The rand is under pressure from a stronger US dollar

The JSE ended modestly higher on Tuesday after a fairly choppy session during which the all share index rose nearly 1% at one stage before dipping into the red when US markets opened.

The index eventually settled 0.21% higher at 67,538.77 points, as the top 40 eked out a gain of 0.16%, propped up by a handful of big industrial shares...A subscription helps you enjoy the best of our business content every day along with benefits such as articles from our international business news partners; ProfileData financial data; and digital access to the Sunday Times and Sunday Times Daily.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

MARKET WRAP: JSE holds up as its European peers reel from energy supply jittersThe local share market is still recovering after a big sell-off last week during which foreign investors offloaded R14.9bn worth of shares on a net basis

Read more »

Strong dollar is bad for EM markets[ICYMI] MoneywebNow podcast with SimonPB, a look at whether ZAR weakness creates opportunity for the JSE, analysis of Fortress results and what are implications for stock markets on the back of the European energy crisis. Download podcast:

Strong dollar is bad for EM markets[ICYMI] MoneywebNow podcast with SimonPB, a look at whether ZAR weakness creates opportunity for the JSE, analysis of Fortress results and what are implications for stock markets on the back of the European energy crisis. Download podcast:

Read more »

Retail support group CA&S reports headline earnings leap of 44%The group attributes the growth to higher food prices and sale of alcohol without restrictions in Swaziland and top market Botswana

Read more »

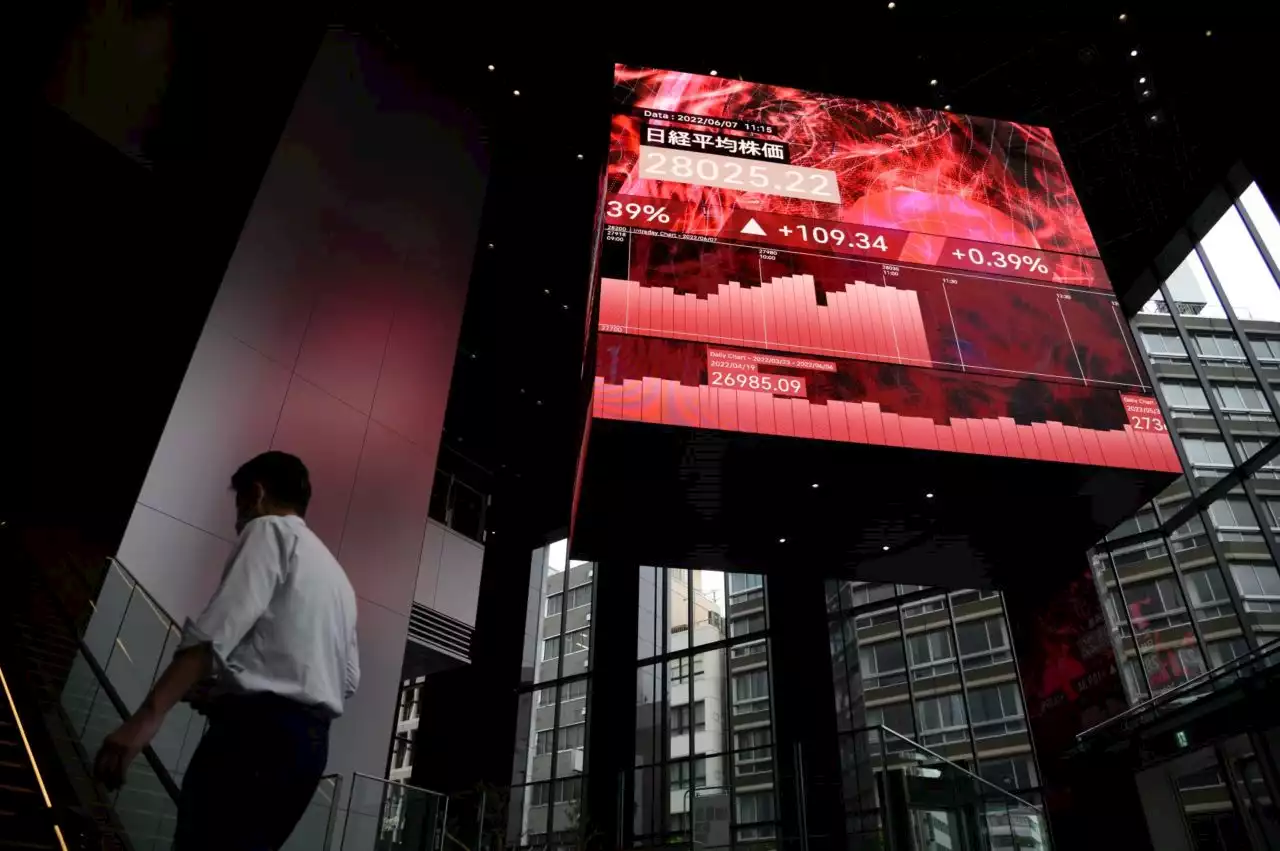

Business Maverick: Stocks mixed; treasury yields rise as oil climbs: markets wrapUS equity futures rose while stocks in Asia were mixed on Tuesday amid a dip in the dollar, as sentiment continued to be tested by central banks tightening monetary policy and Europe’s energy crisis.

Business Maverick: Stocks mixed; treasury yields rise as oil climbs: markets wrapUS equity futures rose while stocks in Asia were mixed on Tuesday amid a dip in the dollar, as sentiment continued to be tested by central banks tightening monetary policy and Europe’s energy crisis.

Read more »

Business Maverick: Stocks Erase Drop With Rebound in Defensive Shares: Markets WrapStocks rose, following three straight weeks of losses in Wall Street that pushed the market closer to oversold levels.

Business Maverick: Stocks Erase Drop With Rebound in Defensive Shares: Markets WrapStocks rose, following three straight weeks of losses in Wall Street that pushed the market closer to oversold levels.

Read more »

SA’s buy-now-pay-later market expected to hit R2bn by year-endThese types of payments are growing 10%-15% a month and recorded a 50% hike between the first and second quarters of 2022

Read more »