Opinion | Jamie Dimon’s war on remote work likely to end badly WashTimesOpEd

Last month, Wall Street Pied Piper Jamie Dimon decreed from his Manhattan perch — or perhaps from a remote location in Palm Beach — that his white-collar minions must once again chain themselves to their desks in the offices of JPMorgan.

Of perhaps most consequence from a corporate strategy perspective, those companies that take the hardest line on in-office attendance face a real risk of losing their best, brightest, most entrepreneurial minions to their remote model competitors. Yet in today’s tight labor market, workers are now shopping around not only on wages and benefits but also on workplace location. Those who have been unchained by the pandemic have learned that with appropriate discipline, they can be as or more productive — and far happier — without having to endure the hassle and costs of a commute.

Some companies, such as Apple, Google, Salesforce and Starbucks, are trying for a King Solomon compromise by embracing a hybrid model that mandates office attendance a few days a week. Yet this loses one of the great advantages of remote work: an expanded talent pool that comes with the ability to recruit from San Diego to Des Moines and Bangor.

From a macroeconomic point of view, we are unquestionably in the midst of a profound structural adjustment in our economy with as yet unforeseen consequences on growth and productivity. Yet at least one clear benefit in these inflationary times is the moderating effect remote work can have on wage inflation.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

How Wall Street is preparing for possible US debt defaultThe financial industry has prepared for such a crisis before. But this time, the relatively short time frame for reaching a compromise has bankers on edge.

How Wall Street is preparing for possible US debt defaultThe financial industry has prepared for such a crisis before. But this time, the relatively short time frame for reaching a compromise has bankers on edge.

Read more »

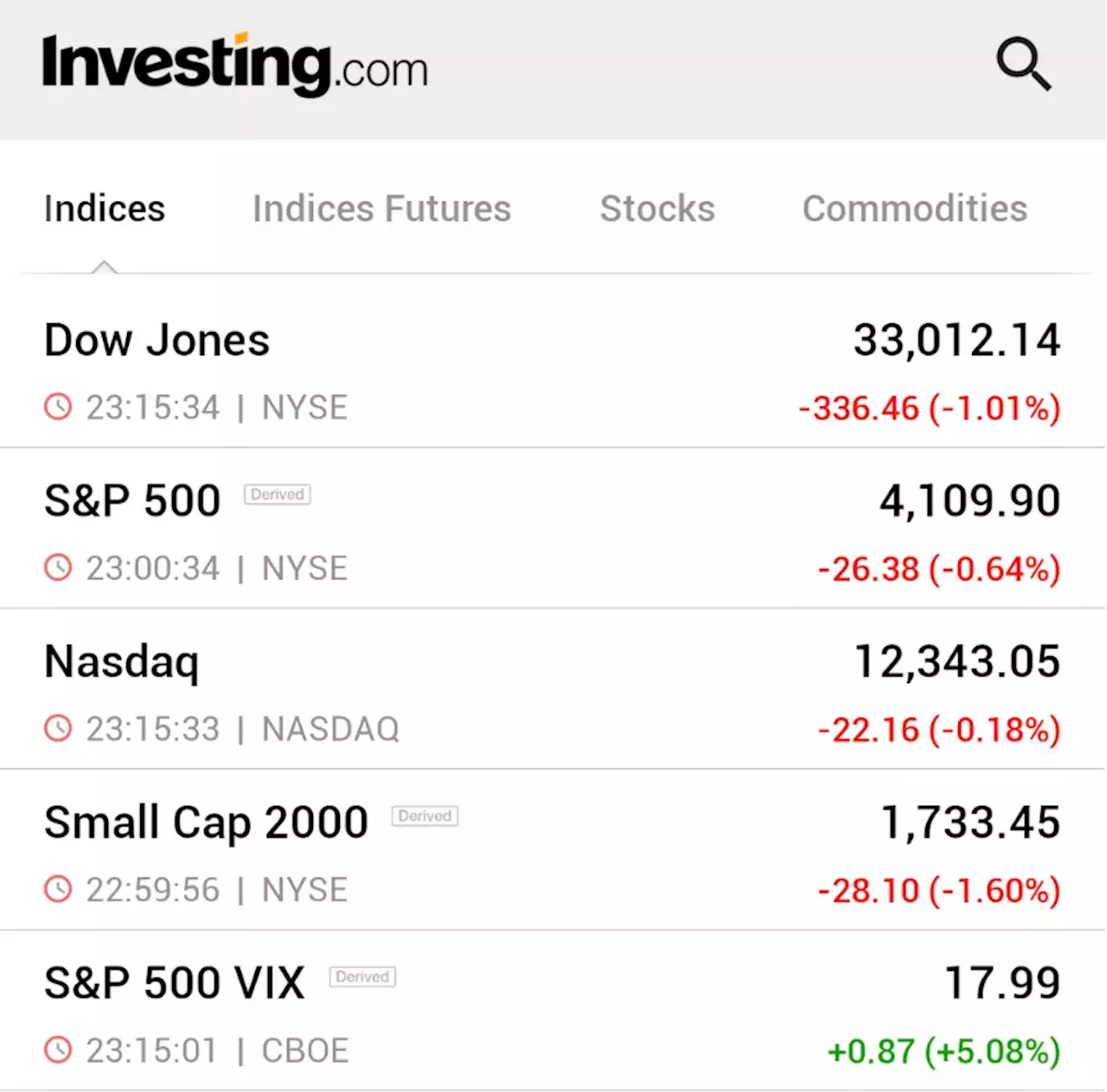

Wall Street closes lower after Home Depot outlook, US retail sales By Reuters⚠️BREAKING: *DOW ENDS DOWN OVER 300 POINTS AS U.S. STOCKS TUMBLE ON GLOOMY HOME DEPOT OUTLOOK, DEBT CEILING CONCERNS $DIA $SPY $QQQ $IWM $VIX

Wall Street closes lower after Home Depot outlook, US retail sales By Reuters⚠️BREAKING: *DOW ENDS DOWN OVER 300 POINTS AS U.S. STOCKS TUMBLE ON GLOOMY HOME DEPOT OUTLOOK, DEBT CEILING CONCERNS $DIA $SPY $QQQ $IWM $VIX

Read more »

Stock futures are slightly higher as Wall Street focuses on debt ceiling negotiations: Live updatesInvestors will watch for any updates out of debt limit talks.

Stock futures are slightly higher as Wall Street focuses on debt ceiling negotiations: Live updatesInvestors will watch for any updates out of debt limit talks.

Read more »

Wall Street closes lower after Home Depot outlook, US retail salesU.S. stock indexes closed lower on Tuesday after a disappointing forecast from Home Depot and U.S. retail sales data for April pointed to softer consumer spending, while uncertainty about interest rates and debt limit negotiations weighed on sentiment.

Wall Street closes lower after Home Depot outlook, US retail salesU.S. stock indexes closed lower on Tuesday after a disappointing forecast from Home Depot and U.S. retail sales data for April pointed to softer consumer spending, while uncertainty about interest rates and debt limit negotiations weighed on sentiment.

Read more »

Wall Street braces for stock market chaos as debt-ceiling crisis drags onWall Street is bracing for stock market chaos as the debt-ceiling face-off drags on

Read more »