Federal Reserve officials are signaling that they will take a more aggressive approach to fighting high inflation in the coming months — actions that will make borrowing sharply more expensive for consumers and businesses and heighten risks to the economy.

FILE- Federal Reserve Chairman Jerome Powell testifies before the Senate Banking Committee hearing, on March 3, 2022 on Capitol Hill in Washington. The Senate Banking Committee approved Powell's nomination to a second four-year term as chair of the Federal Reserve on Wednesday, March 16, 2022, ust hours after the Fed began what will be a difficult effort to combat inflation.

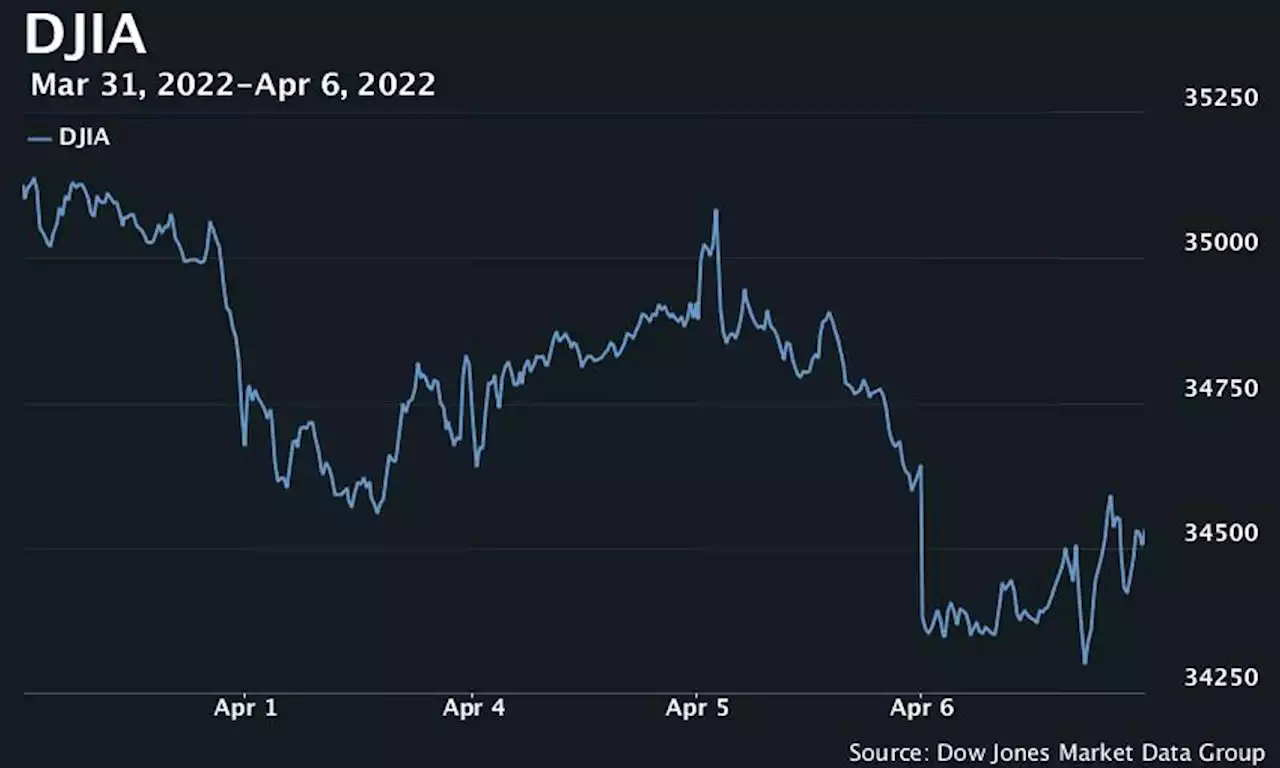

The stock market sold off when the minutes were released but later rebounded from its worst levels. Still, the S&P 500 index closed down nearly 1% after a sharp drop on Tuesday. In a speech Tuesday, Brainard underscored the Fed's increasing aggressiveness by saying its bond holdings will “shrink considerably more rapidly” over “a much shorter period" than the last time it reduced its balance sheet, from 2017-2019. At that time, the balance sheet was about $4.5 trillion. Now, it's twice as large.After the pandemic hammered the economy two years ago, the Fed bought trillions in Treasury and mortgage bonds, with the goal of lowering longer-term loan rates.

Gennadiy Goldberg, senior U.S. rates strategist at TD Securities, said the narrow gap between longer- and shorter-term bond yields indicates that investors think the economy will slow enough in the next two years to force the Fed to scale back its rate hikes.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Fed signals more aggressive steps to fight inflationFederal Reserve officials are signaling that they will take a more aggressive approach to fighting high inflation in the coming months — actions that will make borrowing sharply more expensive for consumers and businesses and heighten risks to the economy.

Fed signals more aggressive steps to fight inflationFederal Reserve officials are signaling that they will take a more aggressive approach to fighting high inflation in the coming months — actions that will make borrowing sharply more expensive for consumers and businesses and heighten risks to the economy.

Read more »

Fed signals more aggressive steps to fight inflationFederal Reserve officials are signaling that they will take a more aggressive approach to fighting high inflation in the coming months — actions that will make borrowing sharply more expensive for consumers and businesses and heighten risks to the economy.

Fed signals more aggressive steps to fight inflationFederal Reserve officials are signaling that they will take a more aggressive approach to fighting high inflation in the coming months — actions that will make borrowing sharply more expensive for consumers and businesses and heighten risks to the economy.

Read more »

Fed officials plan to shrink the balance sheet by $95 billion a month, meeting minutes indicateThe Federal Reserve on Wednesday released minutes from its March 15-16 policy meeting.

Fed officials plan to shrink the balance sheet by $95 billion a month, meeting minutes indicateThe Federal Reserve on Wednesday released minutes from its March 15-16 policy meeting.

Read more »

Stocks trade at or near session lows as investors weigh Fed balance-sheet plansStocks fell back to or near session lows after briefly trimming losses following the release of minutes from the Federal Reserve's March policy meeting...

Stocks trade at or near session lows as investors weigh Fed balance-sheet plansStocks fell back to or near session lows after briefly trimming losses following the release of minutes from the Federal Reserve's March policy meeting...

Read more »

Nasdaq sinks more than 2% as stocks end lower after Fed minutesStocks ended lower but off their worst levels, with the tech-heavy Nasdaq Composite bearing the brunt of selling pressure for a second session Wednesday. The Dow Jones Industrial Average ended with a loss of around 145 points, or 0.4%, near 34,497.

Nasdaq sinks more than 2% as stocks end lower after Fed minutesStocks ended lower but off their worst levels, with the tech-heavy Nasdaq Composite bearing the brunt of selling pressure for a second session Wednesday. The Dow Jones Industrial Average ended with a loss of around 145 points, or 0.4%, near 34,497.

Read more »

Stock Futures Slip, Bond Yields Rise Ahead of Fed MinutesStock futures edged down and bond yields hit their highest level in three years as investors awaited more details about the Federal Reserve’s plan to raise interest rates.

Stock Futures Slip, Bond Yields Rise Ahead of Fed MinutesStock futures edged down and bond yields hit their highest level in three years as investors awaited more details about the Federal Reserve’s plan to raise interest rates.

Read more »