Kuala Lumpur: The Malaysian government will be able to increase its revenue for the country’s spending without bringing back the Goods and Services Tax (GST), by opting to instead hike the service tax to 8 per cent under Budget 2024, tax advisory firms have said.

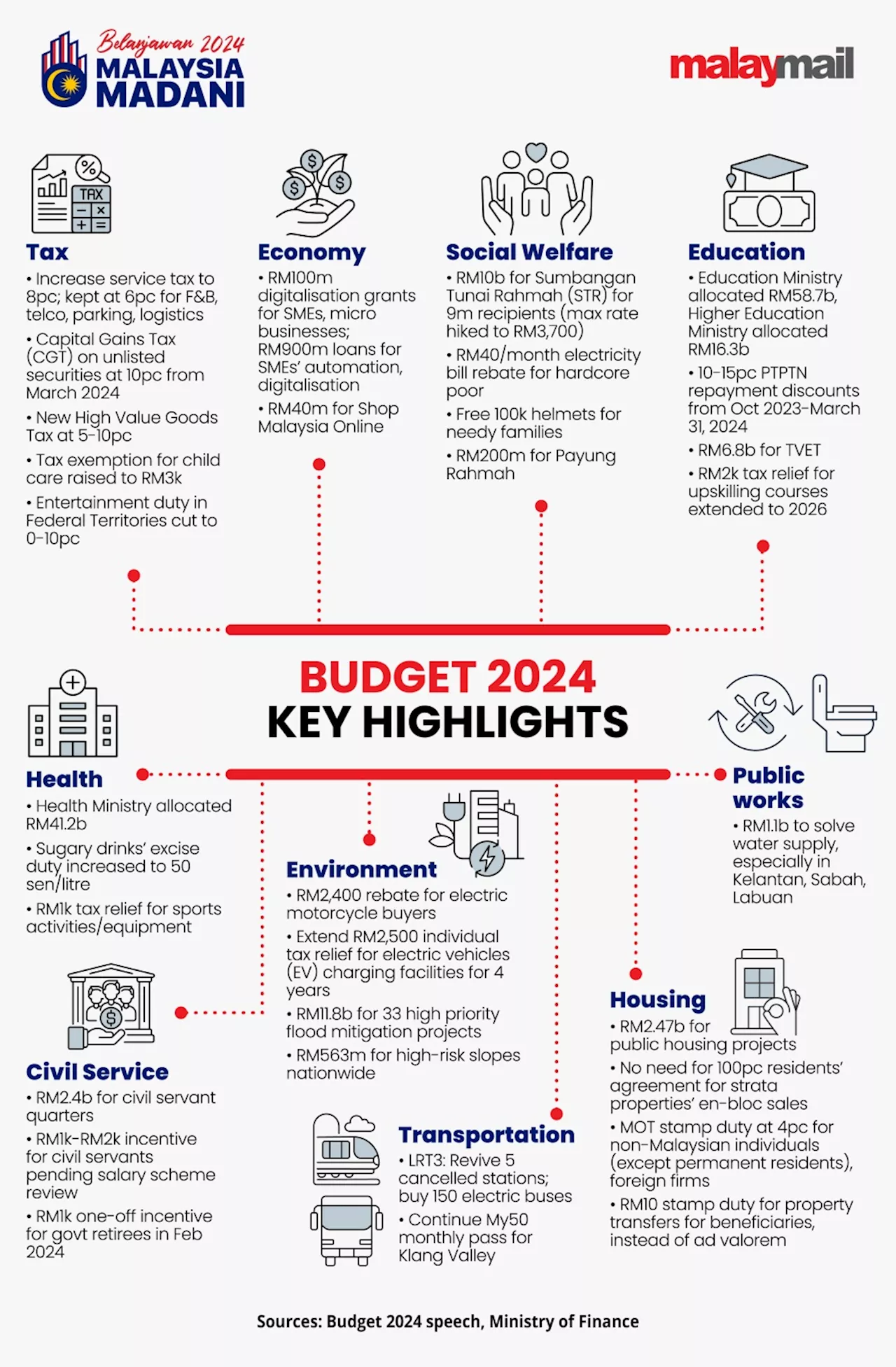

But the tax consultancy firms also cautioned that the increased service tax rate may result in higher costs for both consumers and businesses.Yesterday, Prime Minister Datuk Seri Anwar Ibrahim in his Budget 2024 speech said the government will expand service tax to cover logistics, brokerage, underwriting and karaoke, and will increase the service tax rate to 8 per cent, but will maintain the 6 per cent rate for services such as food and beverages and telecommunications.

Deloitte Malaysia’s country tax leader Sim Kwang Gek said the service tax rate hike to 8 per cent and widened coverage of taxable services under this tax would broaden Malaysia’s tax base.One of the Malaysian government’s sources of funding or revenue for its RM393.8 billion overall Budget 2024 is indirect tax .

At the same time, Deloitte Malaysia’s global employer services leader Ang Weina commented on Budget 2024’s proposed extension for income tax reliefs for Malaysians and extensions of tax exemptions and incentives that they may enjoy. PwC Malaysia’s tax leader Jagdev Singh said the service tax rate hike seems to be a temporary measure in the absence of a GST-like broad-based consumption tax.

At the same time, Jagdev said the proposed Budget 2024 contains measures that would help ensure Malaysians’ welfare. Farah Rosley, Malaysia Tax Leader at Ernst & Young Tax Consultants Sdn Bhd, last night said it was expected that the Malaysian government would not revive GST in the Budget for next year.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Budget 2024: Putrajaya to increase Sales and Service Tax to 8pcKUALA LUMPUR, Oct 13 — Putrajaya is increasing the Sales and Services Tax from 6 per cent to 8 per cent. Prime Minister Datuk Seri Anwar Ibrahim said this increase will not...

Budget 2024: Putrajaya to increase Sales and Service Tax to 8pcKUALA LUMPUR, Oct 13 — Putrajaya is increasing the Sales and Services Tax from 6 per cent to 8 per cent. Prime Minister Datuk Seri Anwar Ibrahim said this increase will not...

Read more »

Budget 2024: Sales and Service Tax up to 8pcKuala Lumpur: Putrajaya is increasing the Sales and Services Tax from 6 per cent to 8 per cent.

Budget 2024: Sales and Service Tax up to 8pcKuala Lumpur: Putrajaya is increasing the Sales and Services Tax from 6 per cent to 8 per cent.

Read more »

Malaysia’s new 8pc service tax rate increases govt coffers without GST comeback, but may up consumers’ costs, tax firms sayKUALA LUMPUR, Oct 14 — The Malaysian government will be able to increase its revenue for the country’s spending without bringing back the Goods and Services Tax (GST), by...

Malaysia’s new 8pc service tax rate increases govt coffers without GST comeback, but may up consumers’ costs, tax firms sayKUALA LUMPUR, Oct 14 — The Malaysian government will be able to increase its revenue for the country’s spending without bringing back the Goods and Services Tax (GST), by...

Read more »

Belanjawan 2024 menekan golongan rakyat pertengahan, dakwa Syed SaddiqSyed Saddiq Syed Abdul Rahman mendakwa kenaikan cukai SST hanya topeng kepada GST.

Belanjawan 2024 menekan golongan rakyat pertengahan, dakwa Syed SaddiqSyed Saddiq Syed Abdul Rahman mendakwa kenaikan cukai SST hanya topeng kepada GST.

Read more »

MOF: Choice between SST, GST hinges on nation's economic goalsKUALA LUMPUR: The choice between sales and service tax (SST) and the goods and services tax (GST) hinges on Malaysia&039;s economic goals, administrative ...

MOF: Choice between SST, GST hinges on nation's economic goalsKUALA LUMPUR: The choice between sales and service tax (SST) and the goods and services tax (GST) hinges on Malaysia&039;s economic goals, administrative ...

Read more »