The vote is non-binding, but could spur engagement from the company with shareholders.

, and Greg Peters, who was COO of the company last year and was elevated to the co-CEO role earlier this year.

The “no” vote on the “Say on Pay” proposal is non-binding, but in the past such no votes have led to changes in how executive pay is handed out in the future. It was not immediately clear how wide a margin the vote failed by. In fact, Netflix dealt with this exact issue in 2019, engaging with shareholders after they rejected its compensation plans.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Exxon, Chevron shareholders soundly reject climate-related petitionsExxon Mobil Corp and Chevron Corp shareholders on Wednesday overwhelmingly rejected calls for stronger measures to mitigate climate change, dismissing more than a dozen climate-related proposals at their annual meetings.

Exxon, Chevron shareholders soundly reject climate-related petitionsExxon Mobil Corp and Chevron Corp shareholders on Wednesday overwhelmingly rejected calls for stronger measures to mitigate climate change, dismissing more than a dozen climate-related proposals at their annual meetings.

Read more »

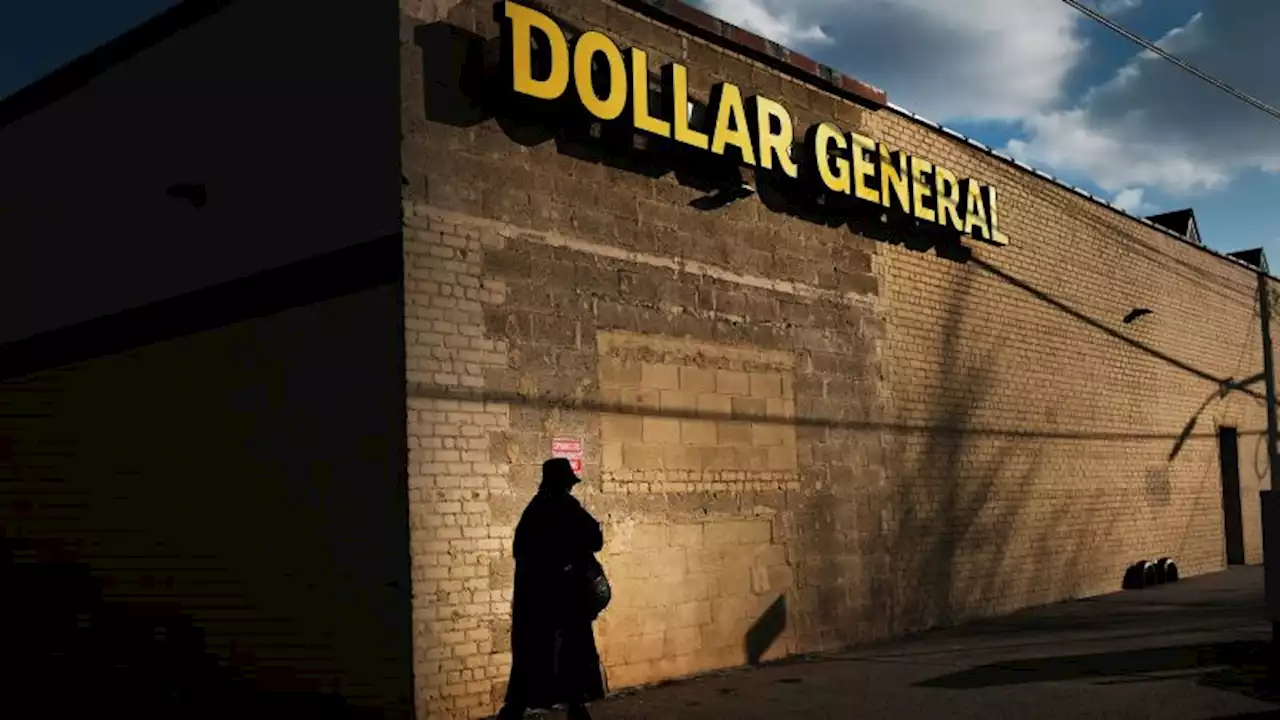

Dollar General shareholders pass proposal to improve worker safetyA shareholder proposal to improve worker safety at Dollar General by conducting an independent audit passed during the retailer's annual meeting Wednesday.

Dollar General shareholders pass proposal to improve worker safetyA shareholder proposal to improve worker safety at Dollar General by conducting an independent audit passed during the retailer's annual meeting Wednesday.

Read more »

XRP's Security Status: Controversial Debate Sparked Among ExpertsIs XRP a security? Legal experts and Ripple exec weigh in hot debate xrp xrparmy xrpcommunity xrpl xrpledger xrpthestandart ripple $xrp Belisarius2020 JoelKatz Marc_Fagel

XRP's Security Status: Controversial Debate Sparked Among ExpertsIs XRP a security? Legal experts and Ripple exec weigh in hot debate xrp xrparmy xrpcommunity xrpl xrpledger xrpthestandart ripple $xrp Belisarius2020 JoelKatz Marc_Fagel

Read more »

Dollar General shareholders vote to review safety policies after 49 deaths in a decade | CNN BusinessDollar General investors approved a resolution Wednesday to create an independent audit of the chain’s safety policies because of violence at stores and millions of dollars in fines for workplace safety violations.

Dollar General shareholders vote to review safety policies after 49 deaths in a decade | CNN BusinessDollar General investors approved a resolution Wednesday to create an independent audit of the chain’s safety policies because of violence at stores and millions of dollars in fines for workplace safety violations.

Read more »

Ripple Executive Highlights Crucial Crypto HearingRipple exec Susan Friedman has underlined the hearing's importance

Ripple Executive Highlights Crucial Crypto HearingRipple exec Susan Friedman has underlined the hearing's importance

Read more »

Former Wells Fargo exec settles SEC fraud charges, to pay $3 millionThe former head of Wells Fargo & Co's retail bank agreed to pay a $3 million penalty to settle U.S. Securities and Exchange Commission fraud charges for misleading investors about sales practices used to inflate a performance metric, the SEC said on Tuesday.

Former Wells Fargo exec settles SEC fraud charges, to pay $3 millionThe former head of Wells Fargo & Co's retail bank agreed to pay a $3 million penalty to settle U.S. Securities and Exchange Commission fraud charges for misleading investors about sales practices used to inflate a performance metric, the SEC said on Tuesday.

Read more »