The Federal Reserve is scheduled Friday to release a highly-anticipated review of its supervision of Silicon Valley Bank, the go-to bank for venture capital firms and technology start-ups that failed spectacularly in March.

of New York. Although regulators guaranteed all the banks’ deposits, customers at other midsize regional banks rushed to pull out their money — often with a few taps on a mobile device — and move it to the perceived safety of big money center banks such as JPMorgan Chase.

Although the withdrawals have abated at many banks, First Republic Bank in San Francisco appears to be in peril, even after receiving a $30 billion infusion of deposits from 11 major banks in March. The bank’safter it revealed the extent to which customers pulled their deposits in the days after Silicon Valley Bank failed.

The nation’s banks are regulated by a troika of regulators: the Federal Reserve, the Office of the Comptroller of the Currency and the Federal Deposit Insurance Corporation. All have been criticized for potentially missing signs that Silicon Valley Bank and Signature Bank might be in trouble. Michael Barr, the Fed’s vice chair for supervision, appeared at two hearings in Congress last month and

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

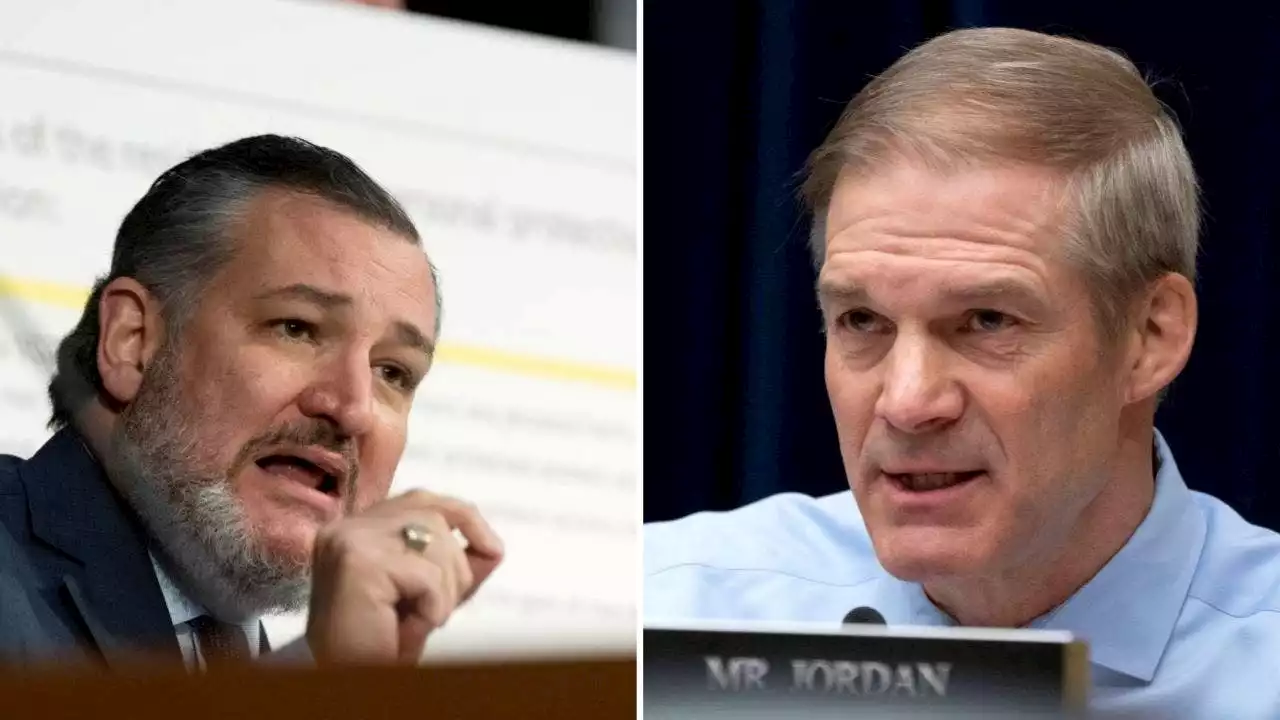

Ted Cruz, Jim Jordan press San Francisco Fed on Silicon Valley Bank collapseSen. Ted Cruz and Rep. Jim Jordan wrote to San Francisco Federal Reserve Chair Mary Daly to request information on the Fed's supervision of Silicon Valley Bank prior to its failure.

Ted Cruz, Jim Jordan press San Francisco Fed on Silicon Valley Bank collapseSen. Ted Cruz and Rep. Jim Jordan wrote to San Francisco Federal Reserve Chair Mary Daly to request information on the Fed's supervision of Silicon Valley Bank prior to its failure.

Read more »

![]() Silicon Valley high schooler nearly moves debate judge to tearsNewsweek Mightier supports the next generation of American leaders as they try to find common ground in our fractious, sometimes toxic, national conversation. Read about one SVUDL high schooler whose passion for debate made a judge emotional:

Silicon Valley high schooler nearly moves debate judge to tearsNewsweek Mightier supports the next generation of American leaders as they try to find common ground in our fractious, sometimes toxic, national conversation. Read about one SVUDL high schooler whose passion for debate made a judge emotional:

Read more »

![]() Silicon Valley-based tech accelerator expands its digital asset vertical to FrancePlug and Play Tech Center is expanding the scope of its crypto and digital asset vertical to its French office.

Silicon Valley-based tech accelerator expands its digital asset vertical to FrancePlug and Play Tech Center is expanding the scope of its crypto and digital asset vertical to its French office.

Read more »

![]() Former Silicon Valley startup CEO pleads guilty to federal fraud chargesProsecutors said the former CEO of Headspin, a business-software provider, had repeatedly given investors false and exaggerated information in order to gain their financial support.

Former Silicon Valley startup CEO pleads guilty to federal fraud chargesProsecutors said the former CEO of Headspin, a business-software provider, had repeatedly given investors false and exaggerated information in order to gain their financial support.

Read more »

First Republic shares continue their free fall amid mounting worriesFirst Republic Bank's shares are sliding in pre-market trading after shedding half their value on Tuesday amid fears the regional firm could become the third bank to fail following the collapse of Silicon Valley Bank and Signature Bank.

First Republic shares continue their free fall amid mounting worriesFirst Republic Bank's shares are sliding in pre-market trading after shedding half their value on Tuesday amid fears the regional firm could become the third bank to fail following the collapse of Silicon Valley Bank and Signature Bank.

Read more »

First Republic Bank rout; unable to shake depositor anxietyFirst Republic Bank's stock slid Wednesday in an ongoing rout that has erased more than 50% of its value just this week on concerns about the bank’s financial health in the wake of two other bank collapses. Shares slumped nearly 20% following an even more severe tumble the previous day after it revealed depositors withdrew more than $100 billion last month after the collapse of Silicon Valley Bank and Signature Bank. Trading in the bank’s shares was halted several times Wednesday for volatility. The bank said late Monday that it was only able to stop the bleeding after a group of large banks stepped in to save it by depositing $30 billion in uninsured deposits.

First Republic Bank rout; unable to shake depositor anxietyFirst Republic Bank's stock slid Wednesday in an ongoing rout that has erased more than 50% of its value just this week on concerns about the bank’s financial health in the wake of two other bank collapses. Shares slumped nearly 20% following an even more severe tumble the previous day after it revealed depositors withdrew more than $100 billion last month after the collapse of Silicon Valley Bank and Signature Bank. Trading in the bank’s shares was halted several times Wednesday for volatility. The bank said late Monday that it was only able to stop the bleeding after a group of large banks stepped in to save it by depositing $30 billion in uninsured deposits.

Read more »