Goldman Sachs economists say the US central bank will raise interest rates four more times between now and 2023, keeping rates high until 2024. The two-day FOMC meeting starts Tuesday.

is unlikely to pivot and cut its benchmark interest rate until 2024 at the soonest as it tries to crush the hottest inflation in four decades, according to Goldman Sachs strategists.

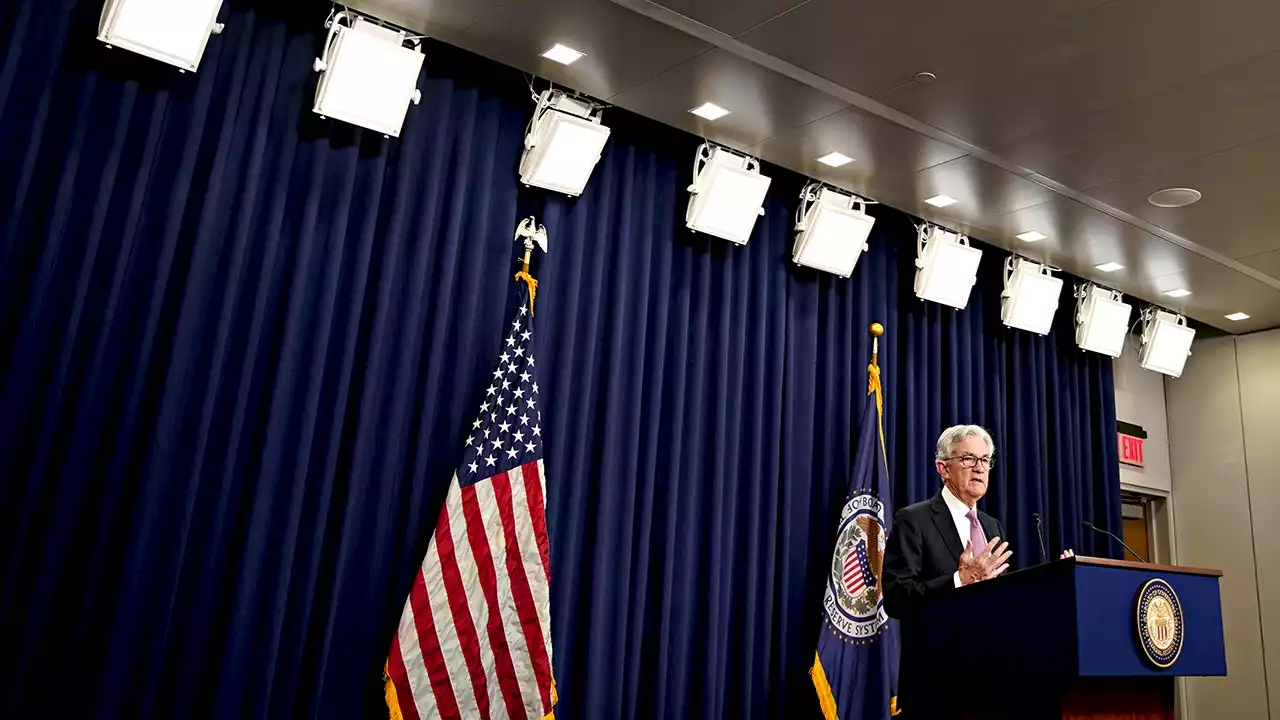

Jerome Powell, chairman of the U.S. Federal Reserve, speaks during a news conference following a Federal Open Market Committee meeting in Washington, D.C., on Wednesday, May 4, 2022. Although Goldman economists, like many other experts, initially thought the Fed would reduce the size of rate increases after July, that changed after the August inflation data released last week came in hotter than expected. The consumer price index unexpectedly rose 0.1% in August from the previous month, dashing hopes for a slowdown. On an annual basis, prices are up 8.3% — near the highest level since 1981.

Permits for future construction, a good gauge of future housing activity, are anticipated to fall 4.5% to 1.610 million in August, the lowest since September . The Federal Reserve is widely expected to raise the Federal Funds rate by three-quarters of a percentage point to a range of 3%-3.25%, up from the current range of 2.25%-2.50%.

The Federal Reserve’s balance sheet currently stands just shy of $9 trillion, having doubled since the pandemic as the Fed bought trillions in Treasuries and mortgaged-backed securities to try and hold off an economic collapse. The central bank began winding down its balance sheet in June by allowing up to $47.5 billion per month to mature without reinvesting the proceeds. That figure has doubled as of last week.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Goldman Sachs cuts 2023 US GDP forecasts to 1.1%Goldman Sachs (GS) cut its forecast for 2023 US Gross Domestic Product (GDP) as it projects a more aggressive Federal Reserve tightening policy throug

Goldman Sachs cuts 2023 US GDP forecasts to 1.1%Goldman Sachs (GS) cut its forecast for 2023 US Gross Domestic Product (GDP) as it projects a more aggressive Federal Reserve tightening policy throug

Read more »

Fed unlikely to cut interest rates until 2024, Goldman Sachs saysGoldman Sachs economists see the Federal Reserve raising interest rates until 2023 to a range of 4.25% to 4.50% and then holding there for a year as they fight inflation.

Fed unlikely to cut interest rates until 2024, Goldman Sachs saysGoldman Sachs economists see the Federal Reserve raising interest rates until 2023 to a range of 4.25% to 4.50% and then holding there for a year as they fight inflation.

Read more »

BOJ Preview: To maintain status quo across all monetary policy parameters – Goldman SachsAccording to economists at Goldman Sachs, the Bank of Japan (BOJ) is unlikely to alter its ultra-loose monetary policy stance, despite the increased p

BOJ Preview: To maintain status quo across all monetary policy parameters – Goldman SachsAccording to economists at Goldman Sachs, the Bank of Japan (BOJ) is unlikely to alter its ultra-loose monetary policy stance, despite the increased p

Read more »

Contractor spills details of planned Goldman Sachs campus near downtown DallasContractor Balfour Beatty says its building a an Uptown Dallas corporate campus with three towers. The description matches with plans for Goldman Sachs' new...

Contractor spills details of planned Goldman Sachs campus near downtown DallasContractor Balfour Beatty says its building a an Uptown Dallas corporate campus with three towers. The description matches with plans for Goldman Sachs' new...

Read more »

Goldman Sachs' bearish macro outlook puts Bitcoin at risk of crashing to $12KBitcoin derivatives data also shows sentiment shifting in favor of a massive crash below $20,000, the current psychological support.

Goldman Sachs' bearish macro outlook puts Bitcoin at risk of crashing to $12KBitcoin derivatives data also shows sentiment shifting in favor of a massive crash below $20,000, the current psychological support.

Read more »

Shrinking margins could spell trouble for stock-market returns: Goldman SachsShrinking margins are posing downside risk to S&P 500’s equity returns as hotter-than-expected inflation reading and another massive interest rate hike bring...

Shrinking margins could spell trouble for stock-market returns: Goldman SachsShrinking margins are posing downside risk to S&P 500’s equity returns as hotter-than-expected inflation reading and another massive interest rate hike bring...

Read more »