Trian Fund Management is Wendy’s largest shareholder

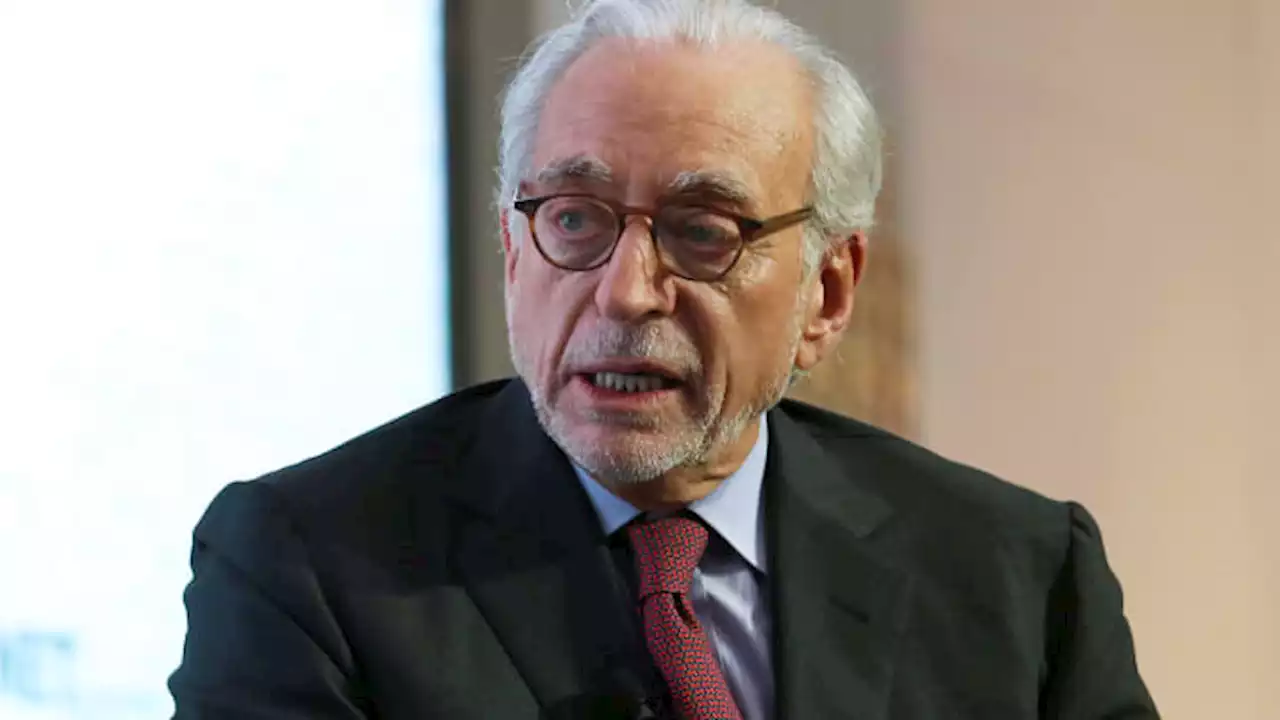

Nelson Peltz’s Trian Fund Management will not pursue a takeover of Wendy’s Co., the activist hedge fund said Friday.

Peltz is Wendy’s WEN non-executive chairman, as well as CEO of Trian Fund Management , which is Wendy’s largest shareholder. Last year Trian, which owns 19.4% of the company’s shares, pushed for a possible sale of Wendy’s. On Friday, Wendy’s also announced that it is embarking on a redesign of its organizational structure. “The redesign will be made in an effort to better support the execution of the Company’s long-term growth strategy by maximizing organizational efficiency and streamlining decision making,” the company said, in the statement. “As a result of the redesign, the Company anticipates its 2023 and 2024 G&A will be relatively flat versus 2022, despite elevated inflationary pressures,” it added.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Peltz's Trian Fund says it will not pursue takeover bid for Wendy'sTrian Fund Management, run by activist investor Nelson Peltz, said on Friday it will not pursue a takeover of Wendy's Co , months after the company's largest shareholder said it was considering a potential bid for the burger chain.

Peltz's Trian Fund says it will not pursue takeover bid for Wendy'sTrian Fund Management, run by activist investor Nelson Peltz, said on Friday it will not pursue a takeover of Wendy's Co , months after the company's largest shareholder said it was considering a potential bid for the burger chain.

Read more »

Nelson Peltz lays out his case for Disney proxy fight, slams Fox acquisitionDisney will be facing Nelson Peltz's Trian Fund Management in a proxy fight.

Nelson Peltz lays out his case for Disney proxy fight, slams Fox acquisitionDisney will be facing Nelson Peltz's Trian Fund Management in a proxy fight.

Read more »

Disney faces proxy fight from activist investor Nelson PeltzA proxy fight is brewing between Trian Fund Management and the Walt Disney Company as Trian looks to secure a board seat for its CEO Nelson Peltz

Disney faces proxy fight from activist investor Nelson PeltzA proxy fight is brewing between Trian Fund Management and the Walt Disney Company as Trian looks to secure a board seat for its CEO Nelson Peltz

Read more »

Here’s Why Investors Are Bullish On Disney Despite Its Proxy Fight With Billionaire Peltz“The proxy battle will be time-consuming and costly, but we believe an investor such as Trian taking an almost $1 billion investment in DIS highlights the underlying value of the shares,” according to Loop Capital.

Here’s Why Investors Are Bullish On Disney Despite Its Proxy Fight With Billionaire Peltz“The proxy battle will be time-consuming and costly, but we believe an investor such as Trian taking an almost $1 billion investment in DIS highlights the underlying value of the shares,” according to Loop Capital.

Read more »

Hedge funds are aggressively buying Chinese stocks, betting on a deeper, but shorter Covid setbackHedge funds have been consistent net buyers of China equities for eight of the past 10 weeks, going back to start of November.

Hedge funds are aggressively buying Chinese stocks, betting on a deeper, but shorter Covid setbackHedge funds have been consistent net buyers of China equities for eight of the past 10 weeks, going back to start of November.

Read more »