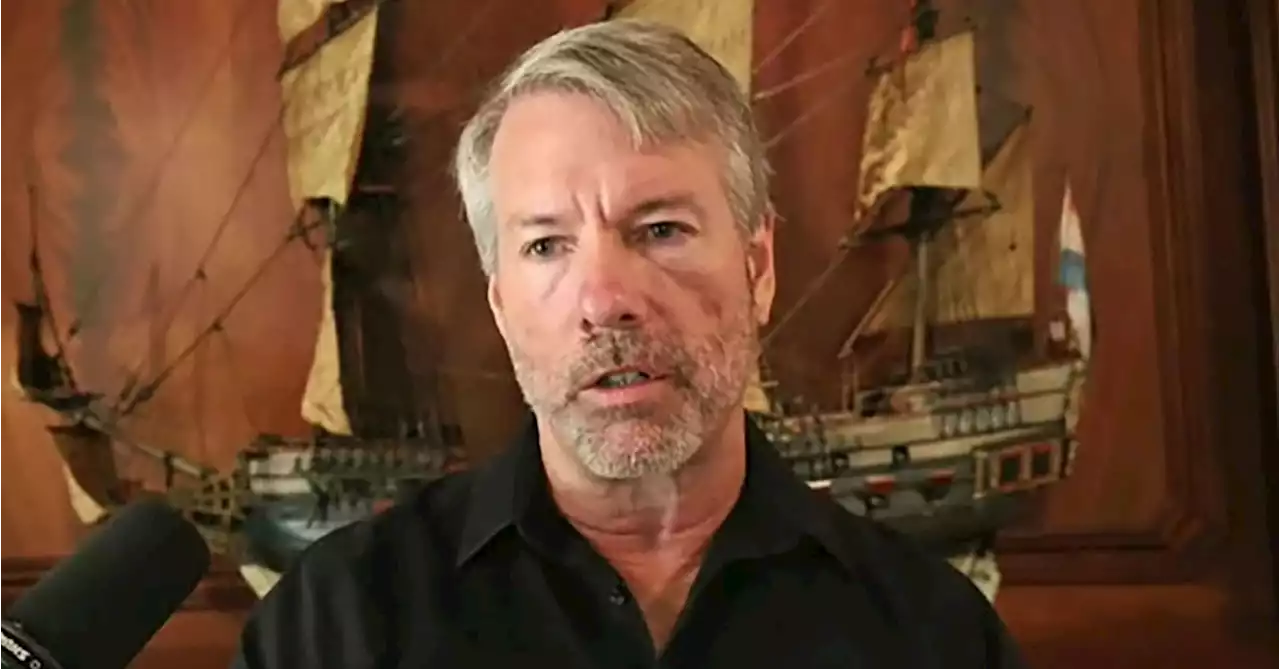

.MicroStrategy reported a $918 million impairment charge on its bitcoin holdings in Q2, reflecting the crypto’s sharp drop in the quarter. But founder and chairman saylor continues to HODL. By NelWang

secured a $205 million term loan in March

to potentially purchase additional bitcoin, but Saylor, a bitcoin maximalist, has noted that the company has thousands of bitcoin it can pledge as additional collateral if needed. MicroStrategy's digital asset impairment reflects the decline in the price of bitcoin versus the price at which the bitcoin was acquired. Under standard accounting rules, the value of digital assets such as cryptocurrencies must be recorded at their cost and then only adjusted if their value is impaired, or goes down. But if the price rises, that does not get reported unless an asset is sold.

The company's 129,699 bitcoins held at the end of June 30, 2022, were acquired for approximately $4 billion, reflecting an average cost per bitcoin of approximately $30,664, the company reported. At bitcoin’s current price of about $23,000, the value of those holdings is approximately $3 billion. MicroStrategy's entire market capitalization is roughly $3.2 billion.

MicroStrategy shares were flat at $278.01 in after-hours trading Tuesday, after initially falling 2% to 3%. Shares have tumbled around 46% year to date, just shy of bitcoin’s roughly 50% drop over the same time period.Read more:

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Permian Basin oil and gas company Diamondback reports soaring Q2 profitsMidland-based Diamondback Energy reported a $1.4 billion profit during the three month...

Permian Basin oil and gas company Diamondback reports soaring Q2 profitsMidland-based Diamondback Energy reported a $1.4 billion profit during the three month...

Read more »

Europe dominates blockchain venture deals in Q2 as growth drops in Asia and the USEurope and Africa are the only two regions to see blockchain venture funding gains in the second quarter of this year.

Europe dominates blockchain venture deals in Q2 as growth drops in Asia and the USEurope and Africa are the only two regions to see blockchain venture funding gains in the second quarter of this year.

Read more »

While Silvergate Stock Crashed in Q2, Its Earnings Crushed: Here's WhyNo FOMO. No FUD. The CEO of Silvergate says the crypto bank stuck to what they know and managed risk smartly during the good times. That's why they beat Q2 earnings estimates.

While Silvergate Stock Crashed in Q2, Its Earnings Crushed: Here's WhyNo FOMO. No FUD. The CEO of Silvergate says the crypto bank stuck to what they know and managed risk smartly during the good times. That's why they beat Q2 earnings estimates.

Read more »

A publicly traded bitcoin whale's glaring (paper) lossMicroStrategy invested $4B in bitcoin — holding the most of any public company. Now its Q2 earnings report will show just how much damage the crypto bear market has done to its balance sheet.

A publicly traded bitcoin whale's glaring (paper) lossMicroStrategy invested $4B in bitcoin — holding the most of any public company. Now its Q2 earnings report will show just how much damage the crypto bear market has done to its balance sheet.

Read more »

Permian Basin oil and gas company Diamondback reports soaring Q2 profitsMidland-based Diamondback Energy reported a $1.4 billion profit during the three month...

Permian Basin oil and gas company Diamondback reports soaring Q2 profitsMidland-based Diamondback Energy reported a $1.4 billion profit during the three month...

Read more »

The latest global tablet sales numbers are in... and they're pretty confusingWhile Apple undoubtedly dominated the global tablet market... again, a number of things are not clear from the latest reports, starting with whether or not overall sales declined in Q2.

The latest global tablet sales numbers are in... and they're pretty confusingWhile Apple undoubtedly dominated the global tablet market... again, a number of things are not clear from the latest reports, starting with whether or not overall sales declined in Q2.

Read more »