In 26 months, some families who pay no inheritance tax will face sizeable federal taxes unless benefactors act now. Consider these strategies now to save later.

In 26 months, some families who pay no inheritance tax now will face sizeable federal taxes unless Congress intervenes. New families affected would include those with far less wealth.Making changes to estate plans can be time-consuming, so it's critical for benefactors to start considering changes as soon as possible.

This reduction would expose some estates to federal taxation for the first time in years and others, for the first time ever. About 0.1 to 0.2% of estates of people who died in recent years have been subject to federal tax. Under the scheduled lower exemption, this range could increase to 0.3 to 0.4%.For example, heirs of estates containing no more than a large home, a vacation home and a few million in liquid assets could owe inheritance tax that they wouldn't face today.

As this is an annual limit, benefactors can take advantage by making gifts in 2023, 2024 and 2025. This annual gift-tax exclusion limit isn't changing, so you can continue making these gifts after 2025. Unless you have substantial room in your lifetime exemption, a best practice may be to keep gifts below the $17,000 exclusion limit.There are various other ways to pass pieces of your estate along to heirs while you're still alive, before the current exemption halves. Among them are:

Transferring life insurance policies out your estate. Owning a policy in your name can automatically make it part of your estate, and a substantial policy can vastly increase your estate's total value. The solution is to transfer ownership to an heir or, to reduce the heir's tax liability, to an appropriate form of trust, with that heir as the trust's beneficiary.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

College football predictions: Three bets to consider on SaturdayThe College Football Playoff race is heating up.

College football predictions: Three bets to consider on SaturdayThe College Football Playoff race is heating up.

Read more »

US Jews Consider Gun Ownership, Training After Hamas Attack in IsraelThe Oct. 7 Hamas terror attack in Israel and alarming social media threats that followed is prompting many American Jews to reconsider their tradition resistance to owning or using guns.

Read more »

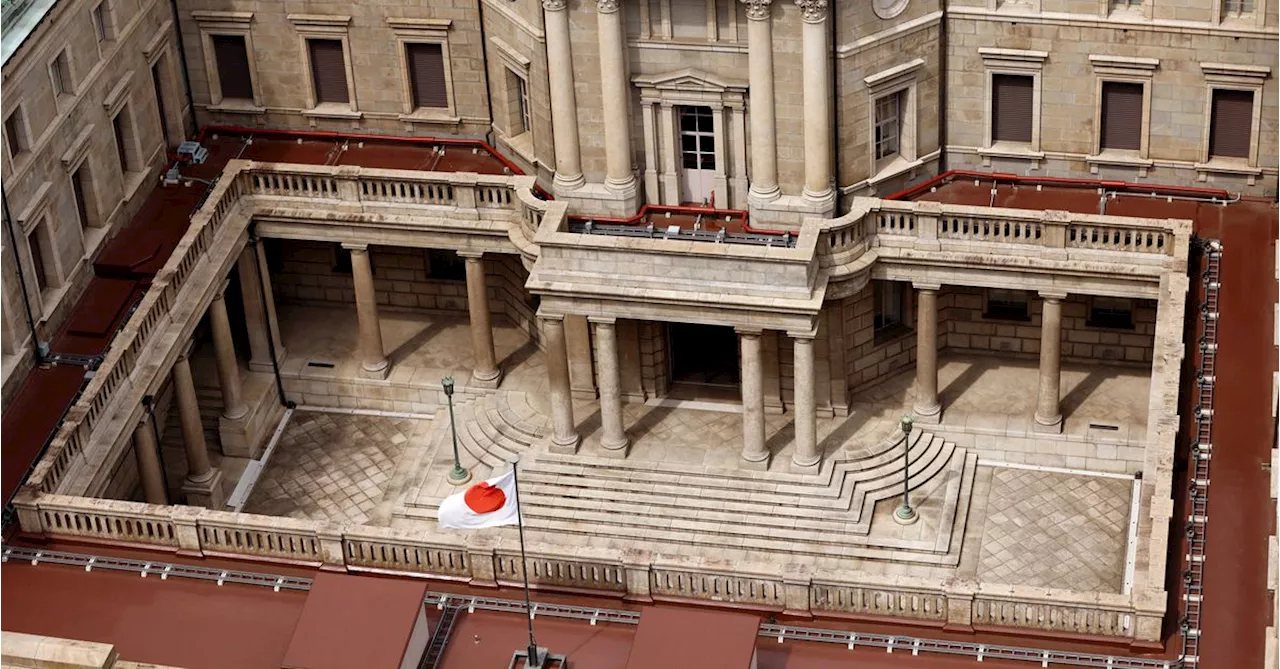

Rising yields may pressure BOJ to consider raising newly set capA recent surge in global interest rates is heightening pressure on the Bank of Japan to change its bond yield control next week, with a hike to an existing yield cap set just three months ago being discussed as a possibility.

Rising yields may pressure BOJ to consider raising newly set capA recent surge in global interest rates is heightening pressure on the Bank of Japan to change its bond yield control next week, with a hike to an existing yield cap set just three months ago being discussed as a possibility.

Read more »

Rising yields may pressure BOJ to consider raising newly set capRising yields may pressure BOJ to consider raising newly set cap

Rising yields may pressure BOJ to consider raising newly set capRising yields may pressure BOJ to consider raising newly set cap

Read more »

Judgements VII: Do We Now Consider the Ravens a Super Bowl Contender?Baltimore didn't just beat the Lions; it destroyed them. But history tells us to be careful with our expectations.

Read more »

Battleground Dem senators consider bucking Biden on border, IranJoe Manchin has already signed on to two bills that would freeze $6 billion in assets to Iran, countering the White House. Sherrod Brown and Jon Tester may join him.

Battleground Dem senators consider bucking Biden on border, IranJoe Manchin has already signed on to two bills that would freeze $6 billion in assets to Iran, countering the White House. Sherrod Brown and Jon Tester may join him.

Read more »