Pound Sterling pulls back after US bank rescue seals Fed rate hike GBPUSD Technical Analysis Fundamental Analysis

From a technical perspective, the GBP/USD pair continues to pull back from new year-to-date highs in the 1.2580s formed on April 28, and forms a two-bar reversal pattern that bodes follow-through lower in the very short-term, though the overarching trend remains bullish.

That said, data for March continued to show UK inflation above 10% for the seventh consecutive month suggesting the Bank of England is far from done with putting up interest rates. JOLTS jobs reports data for March, scheduled for release at 14:00 GMT, could impact on the pair. After the release of last month’s JOLTS, for example, the US Dollar declined in as job openings fell from 10.4M to 9.9M. GBP/USD has been a broad sideways trend since the beginning of the year within a longer-term uptrend that began at the September 2022 lows. Despite the volatile ups and downs of recent months, the pair did manage to make new higher highs in the upper 1.

A decisive break above the year-to-date 1.2583 highs of April 28, would probably lead to a continuation higher to the next key resistance level at circa 1.2680. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

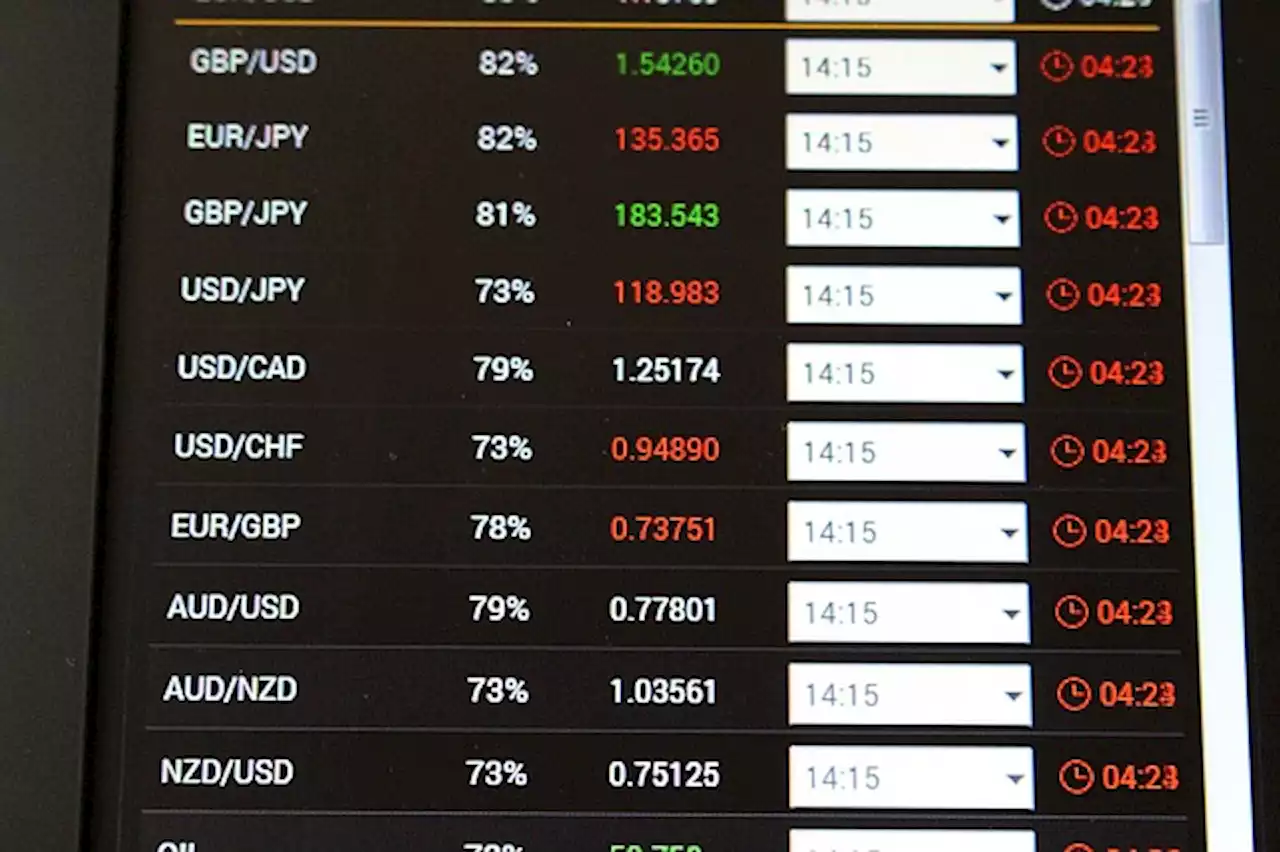

Pairs in Focus This Week \u2013 GBP/USD, EUR/USD, Gold, USD/CADGet the Forex Forecast using fundamentals, sentiment, and technical position analyses for major pairs for the week of April 30th, 2022 here.

Pairs in Focus This Week \u2013 GBP/USD, EUR/USD, Gold, USD/CADGet the Forex Forecast using fundamentals, sentiment, and technical position analyses for major pairs for the week of April 30th, 2022 here.

Read more »

USD/CHF corrects to near 0.8940 as USD Index struggles to extend recovery, Fed policy eyedUSD/CHF corrects to near 0.8940 as USD Index struggles to extend recovery, Fed policy eyed – by Sagar_Dua24 USDCHF Fed SNB DollarIndex Inflation

USD/CHF corrects to near 0.8940 as USD Index struggles to extend recovery, Fed policy eyedUSD/CHF corrects to near 0.8940 as USD Index struggles to extend recovery, Fed policy eyed – by Sagar_Dua24 USDCHF Fed SNB DollarIndex Inflation

Read more »

EUR/USD falls as ISM Manufacturing PMI improves, boosting USD on Fed tightening speculationThe EUR/USD dropped below 1.1000 after the ISM announced that manufacturing activity in April improved. However, it stood in contractionary territory,

EUR/USD falls as ISM Manufacturing PMI improves, boosting USD on Fed tightening speculationThe EUR/USD dropped below 1.1000 after the ISM announced that manufacturing activity in April improved. However, it stood in contractionary territory,

Read more »

Weekly Forex Forecast \u2013 NASDAQ 100 Index, EUR/USD, GBP/USD,The difference between success and failure in Forex / CFD trading is highly likely to depend mostly upon which assets you choose to trade each week.

Weekly Forex Forecast \u2013 NASDAQ 100 Index, EUR/USD, GBP/USD,The difference between success and failure in Forex / CFD trading is highly likely to depend mostly upon which assets you choose to trade each week.

Read more »

Trading Support and Resistance \u2013 GBP/USD, USD/CHF H1This week I will begin with my monthly and weekly Forex forecast of the currency pairs worth watching.

Trading Support and Resistance \u2013 GBP/USD, USD/CHF H1This week I will begin with my monthly and weekly Forex forecast of the currency pairs worth watching.

Read more »

USD/CAD clings to gains near 1.3575 area amid sliding Oil prices, modest USD strengthThe USD/CAD pair attracts some buyers near the 100-day Simple Moving Average (SMA) on Monday and stalls Friday's sharp retracement slide from the 1.36

USD/CAD clings to gains near 1.3575 area amid sliding Oil prices, modest USD strengthThe USD/CAD pair attracts some buyers near the 100-day Simple Moving Average (SMA) on Monday and stalls Friday's sharp retracement slide from the 1.36

Read more »