(Bloomberg) -- Policymakers from Washington to Frankfurt head into the final quarter of 2023 with tentative grounds for optimism that their fight against inflation is making progress.Most Read from BloombergSenate Voting on Bill to Avert US Government ShutdownEurope’s Richest Royal Family Builds $300 Billion Finance EmpireCongress Averts US Government Shutdown Hours Before DeadlineOnce Unthinkable Bond Yields Are Now the New Normal for MarketsWeight-Loss Drugs Estimated to Save Airlines Millions

With Federal Reserve chief Jerome Powell and his European Central Bank counterpart Christine Lagarde both due to speak in the coming week, investors will scrutinize any reaction from them to a transatlantic double whammy of data that offered hints of cheer.

A further increase in borrowing costs isn’t currently anticipated in October, and Friday’s report may start to undermine any push for an ECB hike in December. The ratio of job openings to unemployed persons — a key barometer of job-market tightness for the Fed – probably declined to 1.4, according to Bloomberg Economics. Hiring likely came down sharply last month after the summer’s temporary bump in the leisure and hospitality sector from Taylor Swift and Beyonce concert tours.On Monday, the Institute for Supply Management’s manufacturing index is expected to show an 11th straight month of contraction.

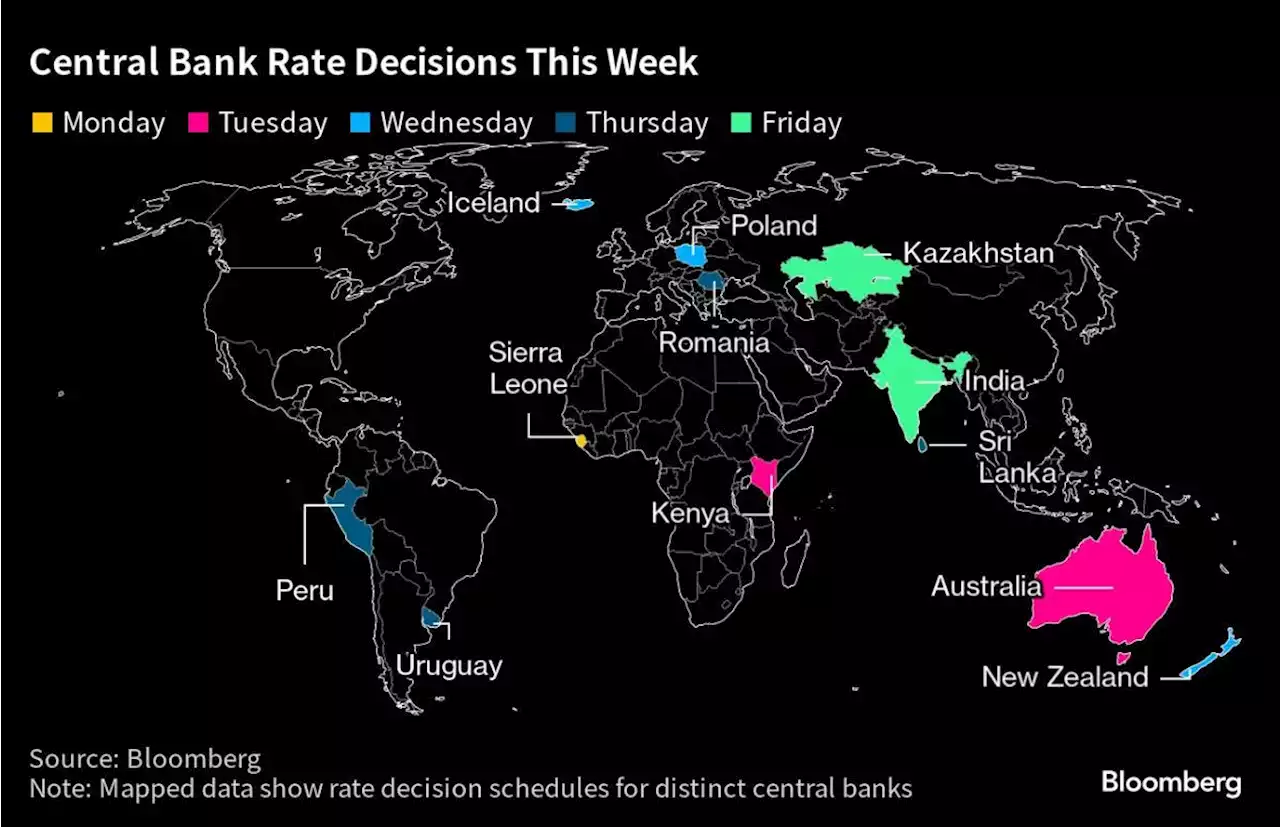

South Korean trade numbers on Sunday showed a slump in exports eased further in September — a positive sign that global trade is regaining ground. PMI figures come on Monday, including from Indonesia, Malaysia, Thailand and Vietnam. Industrial data may draw attention in the euro zone, with German exports and orders due toward the end of the week. French production numbers will be published on Thursday.In the Nordics, Sweden’s Riksbank on Monday will reveal the minutes of its recent decision to raise rates and keep the door open to another move.Iceland’s central bank on Wednesday will decide whether to extend Western Europe’s longest tightening cycle. Some lenders see scope for a quarter-point increase.