Rising Treasury bond yields and home mortgage rates may reduce support at the U.S. Federal Reserve for additional interest rate increases, the prospect of which have already been ebbing on the basis of weaker inflation. The Fed raised interest rates at its July meeting by a quarter of a percentage point, to a range of between 5.25% and 5.5%, a widely anticipated move investors have construed as the central bank's last step in an aggressive 16-month rate hike campaign to slow inflation from 40-year highs. But bond yields since then have raced higher, with the interest rate on a 10-year U.S. Treasury security rising from around 3.86% the day of the Fed's July 26 rate decision to as high as 4.32% on Thursday.

FILE PHOTO: Traders react to Fed rate announcement on the floor of the NYSE in New YorkWASHINGTON - Rising Treasury bond yields and home mortgage rates may reduce support at the U.S. Federal Reserve for additional interest rate increases, the prospect of which have already been ebbing on the basis of weaker inflation.

Rates on a 30-year home mortgage in the U.S. rose to 7.09%, breaching the 7% level for the first time since November and marking a more than 20-year high. The recent climb in yields has been fast enough and surprising enough that "the Fed will be monitoring bond market developments - and the wider fall-out across asset markets - carefully," said Evercore ISI vice chair Krishna Guha.

Indeed, many Fed officials have puzzled over a recent easing of financial conditions, with equity markets rising and some home price indexes moving up despite the Fed's own rate increases and hawkish rhetoric that rates will stay high for as long as it takes to be sure inflation returns to the central bank's 2% target.

Overall economic growth also has continued to outperform expectations, with a strong July retail sales report the latest example of the economy's surprising strength - representing another conundrum for policymakers who both expect the economy to slow and feel it must for inflation to continue falling.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Fed minutes result in higher treasury yields taking gold lowerExclusive to Kitco News, technical analyst Gary Wagner provides a daily recap of what happened in the gold market, highlighting important events that captured investors' attention during the U.S. trading session. Wagner's commentary features a mix of fundamental news and technical analysis, noting important support and resistance levels.

Fed minutes result in higher treasury yields taking gold lowerExclusive to Kitco News, technical analyst Gary Wagner provides a daily recap of what happened in the gold market, highlighting important events that captured investors' attention during the U.S. trading session. Wagner's commentary features a mix of fundamental news and technical analysis, noting important support and resistance levels.

Read more »

U.S. 10-year Treasury yield hits highest since October, drags on sharesSINGAPORE/LONDON, Aug 17 (Reuters) - The U.S. 10-year Treasury yield on Thursday reached its highest in 10 months, underpinned by fears that U.S. interest rates might stay higher for longer, contributing, along with China's economic woes, to world stocks languishing at five-week lows.

U.S. 10-year Treasury yield hits highest since October, drags on sharesSINGAPORE/LONDON, Aug 17 (Reuters) - The U.S. 10-year Treasury yield on Thursday reached its highest in 10 months, underpinned by fears that U.S. interest rates might stay higher for longer, contributing, along with China's economic woes, to world stocks languishing at five-week lows.

Read more »

Man arrested after jumping off Eiffel Tower with a parachutePolice in Paris have arrested a man for jumping off the Eiffel Tower with a parachute on Thursday, according to CNN affiliate BFMTV.

Man arrested after jumping off Eiffel Tower with a parachutePolice in Paris have arrested a man for jumping off the Eiffel Tower with a parachute on Thursday, according to CNN affiliate BFMTV.

Read more »

Gold weaker as U.S. Treasury yields continue to climbSenior Technical Analyst Jim Wyckoff prepares investors with an overview of how the markets opened and closed. What moved metal prices? How do the technicals look? By looking at important developments

Gold weaker as U.S. Treasury yields continue to climbSenior Technical Analyst Jim Wyckoff prepares investors with an overview of how the markets opened and closed. What moved metal prices? How do the technicals look? By looking at important developments

Read more »

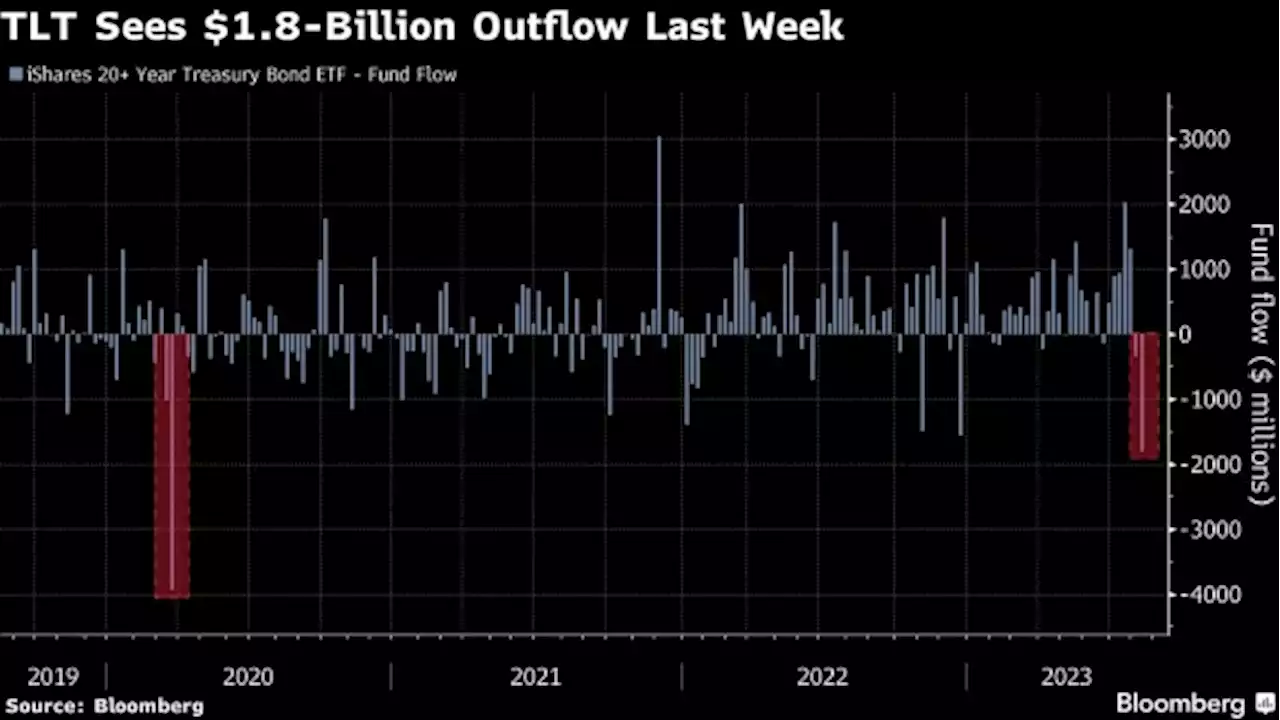

Biggest Treasury ETF Sees Largest Exodus Since 2020 MeltdownInvestors are bailing out of the biggest exchange-traded fund devoted to Treasuries at the fastest pace since markets were hammered during the early months of the pandemic.

Biggest Treasury ETF Sees Largest Exodus Since 2020 MeltdownInvestors are bailing out of the biggest exchange-traded fund devoted to Treasuries at the fastest pace since markets were hammered during the early months of the pandemic.

Read more »

Opinion: Anita Anand’s move to the Treasury Board speaks volumes about Justin Trudeau’s prioritiesThe cabinet minister’s shift from National Defence into the new role is the talk of Ottawa

Opinion: Anita Anand’s move to the Treasury Board speaks volumes about Justin Trudeau’s prioritiesThe cabinet minister’s shift from National Defence into the new role is the talk of Ottawa

Read more »