“Our view is that a fed-funds rate of 4% is about the highest that the economy would be able to withstand,” said Mark Haefele of UBS Global Wealth Management.

Financial market participants appeared to be losing hope that the world’s largest economy can avoid a downturn, a day after the Federal Reserve left little doubt about its willingness to continue aggressively hiking interest rates to curb inflation — leaving traders contemplating a once-unthinkable 5% level for borrowing costs in the next six months.

Amid a worldwide march higher in rates, which also included hikes by the Bank of England and central banks of Switzerland and Norway, major stock indexes from U.S. to Europe and Asia were mostly a sea of red as investors and traders factored in a decent chance of a 5% fed-funds rate target next year — twice as high as where rates were prior to the Fed’s policy announcement on Wednesday.

Economist Derek Tang said “the ship has sailed” on the prospects of a soft landing, while Chris Low of FHN Financial called out a “fantasy element” in the Fed’s economic forecasts, which show the U.S. economy strengthening in 2023 despite a fed-funds rate heading for 4.6%. Jefferies economists Thomas Simons and Aneta Markowska said “Nobel Prizes will be in order” if the Fed can achieve its goal while avoiding a recession.

What’s more, six out of the 19 officials on the policy-setting Federal Open Market Committee indicated they think it would likely be appropriate to lift rates to between 4.75% and 5% next year, according to the Fed’s economic projections released Wednesday. BofA Securities and Deutsche Bank have also flagged the chance of rates moving closer to 5%, a level that hasn’t been seen in over a decade.

On Thursday, the 2-year rate continued to climb toward a 15-year high — breaking past 4.1%, along with the 3-year yield, as the 5-year rate also moved higher in sympathy. In the process, the 2-year yield exceed the yield on the 10-year Treasury note by as much as 59 basis points at one point, deepening the inversion of that measure of the yield curve.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

House Jan. 6 hearing set for what could mark final investigative presentationCommittee members have said the Jan 6 hearing on Wednesday, Sept. 28, will cover new evidence that the panel has not yet shared with the public, possibly related to former Vice President Mike Pence.

House Jan. 6 hearing set for what could mark final investigative presentationCommittee members have said the Jan 6 hearing on Wednesday, Sept. 28, will cover new evidence that the panel has not yet shared with the public, possibly related to former Vice President Mike Pence.

Read more »

Billionaire Baby Season: Mark Zuckerberg Is Welcoming His Third ChildIt’s Billionaire Baby Season: Mark Zuckerberg Is Welcoming His Third Child

Billionaire Baby Season: Mark Zuckerberg Is Welcoming His Third ChildIt’s Billionaire Baby Season: Mark Zuckerberg Is Welcoming His Third Child

Read more »

San Antonio Sports focused on future after hitting $1 billion markA rip-roaring celebration isn’t in the offing after San Antonio Sports announced...

San Antonio Sports focused on future after hitting $1 billion markA rip-roaring celebration isn’t in the offing after San Antonio Sports announced...

Read more »

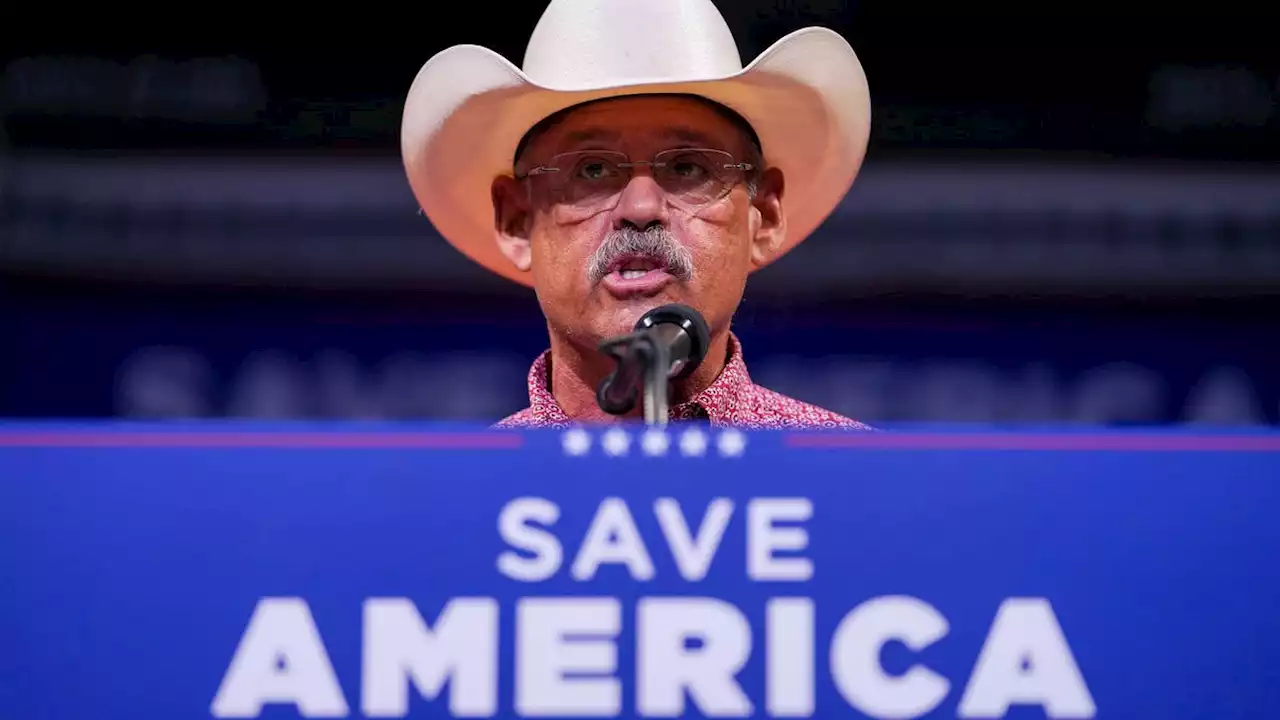

Mark Finchem's startling admission should disqualify him from being secretary of stateOpinion from LaurieRoberts: Mark Finchem says it's 'fantasy' to believe that Joe Biden won or could win Arizona. That's a stunning statement from a guy who wants to run Arizona's 2024 elections.

Mark Finchem's startling admission should disqualify him from being secretary of stateOpinion from LaurieRoberts: Mark Finchem says it's 'fantasy' to believe that Joe Biden won or could win Arizona. That's a stunning statement from a guy who wants to run Arizona's 2024 elections.

Read more »