The Chicago Fed president said that he expects the central bank’s benchmark federal-funds rate will need to rise to slightly more than 4.5% by early next year

Inflation pressures are increasingly broad-based and require tighter monetary policy, said Chicago Fed President Charles Evans

A series of interest-rate rises have rippled through the U.S. economy, and more are projected to be on the way. WSJ breaks down the numbers hitting Americans’ wallets this year and beyond. Photo: Elise Amendola/Associated PressThe Federal Reserve will need to hold interest rates high enough to slow the economy after itand into early next year, a central bank official said Monday.

Federal Reserve Bank of Chicago President Charles Evans said in remarks at an economics conference Monday that he expects the central bank’s benchmark federal-funds rate will need to rise to slightly more than 4.5% by early next year and then remain at that level for some time.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Fed's Evans: Need to carefully navigate to reasonably restrictive policyChicago Fed President Charles Evans said on Monday that the Fed needs to 'carefully and judiciously' navigate to a 'reasonably restrictive' policy rat

Fed's Evans: Need to carefully navigate to reasonably restrictive policyChicago Fed President Charles Evans said on Monday that the Fed needs to 'carefully and judiciously' navigate to a 'reasonably restrictive' policy rat

Read more »

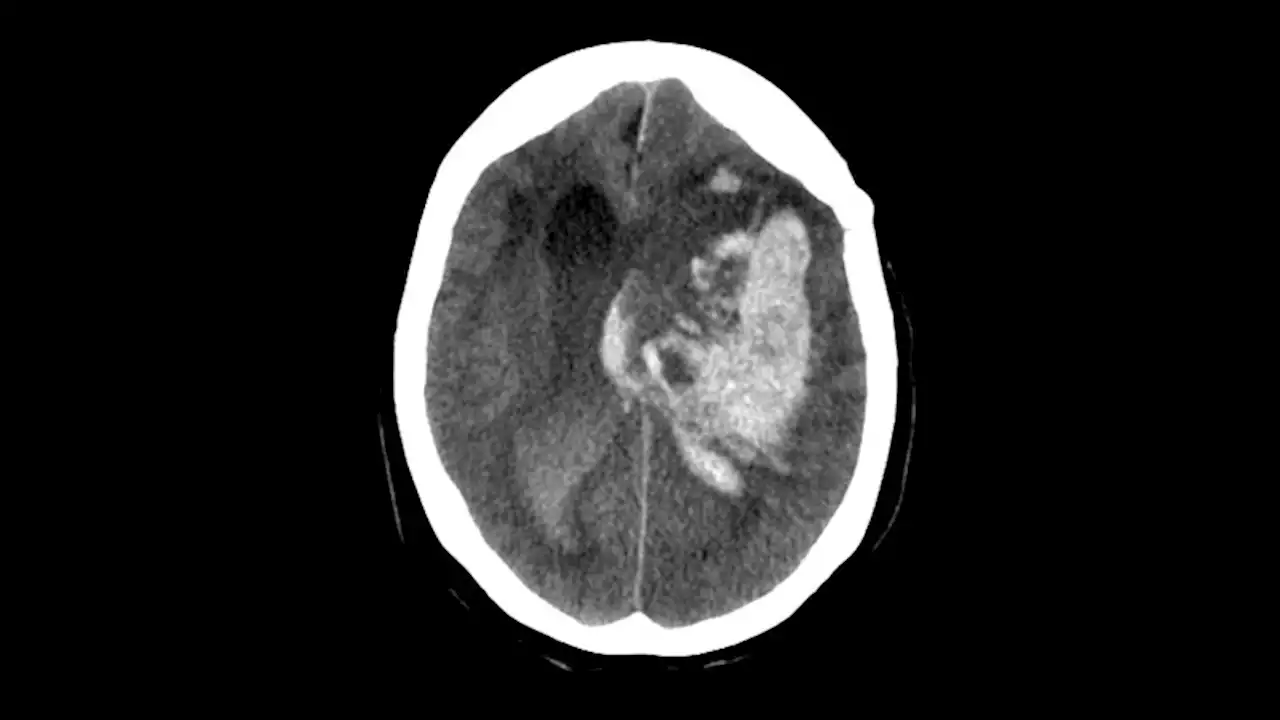

ICH Patients at Increased Risk of Subsequent Vascular EventsPatients with prior intracerebral hemorrhage have higher rates of major ischemic and hemorrhagic events than the general population, emphasizing the need for better secondary preventive measures.

ICH Patients at Increased Risk of Subsequent Vascular EventsPatients with prior intracerebral hemorrhage have higher rates of major ischemic and hemorrhagic events than the general population, emphasizing the need for better secondary preventive measures.

Read more »

A Jittery Stock Market Heads Into Earnings SeasonJPMorgan, PepsiCo and others report results this week, giving investors the broadest look yet at how business has held up as the Fed keeps raising rates

A Jittery Stock Market Heads Into Earnings SeasonJPMorgan, PepsiCo and others report results this week, giving investors the broadest look yet at how business has held up as the Fed keeps raising rates

Read more »

Pickleball popularity sparks turf war at some West Village parksA turf war is pitting some New York City parents against some players of pickleball. DaveCarlinTV has more on the testy exchanges and calls for action.

Pickleball popularity sparks turf war at some West Village parksA turf war is pitting some New York City parents against some players of pickleball. DaveCarlinTV has more on the testy exchanges and calls for action.

Read more »

Dollar climbs as case for U.S. rate hikes firmsThe dollar started the week firmly on Monday, with a strong U.S. labour market reinforcing bets on higher interest rates as traders braced for data expected to show stubbornly high inflation.

Dollar climbs as case for U.S. rate hikes firmsThe dollar started the week firmly on Monday, with a strong U.S. labour market reinforcing bets on higher interest rates as traders braced for data expected to show stubbornly high inflation.

Read more »