No 1 source of global mining news and opinion

Liquidity in CME Group Inc.’s lithium contracts is on the rise again, with financial players looking to benefit from arbitrage opportunities in the market that’s key to the energy transition.

“Liquidity brings in liquidity,” said Jack Nathan, head of battery materials at broker Tullett Prebon. Financial players such as funds “always look for liquid markets to implement strategies,” he said. The robust growth in liquidity in CME’s two lithium contracts comes as the Chicago-based bourse has been pushing to take on the London Metal Exchange in battery metals as the latter wades through the fallout of the nickel crisis in 2022 and western sanctions on Russian metals. In cobalt, another key battery metal, while total open interest and volume have slowed this year, CME’s cash-settled cobalt metal contract has grown sharply since its inception in December 2020.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Lithium giant Albemarle halts Australia plant expansion, reviews costs on weak lithium pricesThe decision comes as the company reported a second-quarter net loss of $188 million, or $1.96 per share. Excluding items, it earned 4 cents a share.

Lithium giant Albemarle halts Australia plant expansion, reviews costs on weak lithium pricesThe decision comes as the company reported a second-quarter net loss of $188 million, or $1.96 per share. Excluding items, it earned 4 cents a share.

Read more »

Lithium giant Albemarle halts Australia plant expansion, reviews costs on weak lithium pricesThe decision comes as the company reported a second-quarter net loss of $188 million, or $1.96 per share. Excluding items, it earned 4 cents a share.

Lithium giant Albemarle halts Australia plant expansion, reviews costs on weak lithium pricesThe decision comes as the company reported a second-quarter net loss of $188 million, or $1.96 per share. Excluding items, it earned 4 cents a share.

Read more »

CME's Ether Futures Record Highest Ever Open Interest of 383K ETH After ETF DebutOmkar Godbole is a Co-Managing Editor on CoinDesk's Markets team.

CME's Ether Futures Record Highest Ever Open Interest of 383K ETH After ETF DebutOmkar Godbole is a Co-Managing Editor on CoinDesk's Markets team.

Read more »

Northern Lights Forecast: Expect ‘Cannibal CME’ Aurora This Week, Scientists SayI'm an award-winning journalist writing about the night sky and eclipses.

Northern Lights Forecast: Expect ‘Cannibal CME’ Aurora This Week, Scientists SayI'm an award-winning journalist writing about the night sky and eclipses.

Read more »

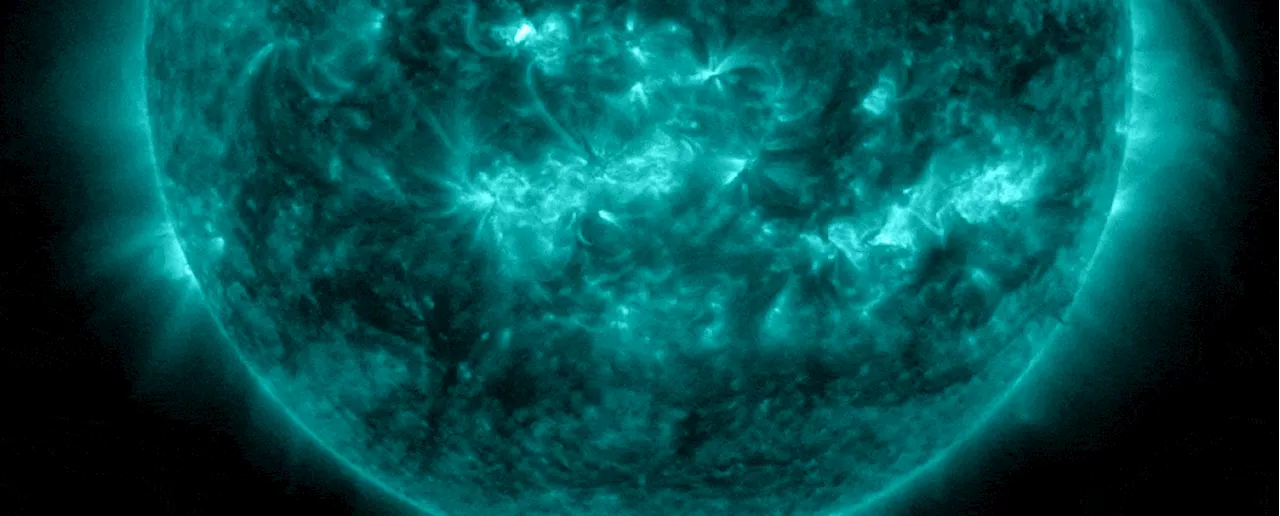

Cannibal CME Is About to Deliver Spectacular Auroras to Earth's AtmosphereThe Best in Science News and Amazing Breakthroughs

Cannibal CME Is About to Deliver Spectacular Auroras to Earth's AtmosphereThe Best in Science News and Amazing Breakthroughs

Read more »

Traders see the odds of a Fed rate cut by September at 100%The probabilities are based on trading in CME Fed Funds futures contracts.

Traders see the odds of a Fed rate cut by September at 100%The probabilities are based on trading in CME Fed Funds futures contracts.

Read more »