Financial technology companies oversaw a disproportionately high rate of fraudulent loans through the Paycheck Protection Program, a new congressional report says

Financial technology companies oversaw a disproportionately high rate of fraudulent loans through the Paycheck Protection Program authorized by Congress to provide small business loans during the Covid-19 pandemic, aThe report by the House Select Committee on the Coronavirus Crisis says “at least tens of billions of dollars” from the federal loan program overseen by financial technology firms were likely given to applicants who were fraudulent or ineligible.

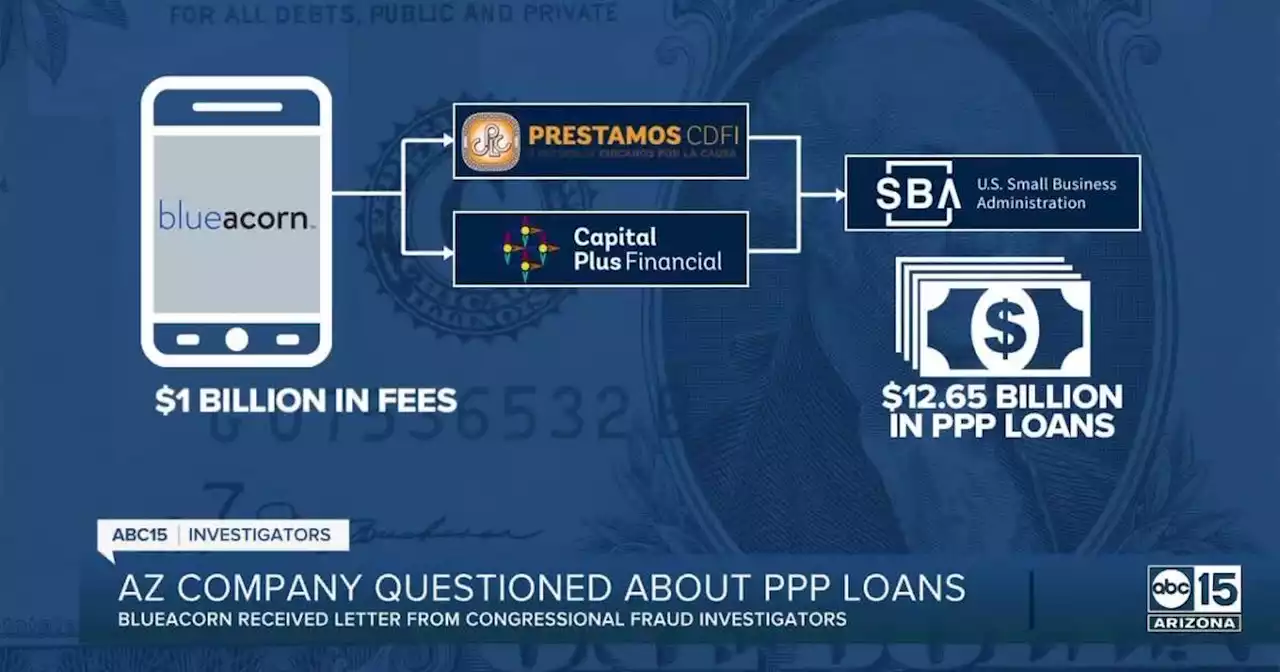

Blueacorn received more than $1 billion in taxpayer-funded processing fees for its work on the Paycheck Protection Program, but spent less than 1% of that amount—$8.6 million—on its fraud prevention program, according to the report. Blueacorn’s founders arranged Paycheck Protection Program loans for themselves through Blueacorn, some of which show signs of potential fraud, the report says.

“The Select Subcommittee’s investigation found that many fintechs, largely existing outside of the regulatory structure governing traditional financial institutions and with little to no oversight from lenders, took billions in fees from taxpayers while becoming easy targets for those who sought to defraud the PPP,” according to the report.

Many of the financial technology companies were newly established or hadn’t before worked in small business lending, yet they were given a significant role over the federal loan program. The report recommends that the Small Business Administration and Congress should consider whether the companies should be allowed to play such a leading role in the future without stepped up oversight.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Cameroonian Fintech Ejara Raises $8 Million in Series A Investment Round – Fintech Bitcoin NewsThe latest capital brings the total funds that Ejara has raised in under 18 months to $10 million. fintech capitalraise ejara

Cameroonian Fintech Ejara Raises $8 Million in Series A Investment Round – Fintech Bitcoin NewsThe latest capital brings the total funds that Ejara has raised in under 18 months to $10 million. fintech capitalraise ejara

Read more »

Scottsdale-based Blueacorn PPP facilitated fraud, per newly released congressional reportA Scottdale-based company that filed Paycheck Protection Program applications failed to screen out those with signs of fraud while abusing the program, according to a new congressional subcommittee.

Scottsdale-based Blueacorn PPP facilitated fraud, per newly released congressional reportA Scottdale-based company that filed Paycheck Protection Program applications failed to screen out those with signs of fraud while abusing the program, according to a new congressional subcommittee.

Read more »

Peter Thiel's VC fund backs TreeCard, a fintech that plants trees when you spendThe deal underscores increased interest from VC investors in companies addressing climate change.

Peter Thiel's VC fund backs TreeCard, a fintech that plants trees when you spendThe deal underscores increased interest from VC investors in companies addressing climate change.

Read more »

Mr Porter Sees Empowering Results With Its Designer Mentorship ProgramThe first batch of designers who went through the 12-month Mr Porter Futures global designer mentorship program in partnership with Swedish online financial services provider Klarna revealed their collections on Wednesday.

Mr Porter Sees Empowering Results With Its Designer Mentorship ProgramThe first batch of designers who went through the 12-month Mr Porter Futures global designer mentorship program in partnership with Swedish online financial services provider Klarna revealed their collections on Wednesday.

Read more »

Supreme Court agrees to hear case over Biden student loan forgiveness programBREAKING: The Supreme Court said Thursday it will take up a court fight between the Biden administration and a coalition of six Republican-led states challenging the legality of the president's student loan forgiveness program.

Supreme Court agrees to hear case over Biden student loan forgiveness programBREAKING: The Supreme Court said Thursday it will take up a court fight between the Biden administration and a coalition of six Republican-led states challenging the legality of the president's student loan forgiveness program.

Read more »