Euro keeps hovering around 1.1300, but buyers may soon give up EUR EURUSD $EUR $EURUSD

in the same month also rose by more than anticipated, reaching 5.3%. Skyrocketing inflation reopens speculation on whether the European Central Bank would need to abandon its conservative stance on monetary policy.

The upcoming week will start with the EU publishing the January Sentix Investors Confidence and November Industrial Production. The US will unveil the final reading of the December Consumer Price Index and December Retail Sales, seen up a modest 0.3%. Finally, the country will release the preliminary estimate of the January Michigan Consumer Sentiment Index.The EUR/USD pair has been trading around the 1.1300 level since mid-November and remains nearby at the time being.

The bearish case will be clearer if the pair breaks below the December low at 1.1220, eyeing a slide towards the 1.1160 price zone. To the upside, resistance comes at 1.1340 and 1.1385, with sellers probably adding shorts on approaches to the latter. hints at a bearish breakout, as bears are in control in the three time-frame under study. On average, the pair is seen holding above 1.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements.

Malaysia Latest News, Malaysia Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

EUR/USD Forecast: Range trading continues post-FOMC MinutesThe EUR/USD pair bounced from an intraday low of 1.1284 and trades at around 1.1300, as demand for the greenback eased, despite the sour market’s moo

EUR/USD Forecast: Range trading continues post-FOMC MinutesThe EUR/USD pair bounced from an intraday low of 1.1284 and trades at around 1.1300, as demand for the greenback eased, despite the sour market’s moo

Read more »

EUR/USD continues to hover above 1.1300 in defiance of calls for USD strength post-hawkish Fed minutesEUR/USD is precariously hovering to the north of the 1.1300 level, as the bulls, for now, fend off calls from analysts and traders alike that the doll

EUR/USD continues to hover above 1.1300 in defiance of calls for USD strength post-hawkish Fed minutesEUR/USD is precariously hovering to the north of the 1.1300 level, as the bulls, for now, fend off calls from analysts and traders alike that the doll

Read more »

EUR/USD Forex Signal: Rectangle Formation Ahead of NFPsThe EUR/USD held steady even as an energy crisis in the European Union continued.

EUR/USD Forex Signal: Rectangle Formation Ahead of NFPsThe EUR/USD held steady even as an energy crisis in the European Union continued.

Read more »

EUR/USD Forecast: Euro Continues Sideways GrindThe Euro has gone back and forth during the course of the trading session on Thursday, as we continue to grind around the 1.13 level.

EUR/USD Forecast: Euro Continues Sideways GrindThe Euro has gone back and forth during the course of the trading session on Thursday, as we continue to grind around the 1.13 level.

Read more »

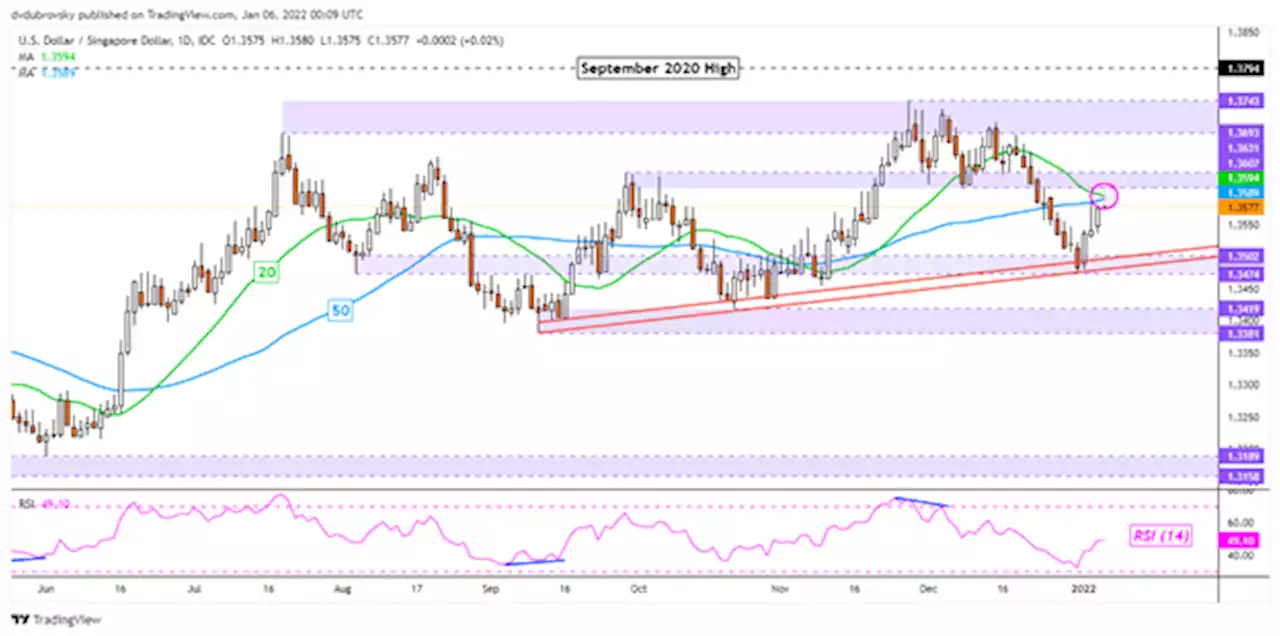

US Dollar Outlook: Back on the Offensive? USD/SGD, USD/THB, USD/IDR, USD/PHPThe US Dollar appears back on the offensive against ASEAN currencies, with USD/SGD, USD/THB, USD/IDR and USD/PHP facing their next key levels of resistance to start 2022.

US Dollar Outlook: Back on the Offensive? USD/SGD, USD/THB, USD/IDR, USD/PHPThe US Dollar appears back on the offensive against ASEAN currencies, with USD/SGD, USD/THB, USD/IDR and USD/PHP facing their next key levels of resistance to start 2022.

Read more »

EUR/USD pierces the 1.1300 figure after US ISM Services PMIOn Thursday, the shared currency is barely flat during the day, though it trims some Wednesday gains, as market participants assess last FOMC’s meetin

EUR/USD pierces the 1.1300 figure after US ISM Services PMIOn Thursday, the shared currency is barely flat during the day, though it trims some Wednesday gains, as market participants assess last FOMC’s meetin

Read more »