Etiqa Insurance Singapore (Etiqa) and Maybank Singapore have launched 'Invest future', Singapore's first Takaful offering in over a decade. This Shariah-compliant investment-linked plan (ILP) caters to the growing demand for Islamic financial solutions in Singapore, providing sustainable wealth accumulation goals through ethical investment options.

New Shariah-compliant investment-linked product addresses the needs of customers looking for values-based insurance solutions; further strengthening the Group’s Islamic Wealth Management offerings- 6 January 2025 - Maybank ’s insurance arm, Etiqa Insurance Singapore , today jointly announced the launch of Invest future, Singapore ’s first Takaful offering in over a decade, with Maybank Singapore as its exclusive distributor.

“We are excited to lead the way in launching Takaful ILP as our inaugural Takaful product in Singapore, recognising that ethical investing is increasingly gaining traction among Singaporeans,“ said Raymond Ong, CEO of Etiqa Insurance Singapore. “”Our Takaful ILP promotes Shariah values of mutual cooperation and purposeful investing.

● Purposeful: Values-based insurance plans are aimed at sustaining protection for a group of individuals, rather than maximising profit. Wealth Preservation: Protects the accumulated wealth as aligned with Islamic principles through risk management and Takaful . ● Access to Shariah-compliant funds with investments from as low as S$200 per month with access to reputable, Shariah-compliant regional and global funds.

Maybank Etiqa Insurance Takaful Islamic Finance Singapore

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Etiqa Life Insurance Appoints Leong Su Yern as New CEOEtiqa Life Insurance Bhd (ELIB) has appointed Leong Su Yern as its new CEO, effective January 1, 2025. Leong brings over 23 years of experience in the insurance industry and a proven track record of success in leadership roles.

Etiqa Life Insurance Appoints Leong Su Yern as New CEOEtiqa Life Insurance Bhd (ELIB) has appointed Leong Su Yern as its new CEO, effective January 1, 2025. Leong brings over 23 years of experience in the insurance industry and a proven track record of success in leadership roles.

Read more »

Allianz scraps proposed acquisition of Singapore’s Income Insurance, source saysSINGAPORE, Dec 14 — Allianz SE has scrapped a proposed €1.5 billion (RM7 billion) acquisition of a 51 per cent stake in Singaporean firm Income Insurance Ltd because of public...

Allianz scraps proposed acquisition of Singapore’s Income Insurance, source saysSINGAPORE, Dec 14 — Allianz SE has scrapped a proposed €1.5 billion (RM7 billion) acquisition of a 51 per cent stake in Singaporean firm Income Insurance Ltd because of public...

Read more »

Allianz withdraws RM7.26b offer for Singapore’s Income InsuranceSINGAPORE, Dec 16 — German insurer Allianz has withdrawn its offer to acquire at least 51 per cent of Singapore’s Income Insurance for about US$1.63 billion (RM7.26 billion),...

Allianz withdraws RM7.26b offer for Singapore’s Income InsuranceSINGAPORE, Dec 16 — German insurer Allianz has withdrawn its offer to acquire at least 51 per cent of Singapore’s Income Insurance for about US$1.63 billion (RM7.26 billion),...

Read more »

Singapore Flower Delivery Pte Ltd Acquires Singapore Florist And Launches New WebsiteSingapore Flower Delivery Pte Ltd, today announced the acquisition of Singapore Florist, a renowned local florist with a 37-year history of serving th...

Singapore Flower Delivery Pte Ltd Acquires Singapore Florist And Launches New WebsiteSingapore Flower Delivery Pte Ltd, today announced the acquisition of Singapore Florist, a renowned local florist with a 37-year history of serving th...

Read more »

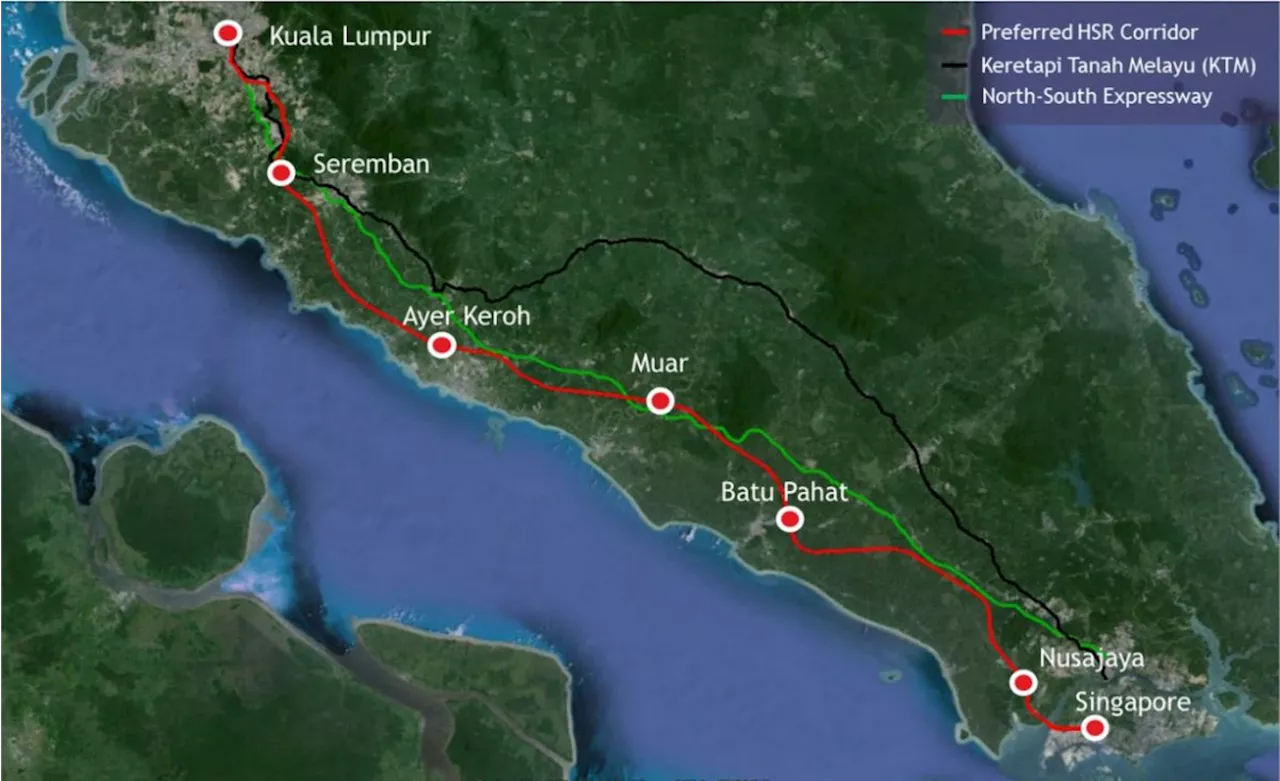

Malaysia and Singapore Postpone KL-Singapore HSR ProjectMalaysia and Singapore have agreed to postpone the development of the KL-Singapore High Speed Rail (HSR) project until May 31, 2020, with no compensation required. The deferral was reached in a spirit of good neighbourliness, as Malaysia is currently reviewing its financial position and construction of the HSR would be an added burden. Both countries aim to continue the project in the future, but will discuss ways to reduce costs during the postponement period.

Malaysia and Singapore Postpone KL-Singapore HSR ProjectMalaysia and Singapore have agreed to postpone the development of the KL-Singapore High Speed Rail (HSR) project until May 31, 2020, with no compensation required. The deferral was reached in a spirit of good neighbourliness, as Malaysia is currently reviewing its financial position and construction of the HSR would be an added burden. Both countries aim to continue the project in the future, but will discuss ways to reduce costs during the postponement period.

Read more »

Anwar to Sign Johor-Singapore SEZ Agreement with Singapore PM WongJohor Menteri Besar Datuk Onn Hafiz Ghazi announced that Prime Minister Datuk Seri Anwar Ibrahim will sign the Johor-Singapore Special Economic Zone (JS-SEZ) Agreement with Singapore Prime Minister Lawrence Wong in Putrajaya this Monday. The agreement is expected to significantly impact Johor's economy, particularly in sectors such as halal industry and tourism.

Anwar to Sign Johor-Singapore SEZ Agreement with Singapore PM WongJohor Menteri Besar Datuk Onn Hafiz Ghazi announced that Prime Minister Datuk Seri Anwar Ibrahim will sign the Johor-Singapore Special Economic Zone (JS-SEZ) Agreement with Singapore Prime Minister Lawrence Wong in Putrajaya this Monday. The agreement is expected to significantly impact Johor's economy, particularly in sectors such as halal industry and tourism.

Read more »