In a scathing report, the Federal Reserve on Friday outlined a series of disastrous decisions that led to the downfall of Silicon Valley Bank — including failures by the central bank’s own supervisors to ward off last month’s crisis.

wrote in a letter accompanying the report. “Regulatory standards for SVB were too low, the supervision of SVB did not work with sufficient force and urgency, and contagion from the firm’s failure posed systemic consequences not contemplated by the Federal Reserve’s tailoring framework.

“The section on tailoring is a thinly veiled attempt to validate the Biden Administration and Congressional Democrats’ calls for more regulation,” McHenry said. “Politicizing bank failures does not serve our economy, financial system, or the American people well.”Barr’s proposals will go through standard rulemaking procedures, but senior Fed officials are confident these changes will come to fruition.

The changes would not require separate legislation or approval from Congress, according to senior Fed officials. Powell and the Fed board’s governors were briefed on the findings, but were not involved in the review or final report. Nor were the staffers involved in supervising SVB before it failed in early March.

The Justice Department and the Securities and Exchange Commission are also investigating the bank’s failure, and Congress will likely launch its own investigation, as well.“It’s going to really set the stage for regulatory reform,” Derek Tang, an economist at the research firm LH Meyer/Monetary Policy Analytics, said of the Fed’s probe. “It establishes the tone of what exactly went wrong.

“As a result, staff approached supervisory messages, particularly supervisory findings and enforcement actions, with a need to accumulate more evidence than in the past, which contributed to delays and in some cases led staff not to take action,” Barr wrote.The Fed and FDIC were quick to announce their probes, with Barr telling Congress that “any time you have a bank failure like this, bank management clearly failed, supervisors failed, and our regulatory system failed.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

![]() Fed faults Silicon Valley Bank execs, itself in bank failureSilicon Valley Bank failed due to a combination of extremely poor bank management, weakened regulations and lax government supervision, the Federal Reserve says in a highly-anticipated review of how the central bank failed to properly supervise the bank before it collapsed early last month. The report issued Friday takes a critical look at what the Fed missed as Silicon Valley Bank grew quickly in size in the years leading up to its collapse. The Fed finds that while poor management ultimately doomed Silicon Valley Bank, watered down regulations and social media's ability to rapidly hasten a bank run also contributed.

Fed faults Silicon Valley Bank execs, itself in bank failureSilicon Valley Bank failed due to a combination of extremely poor bank management, weakened regulations and lax government supervision, the Federal Reserve says in a highly-anticipated review of how the central bank failed to properly supervise the bank before it collapsed early last month. The report issued Friday takes a critical look at what the Fed missed as Silicon Valley Bank grew quickly in size in the years leading up to its collapse. The Fed finds that while poor management ultimately doomed Silicon Valley Bank, watered down regulations and social media's ability to rapidly hasten a bank run also contributed.

Read more »

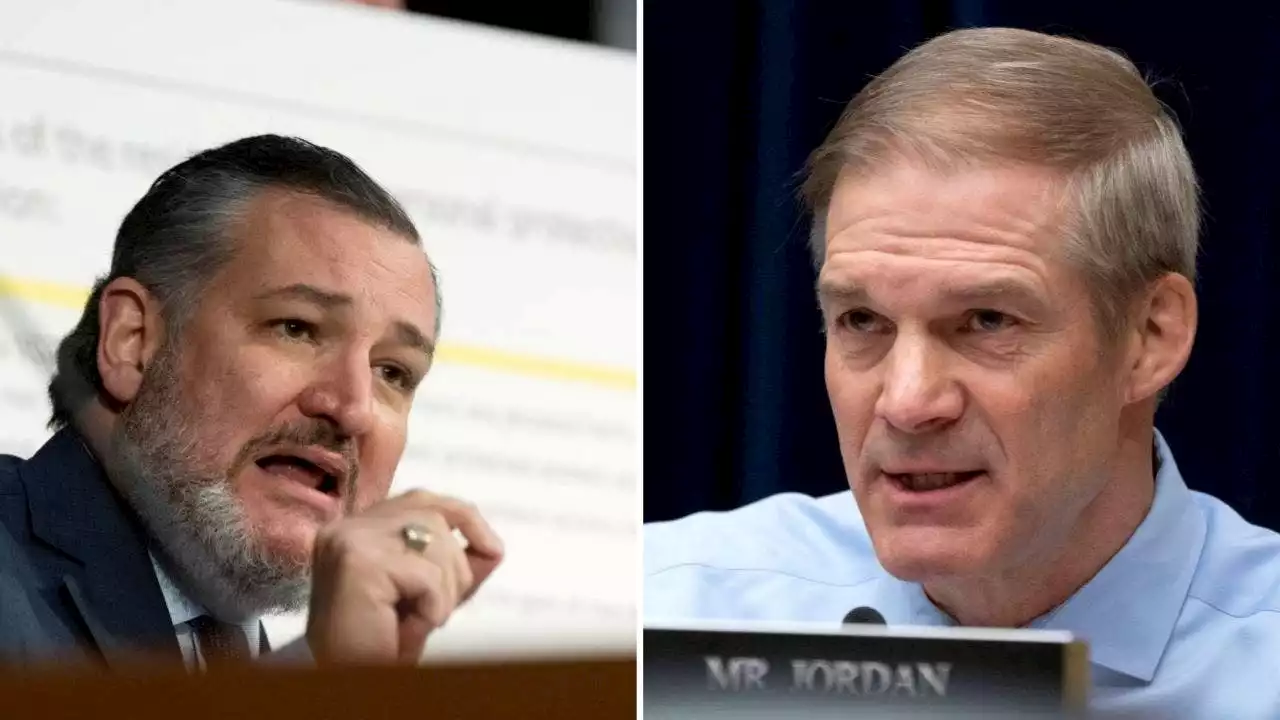

Ted Cruz, Jim Jordan press San Francisco Fed on Silicon Valley Bank collapseSen. Ted Cruz and Rep. Jim Jordan wrote to San Francisco Federal Reserve Chair Mary Daly to request information on the Fed's supervision of Silicon Valley Bank prior to its failure.

Ted Cruz, Jim Jordan press San Francisco Fed on Silicon Valley Bank collapseSen. Ted Cruz and Rep. Jim Jordan wrote to San Francisco Federal Reserve Chair Mary Daly to request information on the Fed's supervision of Silicon Valley Bank prior to its failure.

Read more »

![]() Fed's review of role in Silicon Valley Bank collapse due outThe Federal Reserve is scheduled Friday to release a highly-anticipated review of its supervision of Silicon Valley Bank, the go-to bank for venture capital firms and technology start-ups that failed spectacularly in March, setting off a crisis of confidence for the banking industry.

Fed's review of role in Silicon Valley Bank collapse due outThe Federal Reserve is scheduled Friday to release a highly-anticipated review of its supervision of Silicon Valley Bank, the go-to bank for venture capital firms and technology start-ups that failed spectacularly in March, setting off a crisis of confidence for the banking industry.

Read more »

![]() Regulators to Publish Postmortems on Silicon Valley Bank, Signature FailuresWashington regulators plan to release Friday postmortems of their oversight of Silicon Valley Bank and Signature Bank before they abruptly collapsed last month

Regulators to Publish Postmortems on Silicon Valley Bank, Signature FailuresWashington regulators plan to release Friday postmortems of their oversight of Silicon Valley Bank and Signature Bank before they abruptly collapsed last month

Read more »

Banks, consumers being tested in the wake of Silicon Valley Bank's collapseMore than one month after banking alarms sounded across the globe with the collapse of Silicon Valley Bank and Signature Bank, lending institutions are still reeling, and consumers are skeptical. MORE ⬇️

Banks, consumers being tested in the wake of Silicon Valley Bank's collapseMore than one month after banking alarms sounded across the globe with the collapse of Silicon Valley Bank and Signature Bank, lending institutions are still reeling, and consumers are skeptical. MORE ⬇️

Read more »

Fed report on SVB collapse faults bank's managers — and central bank regulatorsThe Fed blamed failures on mismanagement and supervisory failures, compounded by a dose of social media frenzy.

Fed report on SVB collapse faults bank's managers — and central bank regulatorsThe Fed blamed failures on mismanagement and supervisory failures, compounded by a dose of social media frenzy.

Read more »