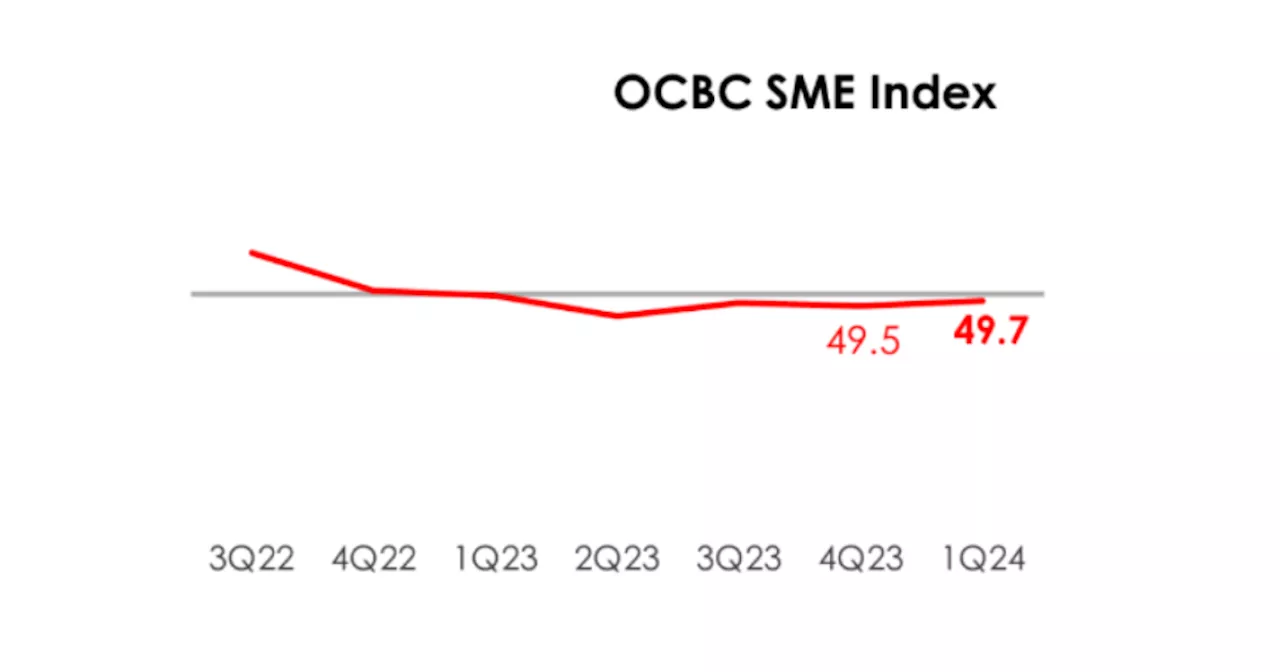

pstrongOverall, SMEs' performance and health remained in a state of contraction with a 49.7 reading./strong/p pThe performance and health of small and medium enterprises (SMEs) in Singapore slightly improved in 1Q24, according to the latest OCBC SME Index./p pDespite a 0.

The performance and health of small and medium enterprises in Singapore slightly improved in 1Q24, according to the latest OCBC SME Index.“SME collections and payments grew by 1.4% YoY and 1.9% YoY against the backdrop of bumpy disinflation trends and elevated cost pressures,” OCBC reported.

On the other hand, Building & Construction and Healthcare turned contractionary after seeing expansion in 4Q23. “The OCBC SME Index is likely to remain flat in the near term before a gradual upturn towards the second half of this year. The turnaround in global electronics and a positive outlook for the ASEAN economies are expected to have a positive impact on the outward-oriented sectors in Singapore,” OCBC said.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Straits Times Index Closes Lower, OCBC Bank and Genting Sing at the FootThe Straits Times Index (STI) closed at 3,218.26 down 0.52% on Friday, April, at 5:21 p.m. OCBC Bank and Genting Sing were at the foot.

Straits Times Index Closes Lower, OCBC Bank and Genting Sing at the FootThe Straits Times Index (STI) closed at 3,218.26 down 0.52% on Friday, April, at 5:21 p.m. OCBC Bank and Genting Sing were at the foot.

Read more »

Outbound Investments from Singapore Drop 54.3% in 1Q24Outbound investments from Singapore have dipped 54.3% QoQ and 94.9% YoY to $911m in 1Q24, data from MSCI Real Assets showed. Knight Frank said the drop is likely a result of market sentiment remaining “tentative and cautious.”

Outbound Investments from Singapore Drop 54.3% in 1Q24Outbound investments from Singapore have dipped 54.3% QoQ and 94.9% YoY to $911m in 1Q24, data from MSCI Real Assets showed. Knight Frank said the drop is likely a result of market sentiment remaining “tentative and cautious.”

Read more »

Residential sector lead 1Q24 investment salespstrongThe sector accounted for 47.1% of investment deals./strong/p pResidential deals accounted for almost half of investment sales activity in Singapore in 1Q24, data from Knight Frank showed./p pThe residential sector recorded a total sales value of $2b, accounting for 47.1% of investment deals.

Residential sector lead 1Q24 investment salespstrongThe sector accounted for 47.1% of investment deals./strong/p pResidential deals accounted for almost half of investment sales activity in Singapore in 1Q24, data from Knight Frank showed./p pThe residential sector recorded a total sales value of $2b, accounting for 47.1% of investment deals.

Read more »

Singapore tops SEA in tech funding with US$604M in 1Q24pstrongHomegrown Capillary had the highest funding round during the period./strong/p pSingapore continues to lead Southeast Asian cities in tech funding, raising US$604 in 1Q24./p pBehind Singapore are Jakarta (US$85.7m), Ho Chi Minh (US$33.2m), Taguig ($32.1m), and Watthana (US$11.0m).

Singapore tops SEA in tech funding with US$604M in 1Q24pstrongHomegrown Capillary had the highest funding round during the period./strong/p pSingapore continues to lead Southeast Asian cities in tech funding, raising US$604 in 1Q24./p pBehind Singapore are Jakarta (US$85.7m), Ho Chi Minh (US$33.2m), Taguig ($32.1m), and Watthana (US$11.0m).

Read more »

Singapore's GDP Grows 2.7% YoY in 1Q24Singapore's gross domestic product (GDP) grew faster in the first quarter of 2024, increasing by 2.7% year-on-year, according to advance estimates from the Ministry of Trade and Industry (MTI). The goods-producing and services-producing industries both saw expansions, contributing to the overall growth.

Singapore's GDP Grows 2.7% YoY in 1Q24Singapore's gross domestic product (GDP) grew faster in the first quarter of 2024, increasing by 2.7% year-on-year, according to advance estimates from the Ministry of Trade and Industry (MTI). The goods-producing and services-producing industries both saw expansions, contributing to the overall growth.

Read more »

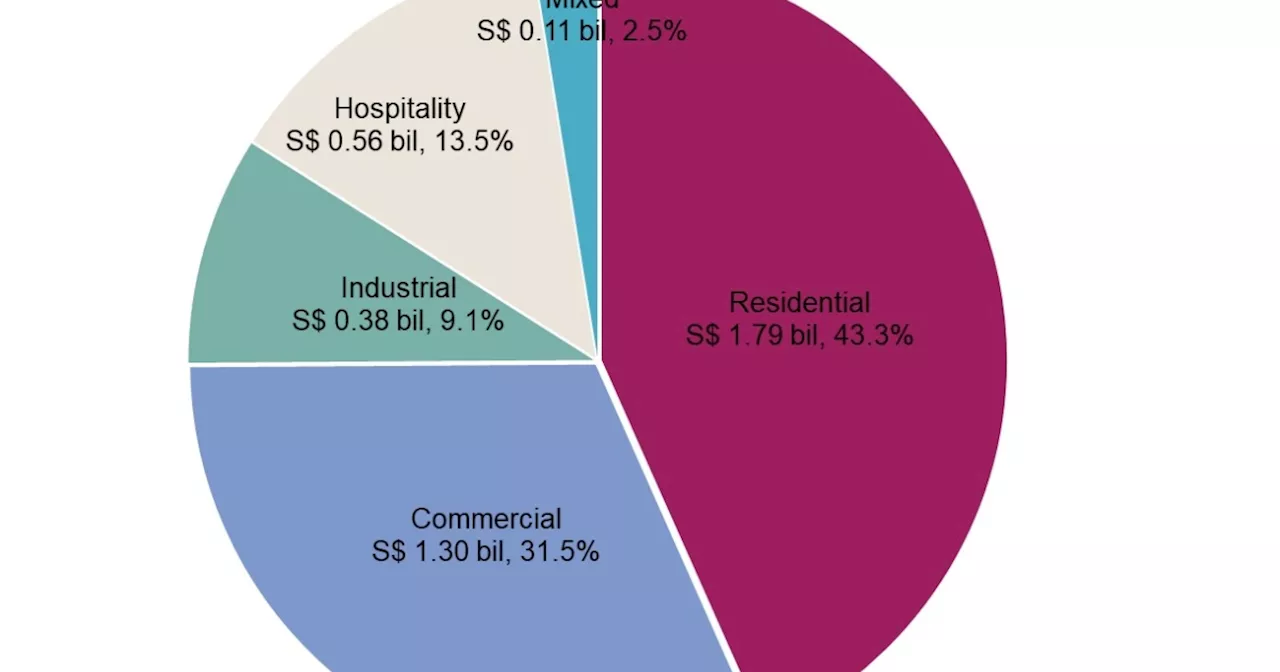

Residential sector dominates 1Q24 investment with $1.79BpstrongThe sector's investment sales, however, dropped 48.5% QoQ./strong/p pThe residential sector led investment sales in 1Q24 with $1.79b, accounting for 43.3% of the total transactions for the period./p pWhilst residential emerged as the top-performing sector, its total sales were 48.5% lower quarter-on-quarter.

Residential sector dominates 1Q24 investment with $1.79BpstrongThe sector's investment sales, however, dropped 48.5% QoQ./strong/p pThe residential sector led investment sales in 1Q24 with $1.79b, accounting for 43.3% of the total transactions for the period./p pWhilst residential emerged as the top-performing sector, its total sales were 48.5% lower quarter-on-quarter.

Read more »