Inflation is still “stubbornly high,” and the Federal Reserve will raise interest rates as much as necessary to bring price pressures back under control, a senior central bank official said on Friday.

Senior Federal Reserve officials say they are determined to squash “stubbornly high,” inflation even if it requires higher interest rates and steeper unemployment to bring price pressures back under control.

“I don’t know why markets are so optimistic about inflation,” said Daly, referring to recent optimism among investors that the Fed was finally gaining the upper hand. The Fed also signaled it plans to raise the so-called fed-funds rate to as high as 5.25% in 2023. Williams said his colleagues expect it to get to 5% to 5.5% next year.In market parlance, a real interest rate is one that is above inflation. The rate of inflation right now, using the Fed’s preferred PCE price gauge, is 6%. That’s markedly higher than the current 4.25% to 4.5% fed-funds rate.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

US recession a growing fear as Fed plans to keep rates highThe Federal Reserve seems unconvinced that its fight against accelerating prices is anywhere near over.

US recession a growing fear as Fed plans to keep rates highThe Federal Reserve seems unconvinced that its fight against accelerating prices is anywhere near over.

Read more »

N.Y. Fed's Williams reiterates rates will rise as much as necessary to bring down 'stubbornly high' inflationInflation is still “stubbornly high,” and the Federal Reserve will raise interest rates as much as necessary to bring price pressures back under control, a senior central bank official said on Friday. John Williams, president of the New York Fed, said in an interview with Bloomberg that inflation h

N.Y. Fed's Williams reiterates rates will rise as much as necessary to bring down 'stubbornly high' inflationInflation is still “stubbornly high,” and the Federal Reserve will raise interest rates as much as necessary to bring price pressures back under control, a senior central bank official said on Friday. John Williams, president of the New York Fed, said in an interview with Bloomberg that inflation h

Read more »

New York Fed’s Williams says interest rates need to top inflation rate to get prices under controlInflation is still "stubbornly high" and the Federal Reserve will raise interest rates as high as necessary, a senior central bank official said on...

New York Fed’s Williams says interest rates need to top inflation rate to get prices under controlInflation is still "stubbornly high" and the Federal Reserve will raise interest rates as high as necessary, a senior central bank official said on...

Read more »

Why a not-so-swift decline in U.S. inflation would keep financial markets turbulent through 2023A path of slowly decelerating inflation would give investors optimism, but also disappoint Federal Reserve policy makers counting on a faster return to normal

Why a not-so-swift decline in U.S. inflation would keep financial markets turbulent through 2023A path of slowly decelerating inflation would give investors optimism, but also disappoint Federal Reserve policy makers counting on a faster return to normal

Read more »

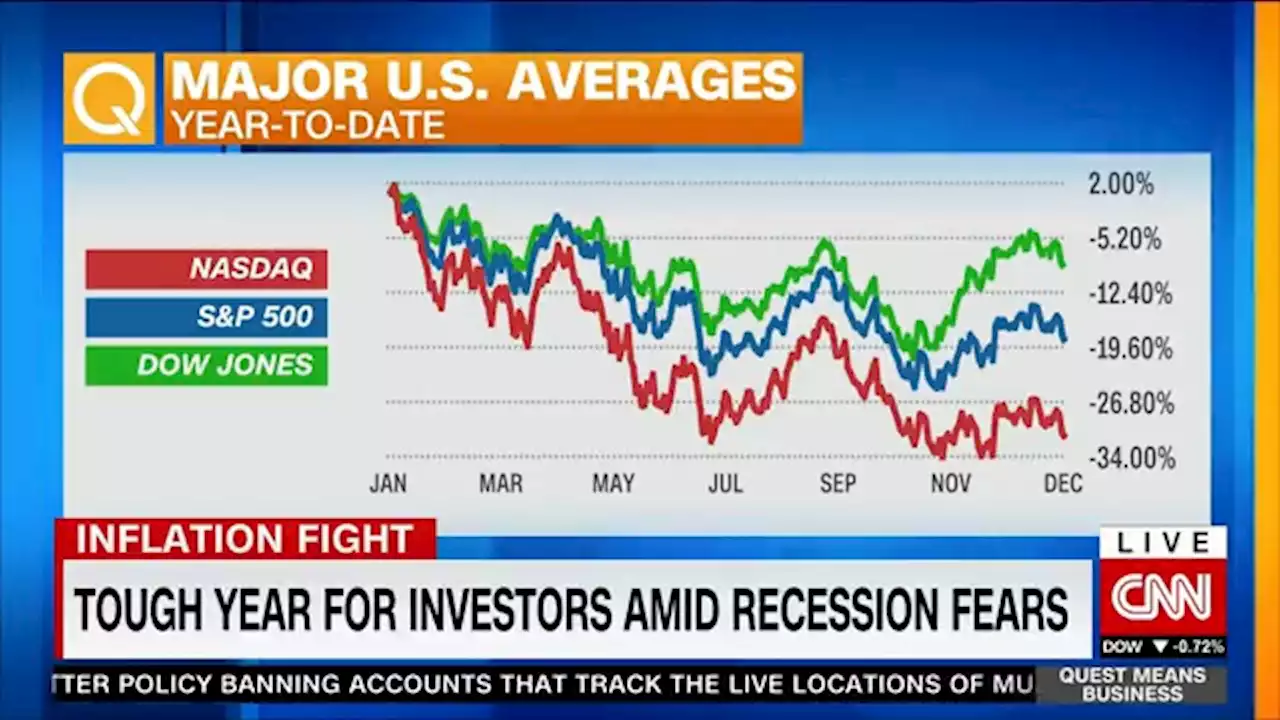

Why recession fears are back: Americans are losing faith | CNN BusinessFrom the executive suite to the grocery aisles to the halls of the Federal Reserve, the big question is: Can red-hot inflation be vanquished without tipping the economy into a recession?

Why recession fears are back: Americans are losing faith | CNN BusinessFrom the executive suite to the grocery aisles to the halls of the Federal Reserve, the big question is: Can red-hot inflation be vanquished without tipping the economy into a recession?

Read more »