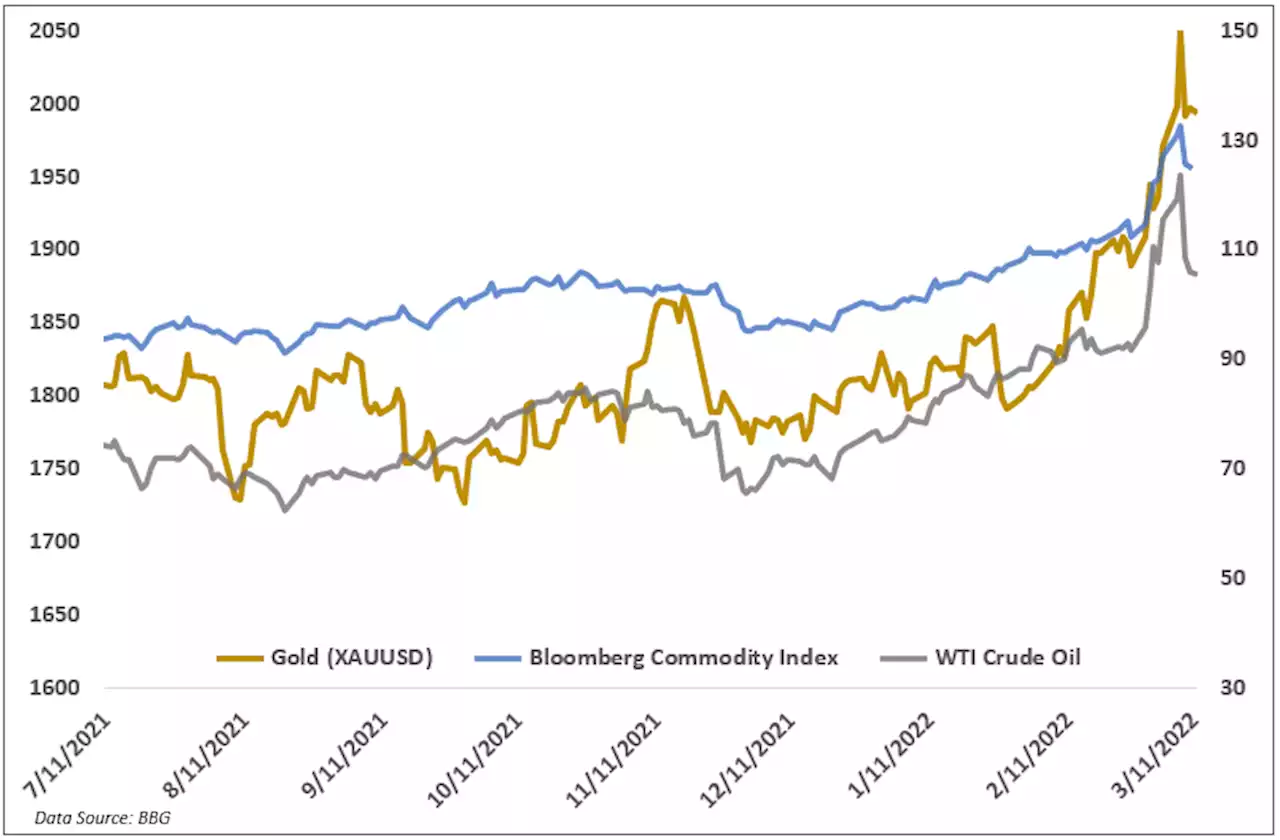

Gold prices eye FOMC but the Fed may take a “wait and see” approach amid war-induced volatility and uncertainty. Bullion’s near-term direction relies upon the on-the-ground situation in Ukraine. Get your weekly gold forecast from FxWestwater here:

. The surge in prices cast a fresh cloud of doubt over the Federal Reserve’s calculus ahead of Wednesday’s rate decision when policymakers are expected to hike the US benchmark rate by 25 basis points.

Typically, gold and other assets would be keenly focused on a Fed rate decision, but the FOMC event may take a backseat to the ongoing and rapidly changing situation in Ukraine. That is partly due to the economic uncertainty that has been injected into the global economy. Outside the 25 bps hike, the Fed may opt to take a “wait and see” approach instead of offering firm guidance on policy. That said, the war has likely already pushed actual inflation higher in the near term.

Gold prices may fall if near-term risks recede, whether it be a major escalation or a complete resolution to the war. Inflation expectations would likely fall back to or near pre-invasion levels under that scenario. That would likely drag gold lower, but prices may remain higher than where they were before Putin’s invasion, given the spillover effects that will likely outlast the conflict, albeit to an unknown degree.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Gold Price Forecast: XAU/USD may surpass $2,000 on steadfast Russian demand for Ukraine surrenderGold Price Forecast: XAU/USD may surpass $2,000 on steadfast Russian demand for Ukraine surrender By Sagar_Dua24 Gold DollarIndex InterestRate Inflation Ukraine

Gold Price Forecast: XAU/USD may surpass $2,000 on steadfast Russian demand for Ukraine surrenderGold Price Forecast: XAU/USD may surpass $2,000 on steadfast Russian demand for Ukraine surrender By Sagar_Dua24 Gold DollarIndex InterestRate Inflation Ukraine

Read more »

Gold Price Forecast: XAU/USD bulls come up for air above $2,000 as Ukraine crisis drives sentimentGold Price Forecast: XAU/USD bulls come up for air above $2,000 as Ukraine crisis drives sentiment By ross_burland Gold Commodities DollarIndex ECB Ukraine

Gold Price Forecast: XAU/USD bulls come up for air above $2,000 as Ukraine crisis drives sentimentGold Price Forecast: XAU/USD bulls come up for air above $2,000 as Ukraine crisis drives sentiment By ross_burland Gold Commodities DollarIndex ECB Ukraine

Read more »

Gold futures sink 1.5% as Putin mentions 'certain positive shifts' in Ukraine'-Russia conflictGold futures head sharply lower Friday morning as comments from President Vladimir Putin appear to dull haven demand for precious metals.

Gold futures sink 1.5% as Putin mentions 'certain positive shifts' in Ukraine'-Russia conflictGold futures head sharply lower Friday morning as comments from President Vladimir Putin appear to dull haven demand for precious metals.

Read more »

Gold: Further correction on the cardsCME Group’s flash data for gold futures markets noted open interest shrank by around 18.7K contracts on Thursday. In the same line, volume dropped for

Gold: Further correction on the cardsCME Group’s flash data for gold futures markets noted open interest shrank by around 18.7K contracts on Thursday. In the same line, volume dropped for

Read more »

Gold Forecast, News and Analysis - FXStreetCheck our updated for Gold News including real time updates, forecast, technical analysis and the economic latest events from the best source of Forex News

Read more »

Stocks and oil slide, gold above $2,000Investors weigh rising inflation and the ongoing Russia-Ukraine conflict as volatility remains high.

Stocks and oil slide, gold above $2,000Investors weigh rising inflation and the ongoing Russia-Ukraine conflict as volatility remains high.

Read more »