The S&P/ASX 200 shed 4.3 points, or 0.1 per cent, to finish at 7193.10.

indicated a tougher profit outlook, saddled by growing competition for deposits.

“Headwinds for the banking sector sentiment are set to continue even though the margin contraction [in Australia] is reasonable compared with offshore banks,” said George Boubouras, head of research at K2 Asset Management. Risk appetite took another knock lower after the US Federal Reserve flagged a possible “mild recession”. The central bank lifted – as expected – its key interest rate by a quarter of a point at its policy meeting and hinted at a possible pause in its tightening cycle.“The equity market has more legs. The Fed hinting a pause is positive for markets. It provides clarity on near term yield expectations,” said Cameron McCormack, portfolio manager at VanEck.

Spot gold gained 0.3 per cent to $US2,044.78 per ounce. It climbed close to an all-time peak of $US2072.49 earlier in the session.Evolution Mining jumped 7.2 per cent to $3.87, WestAfrican Resources added 2.6 per cent to $1.00, Regis Resources added 1.9 per cent to $2.18 and Northern Star Resources advanced 2.5 per cent to $13.89.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

ASX LIVE: ASX drops after RBA decision to lift rate by 0.25pcShares decline at market close after the Reserve Bank’s shock rate call. Real estate sector suffers the most lost. Qantas shares fall 3pc after announcing Vanessa Hudson to lead airline. Woolworths reports 8pc increase in sales. Follow updates here.

ASX LIVE: ASX drops after RBA decision to lift rate by 0.25pcShares decline at market close after the Reserve Bank’s shock rate call. Real estate sector suffers the most lost. Qantas shares fall 3pc after announcing Vanessa Hudson to lead airline. Woolworths reports 8pc increase in sales. Follow updates here.

Read more »

ASX LIVE: ASX to fall; energy, regional banks pace New York lossesShares are poised to open lower. Amcor profit slipped in March quarter. JB Hi-Fi reports sales in third quarter update. Wall Street dropped on energy, regional bank worries. Fed statement on Thursday AEST.

ASX LIVE: ASX to fall; energy, regional banks pace New York lossesShares are poised to open lower. Amcor profit slipped in March quarter. JB Hi-Fi reports sales in third quarter update. Wall Street dropped on energy, regional bank worries. Fed statement on Thursday AEST.

Read more »

ASX LIVE: US regional bank weighs possible sale; NAB cash profit up 17pcShares open lower. New York stumbles on Powell’s comments. NAB reports cash profit jump of 17pc. US stocks finish at session lows. US regional bank PacWest weighs possible sale. European policy decision up next. Follow updates here.

ASX LIVE: US regional bank weighs possible sale; NAB cash profit up 17pcShares open lower. New York stumbles on Powell’s comments. NAB reports cash profit jump of 17pc. US stocks finish at session lows. US regional bank PacWest weighs possible sale. European policy decision up next. Follow updates here.

Read more »

ASX takes a tumble on RBA’s shock rate hikeThe Australian sharemarket slipped on Tuesday after the RBA surprised investors by lifting the cash rate by 25 basis points, but investors say there could be more to come.

ASX takes a tumble on RBA’s shock rate hikeThe Australian sharemarket slipped on Tuesday after the RBA surprised investors by lifting the cash rate by 25 basis points, but investors say there could be more to come.

Read more »

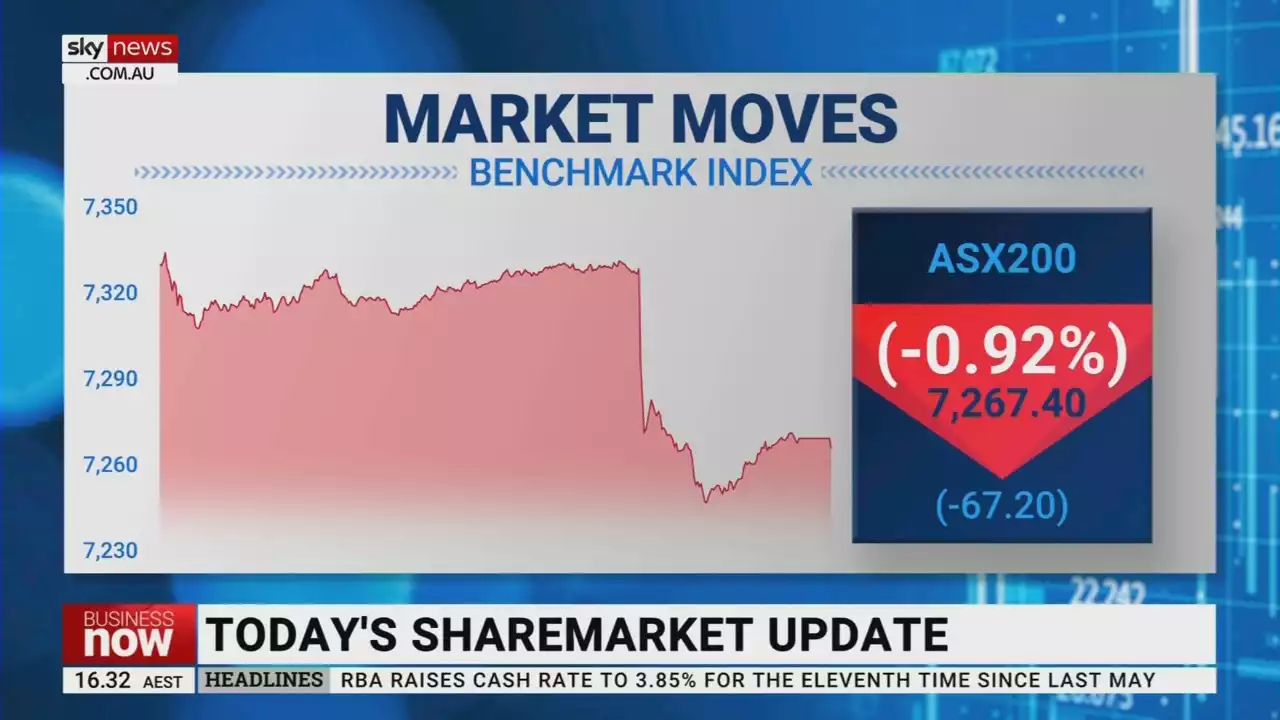

ASX 200 finished the day down on TuesdaySky News Australia Business Editor Ross Greenwood says the ASX 200 finished the day down on Tuesday by 0.92 per cent.

ASX 200 finished the day down on TuesdaySky News Australia Business Editor Ross Greenwood says the ASX 200 finished the day down on Tuesday by 0.92 per cent.

Read more »

ASX falls the most in six weeks after RBA shock rate callReal estate stocks led the sharemarket lower after the Reserve Bank of Australia wrong-footed traders by raising the cash rate to 3.85 per cent.

ASX falls the most in six weeks after RBA shock rate callReal estate stocks led the sharemarket lower after the Reserve Bank of Australia wrong-footed traders by raising the cash rate to 3.85 per cent.

Read more »