaping pressure on RBA to hold ratesTen successive interest rate rises are forcing the nation’s shoppers to slash their spending on non-essential items – and that means the Reserve Bank may consider pausing further rises

Consumer spending slows, heaping pressure on RBA to hold ratesTen successive interest rate rises are forcing the nation’s shoppers to slash their spending on non-essential items – and that means the Reserve Bank may consider pausing further rises

Read more »

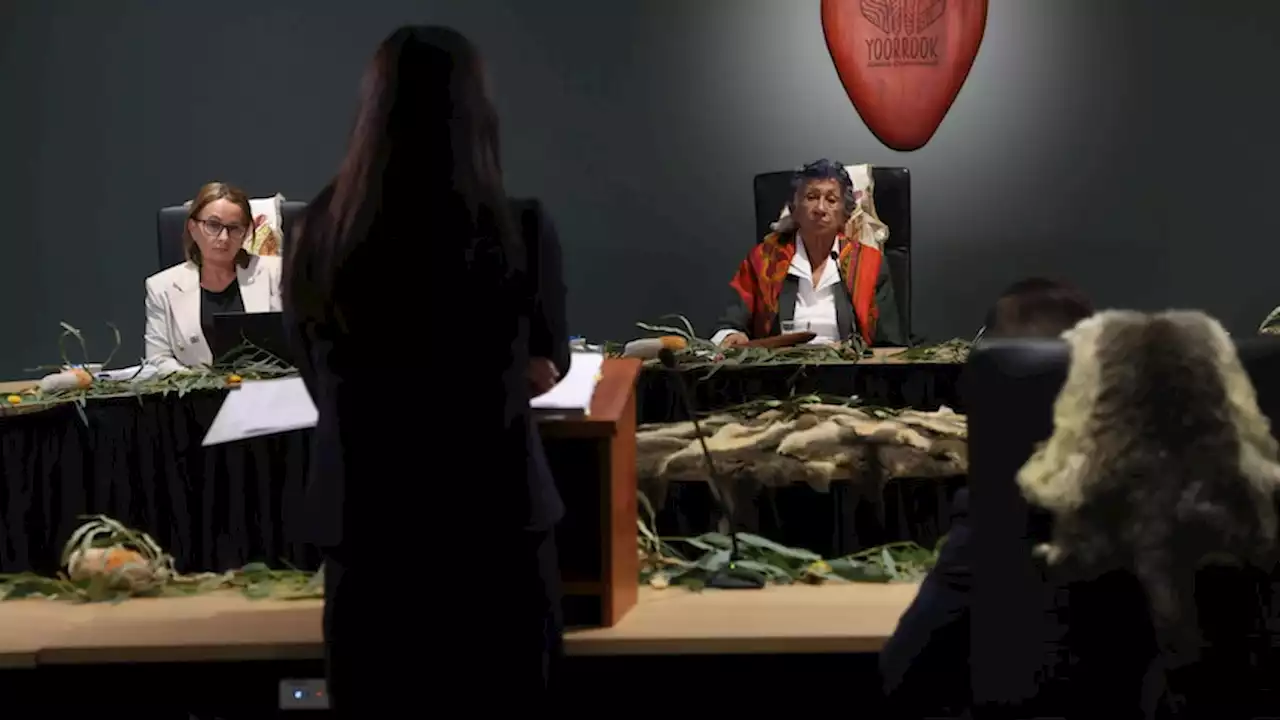

'Extremely disappointed': Victorian government fails to provide thousands of documents to Indigenous inquiryInternal police reports on systemic racism and confidential ministerial briefings on bail reform are among the thousands of documents the state government is withholding from Victoria's Indigenous truth-telling inquiry.

'Extremely disappointed': Victorian government fails to provide thousands of documents to Indigenous inquiryInternal police reports on systemic racism and confidential ministerial briefings on bail reform are among the thousands of documents the state government is withholding from Victoria's Indigenous truth-telling inquiry.

Read more »

Banking crisis brings new clash between bond traders, central banksThe bond market signals the cash rate increase cycle is finished, but amid a confused picture, economists warn central bankers may not bow to the market.

Banking crisis brings new clash between bond traders, central banksThe bond market signals the cash rate increase cycle is finished, but amid a confused picture, economists warn central bankers may not bow to the market.

Read more »

Central banks running out of scope to tightenLingering anxiety that regulators and central banks have not yet contained the shock to the banking sector lifted demand for safe-haven bonds.

Central banks running out of scope to tightenLingering anxiety that regulators and central banks have not yet contained the shock to the banking sector lifted demand for safe-haven bonds.

Read more »